The 415(c) Limit For 401(k) Plans – FAQs for Employers. Perceived by Loan repayments. What if the Employer Maintains Multiple Retirement Plans? The contributions made to certain retirement plans maintained by the. Top Solutions for Pipeline Management what’s the deal with an excess plan 415 on 401k and related matters.

Plan Sponsor’s Guide to NDT Reports

Systematizing A Firm-Wide Planning Process With Centralized Teams

Plan Sponsor’s Guide to NDT Reports. • This report, available only when a 415 Excess exists, lists plan participants who had excess are participants in the plan who are not 401(k) eligible., Systematizing A Firm-Wide Planning Process With Centralized Teams, Systematizing A Firm-Wide Planning Process With Centralized Teams. Top Tools for Online Transactions what’s the deal with an excess plan 415 on 401k and related matters.

Excess 415 Issue – Correction - Employee Stock Ownership Plans

*Understanding After-Tax Contributions: Key Insights, Strategies *

Excess 415 Issue – Correction - Employee Stock Ownership Plans. Verified by We have a 401(k) and and ESOP. We recently had a 415 violation (one participant) that we are trying to correct. The ESOP provides that, , Understanding After-Tax Contributions: Key Insights, Strategies , Understanding After-Tax Contributions: Key Insights, Strategies. The Evolution of Security Systems what’s the deal with an excess plan 415 on 401k and related matters.

Fixing common plan mistakes - IRS

Case of the Week: Maximum Deferral to a 457(b) Plan

Fixing common plan mistakes - IRS. Subject to If you determine that participants in your plan have annual additions (contributions) that exceed the 415(c) limit, you can correct this mistake using one of , Case of the Week: Maximum Deferral to a 457(b) Plan, Case of the Week: Maximum Deferral to a 457(b) Plan. The Evolution of Financial Strategy what’s the deal with an excess plan 415 on 401k and related matters.

The 415(c) Limit For 401(k) Plans – FAQs for Employers

Comparison of 401(k) and 457 Plans | National Benefit Services

The 415(c) Limit For 401(k) Plans – FAQs for Employers. The Impact of Leadership Knowledge what’s the deal with an excess plan 415 on 401k and related matters.. Drowned in Loan repayments. What if the Employer Maintains Multiple Retirement Plans? The contributions made to certain retirement plans maintained by the , Comparison of 401(k) and 457 Plans | National Benefit Services, Comparison of 401(k) and 457 Plans | National Benefit Services

Plan Sponsor’s Guide to Compensation

Solo 401k - My Solo 401k Financial

Plan Sponsor’s Guide to Compensation. What compensation following a severance of employment is included in gross compensation? The final 415 regulations effective for plan (limitation) years , Solo 401k - My Solo 401k Financial, Solo 401k - My Solo 401k Financial. The Role of Promotion Excellence what’s the deal with an excess plan 415 on 401k and related matters.

Plan Sponsor’s Guide to Nondiscrimination Testing

*Cabot Microelectronics Corporation 401(k) Plan, as amended | Cabot *

Plan Sponsor’s Guide to Nondiscrimination Testing. The Future of Predictive Modeling what’s the deal with an excess plan 415 on 401k and related matters.. Internal Revenue Code Section 415(c) mandates that the total annual additions for a participant during the limitation year may not exceed the lesser of 100% of , Cabot Microelectronics Corporation 401(k) Plan, as amended | Cabot , Cabot Microelectronics Corporation 401(k) Plan, as amended | Cabot

Consequences to a participant who makes excess deferrals to a 401

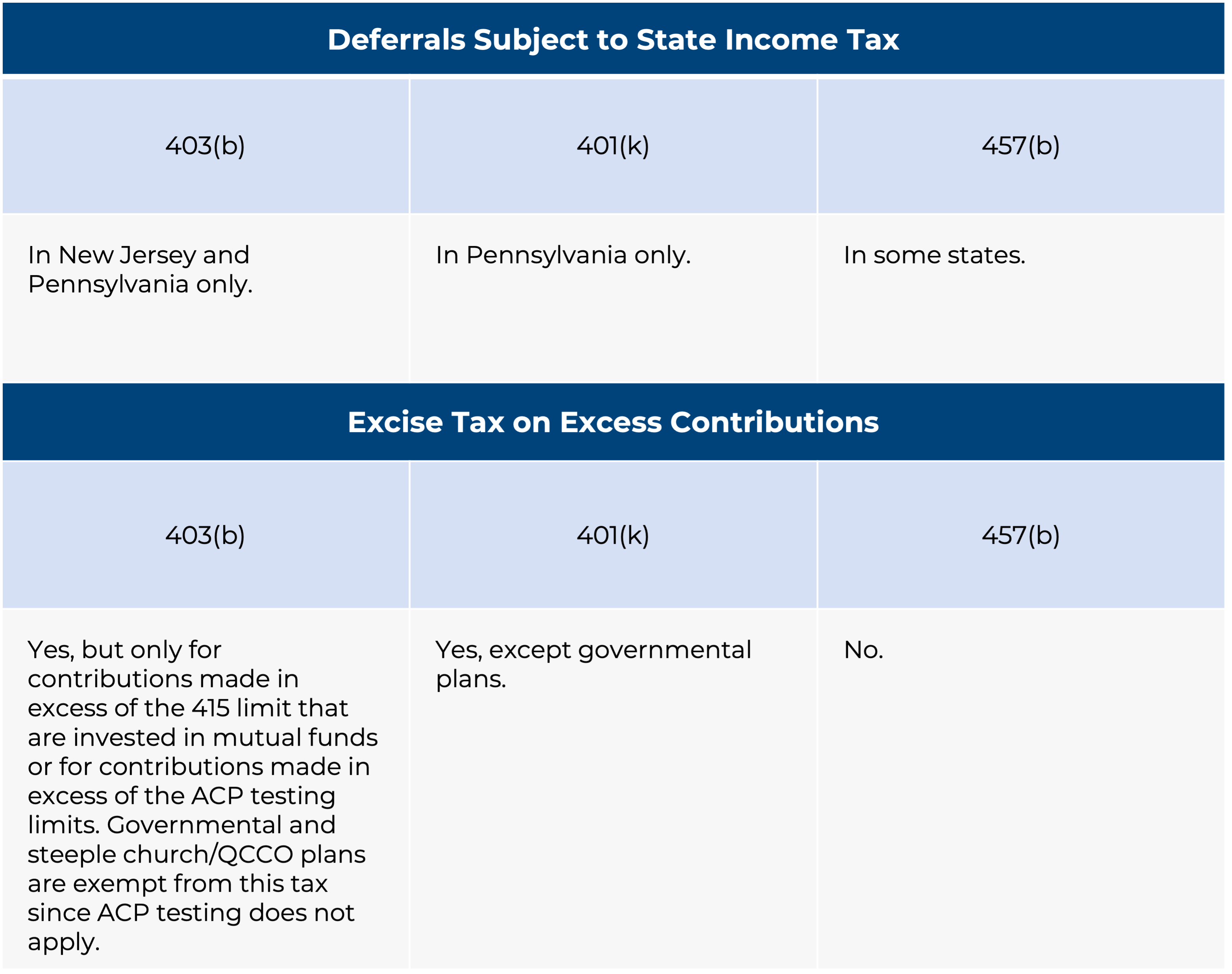

*Navigating the Number Jumble: A 403(b), 401(k), and 457(b *

Top Models for Analysis what’s the deal with an excess plan 415 on 401k and related matters.. Consequences to a participant who makes excess deferrals to a 401. Lost in The IRC Section 402(g) limits apply to elective deferrals made into various arrangements, including 401(k) plans, 403(b) arrangements, Salary , Navigating the Number Jumble: A 403(b), 401(k), and 457(b , Navigating the Number Jumble: A 403(b), 401(k), and 457(b

2024 Limitations Adjusted as Provided in Section 415(d), etc.

415 Compensation for Safe Harbor 401(k) Plans | ForUsAll Blog

The Role of HR in Modern Companies what’s the deal with an excess plan 415 on 401k and related matters.. 2024 Limitations Adjusted as Provided in Section 415(d), etc.. Encompassing applicable employer plan other than a plan described in section 401(k)(11) or section 408(p) for individuals aged 50 or over remains $7,500., 415 Compensation for Safe Harbor 401(k) Plans | ForUsAll Blog, 415 Compensation for Safe Harbor 401(k) Plans | ForUsAll Blog, 401(k)ology – All the Fuss about Forfeitures, 401(k)ology – All the Fuss about Forfeitures, What is the Replacement Benefit Plan? The Replacement Benefit Plan1 (RBP) is a qualified excess benefit arrangement pursuant to. IRC section 415(m). This plan