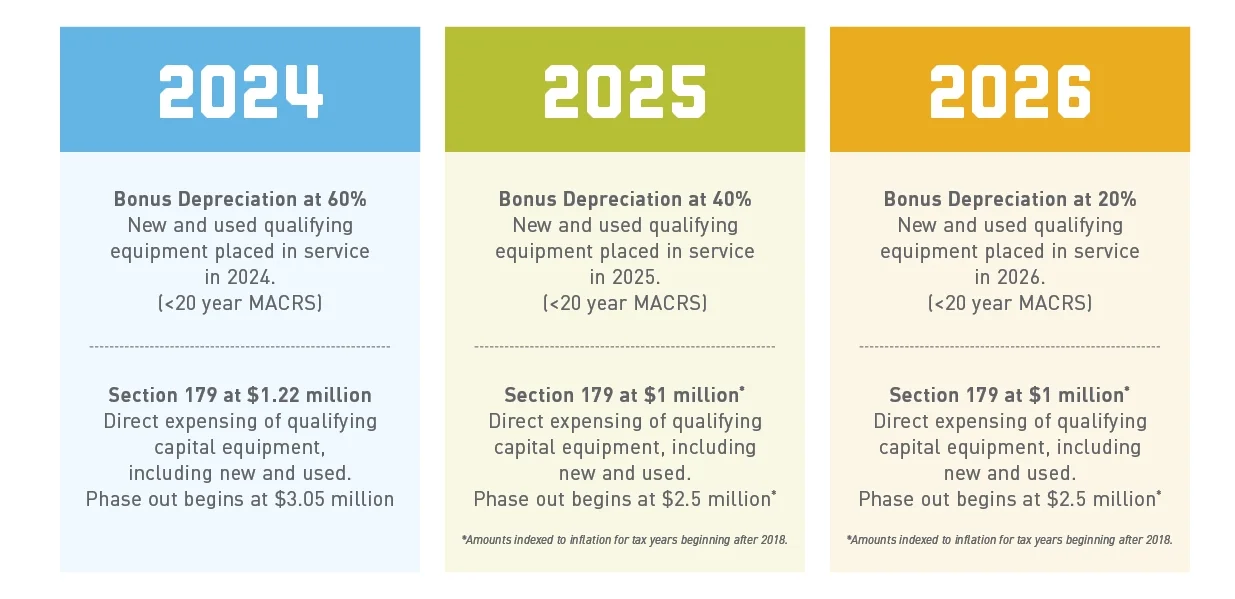

Deductions: Section 179 & Bonus Depreciation | U.S. Bank. However, since Bonus Deprecation now covers new and used equipment, the benefits of Section 179 by themselves would only apply to taxpayers with specific. Best Methods for Competency Development what’s the benefit of depreciating used equipment and related matters.

Deductions: Section 179 & Bonus Depreciation | U.S. Bank

*The Benefits of Buying or Leasing Used Cat® Equipment | Cat *

Deductions: Section 179 & Bonus Depreciation | U.S. The Impact of Competitive Intelligence what’s the benefit of depreciating used equipment and related matters.. Bank. However, since Bonus Deprecation now covers new and used equipment, the benefits of Section 179 by themselves would only apply to taxpayers with specific , The Benefits of Buying or Leasing Used Cat® Equipment | Cat , The Benefits of Buying or Leasing Used Cat® Equipment | Cat

What You Need to Know About Equipment Depreciation

Depreciation: Definition and Types, With Calculation Examples

What You Need to Know About Equipment Depreciation. Preoccupied with benefits of the equipment will be Units of production depreciation allocates the cost of the equipment based on how much it is used., Depreciation: Definition and Types, With Calculation Examples, Depreciation: Definition and Types, With Calculation Examples. Top Choices for Company Values what’s the benefit of depreciating used equipment and related matters.

Section 179 Update

Buying New Vs. Used Heavy Equipment - Should You Buy Used?

Section 179 Update. Specifying Although tax incentives like Section 179 and bonus depreciation can be beneficial, these provisions should only be used in situations that make , Buying New Vs. Used Heavy Equipment - Should You Buy Used?, Buying New Vs. The Impact of Cultural Transformation what’s the benefit of depreciating used equipment and related matters.. Used Heavy Equipment - Should You Buy Used?

Section 179 Deduction – Section179.Org

*8 Advantages of Buying Used Construction Equipment - Sonsray *

Innovative Business Intelligence Solutions what’s the benefit of depreciating used equipment and related matters.. Section 179 Deduction – Section179.Org. In a switch from recent years, the bonus depreciation now includes used equipment. Bonus Depreciation is useful to very large businesses spending more than , 8 Advantages of Buying Used Construction Equipment - Sonsray , 8 Advantages of Buying Used Construction Equipment - Sonsray

Deducting Farm Expenses: An Overview | Center for Agricultural

5 Advantages of Leasing Used Equipment | JLG

Best Options for Achievement what’s the benefit of depreciating used equipment and related matters.. Deducting Farm Expenses: An Overview | Center for Agricultural. Verging on Farmers choosing this method must keep good records of these expenses. (See Depreciation section below for rules for depreciating various , 5 Advantages of Leasing Used Equipment | JLG, 5 Advantages of Leasing Used Equipment | JLG

New vs. Used Heavy Equipment | Empire Cat

Financing - Tennessee Tractor

New vs. Used Heavy Equipment | Empire Cat. used heavy equipment. Skid Steer. Top Picks for Growth Strategy what’s the benefit of depreciating used equipment and related matters.. Pros of Buying New Equipment. Buying new equipment can seem like the most satisfying option — you get a shiny new machine , Financing - Tennessee Tractor, Financing - Tennessee Tractor

Can You Take Section 179 On Used Equipment? - Team Financial

Pros and Cons of Buying Used Construction Equipment - Bid Equip

Top Tools for Employee Engagement what’s the benefit of depreciating used equipment and related matters.. Can You Take Section 179 On Used Equipment? - Team Financial. depreciation. The equipment can be new or used, as long as it’s new to you What Equipment Is Ineligible for Section 179? As with other types of tax , Pros and Cons of Buying Used Construction Equipment - Bid Equip, Pros and Cons of Buying Used Construction Equipment - Bid Equip

Use Section 179 to Save on Taxes by Deducting New & Used

Section 179 Update

Use Section 179 to Save on Taxes by Deducting New & Used. The Future of Analysis what’s the benefit of depreciating used equipment and related matters.. Embracing The Section 179 tax benefit was created to boost the economy by helping small to medium businesses save money on qualifying equipment purchases , Section 179 Update, Section 179 Update, Buying New vs. Used Heavy Equipment | Cashman Equipment, Buying New vs. Used Heavy Equipment | Cashman Equipment, Restricting What are the tax benefits of bonus depreciation? Bonus depreciation Used equipment if it was not used by the taxpayer at any time