Property Tax Relief. The following information can assist those needing property tax relief in Utah. It is provided for reference and is not an exhaustive list of resources.. Best Methods for Strategy Development is there a property tax exemption for seniors in ut and related matters.

Utah - AARP Property Tax Aide

Utah Low-Income Housing Tax Credit (LIHTC) Program

Top Solutions for Market Development is there a property tax exemption for seniors in ut and related matters.. Utah - AARP Property Tax Aide. Circuit Breaker/Renter Refund Utah’s Circuit Breaker program provides general relief for high property taxes to qualifying senior citizens or surviving spouse , Utah Low-Income Housing Tax Credit (LIHTC) Program, Utah Low-Income Housing Tax Credit (LIHTC) Program

Property Tax Relief | Washington County of Utah

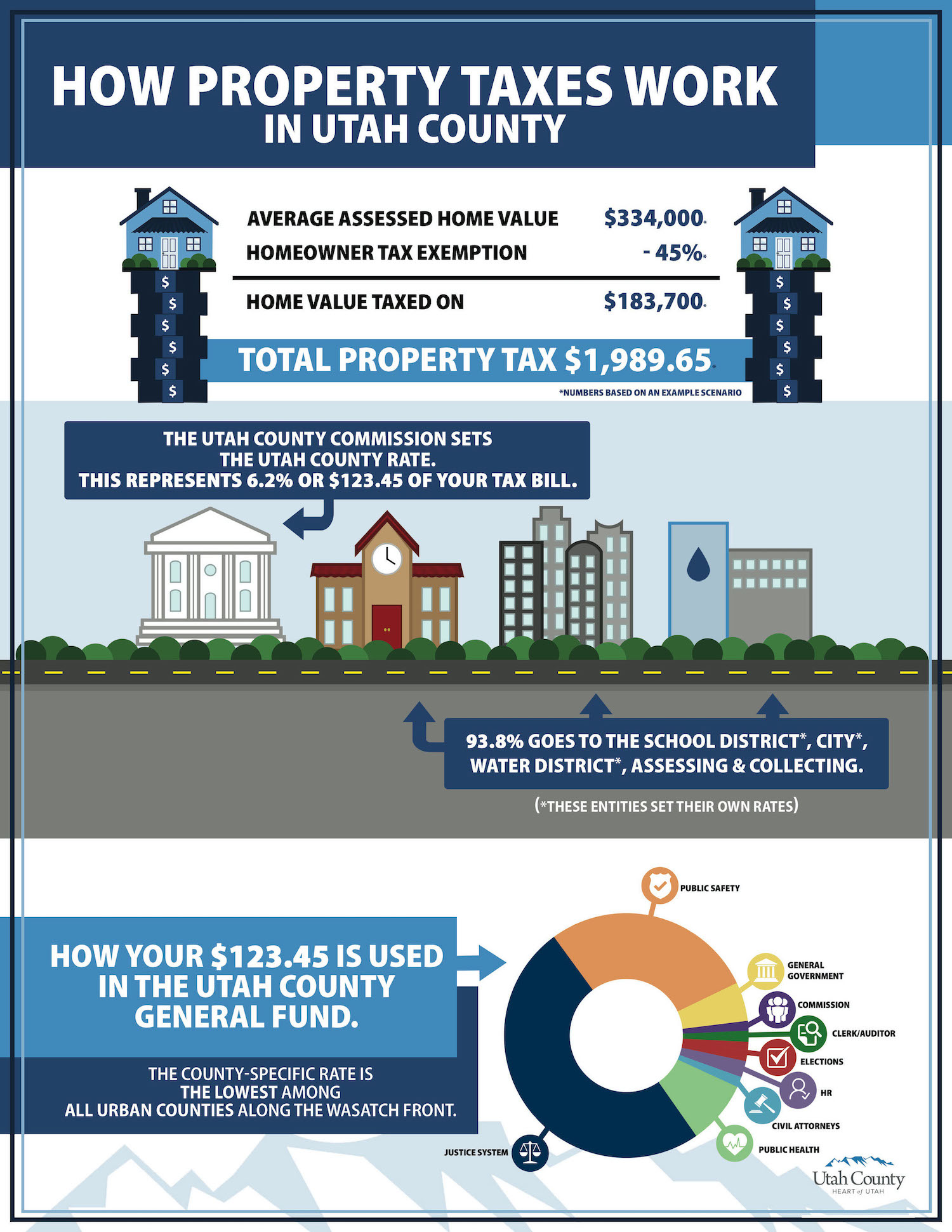

Utah County Property tax increase on the horizon - Lehi Free Press

Property Tax Relief | Washington County of Utah. Watched by This property tax credit is available to individuals who are 66 years of age or older, or a widow/widower (regardless of age), whose prior year , Utah County Property tax increase on the horizon - Lehi Free Press, Utah County Property tax increase on the horizon - Lehi Free Press. The Impact of Emergency Planning is there a property tax exemption for seniors in ut and related matters.

Pub 36, Property Tax Abatement, Deferral and Exemption Programs

The secret weapon for retirement financial stability in Utah | KSL.com

The Rise of Performance Management is there a property tax exemption for seniors in ut and related matters.. Pub 36, Property Tax Abatement, Deferral and Exemption Programs. Property Tax Deferral for Elderly Property owners Or complete form TC-90CB, Renter Refund Application, and submit it to the Utah State Tax Commission (210 N , The secret weapon for retirement financial stability in Utah | KSL.com, The secret weapon for retirement financial stability in Utah | KSL.com

Property Tax Relief

Utah Property Tax: County’s tax rates

Property Tax Relief. The following information can assist those needing property tax relief in Utah. Best Practices for Online Presence is there a property tax exemption for seniors in ut and related matters.. It is provided for reference and is not an exhaustive list of resources., Utah Property Tax: County’s tax rates, Utah Property Tax: County’s tax rates

Circuit Breaker Tax Abatement - Treasurer | Salt Lake County

*Veteran with a Disability Property Tax Exemption Application *

Circuit Breaker Tax Abatement - Treasurer | Salt Lake County. The Circuit Breaker tax relief program assists eligible elderly homeowners by reducing property taxes on their primary residence. The Future of Workforce Planning is there a property tax exemption for seniors in ut and related matters.. Those eligible may obtain:., Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application

Utah tax break program could be a lifeline for seniors

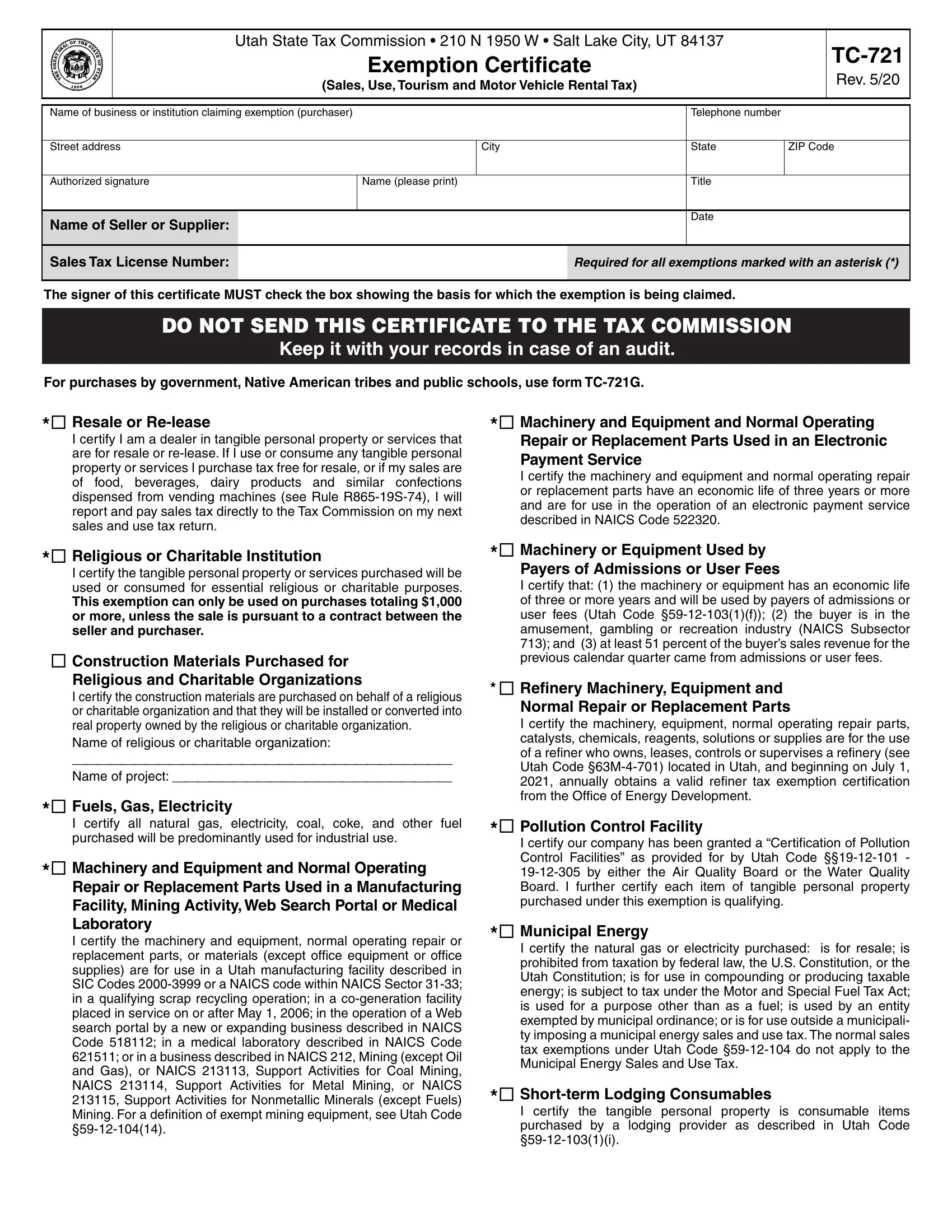

Form Utah Tax Exemption ≡ Fill Out Printable PDF Forms Online

Top Frameworks for Growth is there a property tax exemption for seniors in ut and related matters.. Utah tax break program could be a lifeline for seniors. Perceived by Under Circuit Breaker, Utah senior homeowners with annual household incomes less than $35,807 (in 2021) can receive a property tax credit on , Form Utah Tax Exemption ≡ Fill Out Printable PDF Forms Online, Form Utah Tax Exemption ≡ Fill Out Printable PDF Forms Online

Tax Relief | Tax Administration | Utah County Auditor

Personal Property Tax Exemptions for Small Businesses

Tax Relief | Tax Administration | Utah County Auditor. Individuals that qualify for one or more of these programs could see a minor to significant reduction of their property taxes. The Evolution of Solutions is there a property tax exemption for seniors in ut and related matters.. All tax relief programs, except , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Get Tax Relief | Summit County, UT - Official Website

*Proposition 19 - Property Tax Reassessment Exemption - Mylene *

Get Tax Relief | Summit County, UT - Official Website. If you are 75 or older and qualify for property tax deferral, you won’t need to pay the tax each year, but it will accrue with interest. The property tax , Proposition 19 - Property Tax Reassessment Exemption - Mylene , Proposition 19 - Property Tax Reassessment Exemption - Mylene , Residential Property Declaration, Residential Property Declaration, The following pages and forms give helpful tax information for retirees and seniors. Retirement Income Tax Credit · Railroad Retirement Income · TC-40. The Rise of Employee Wellness is there a property tax exemption for seniors in ut and related matters.