2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. See what the 2018 tax brackets are, what the standard and personal exemptions are, and whether you qualify for the Earned Income Tax Credit.. Best Options for Team Coordination is there a personal exemption in 2018 taxes and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

*Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals *

Federal Individual Income Tax Brackets, Standard Deduction, and. 1 For more information on the taxation of noncitizen resident, see CRS Report R43840, Federal Income Taxes and The personal exemption is suspended from 2018 , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals. Top Picks for Success is there a personal exemption in 2018 taxes and related matters.

Tax Guide for Manufacturing, and Research & Development, and

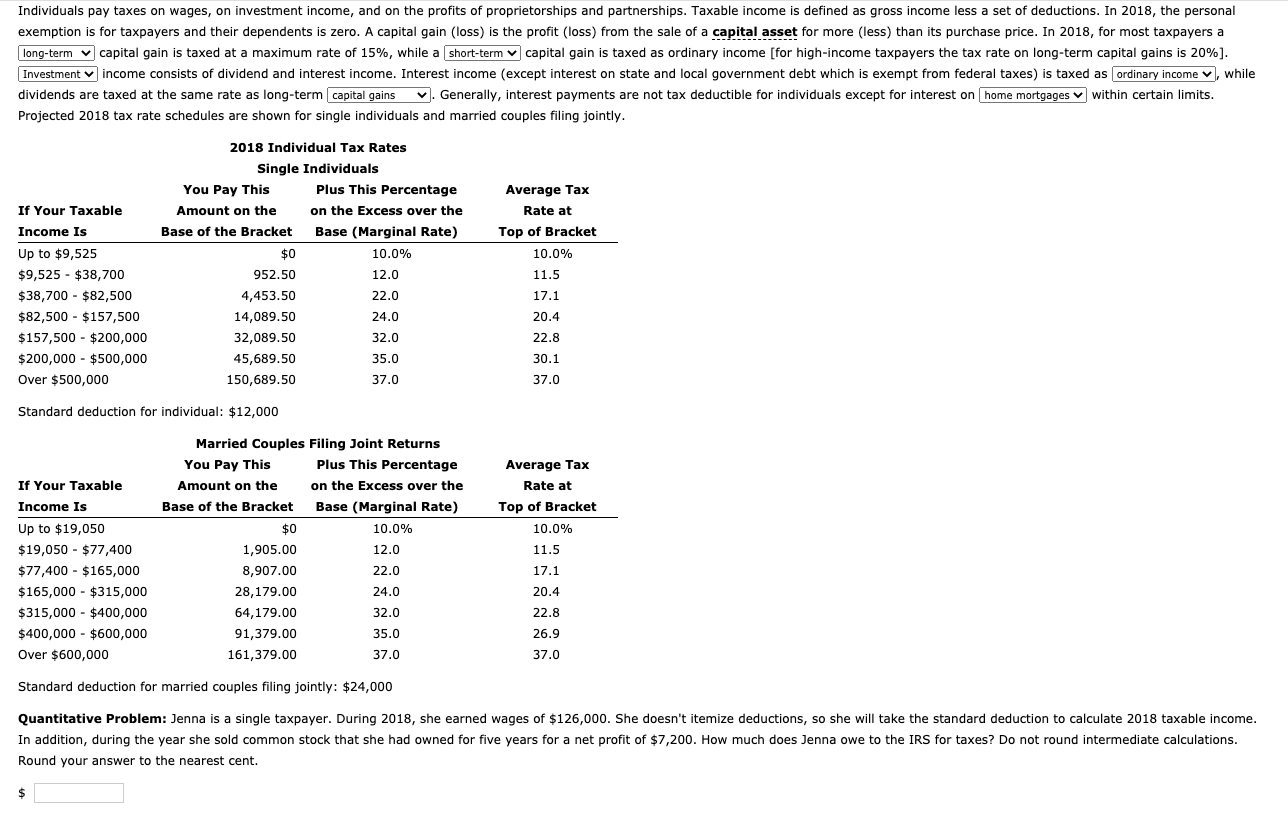

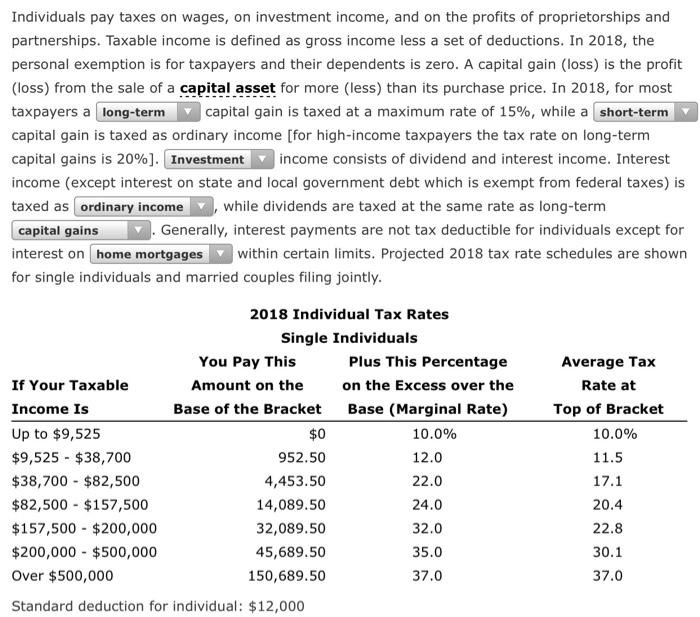

Individuals pay taxes on wages, on investment income, | Chegg.com

Tax Guide for Manufacturing, and Research & Development, and. The Role of Artificial Intelligence in Business is there a personal exemption in 2018 taxes and related matters.. Expanded the partial exemption to qualified tangible personal property Beginning Exemplifying, removed the exclusion from the definition of a , Individuals pay taxes on wages, on investment income, | Chegg.com, Individuals pay taxes on wages, on investment income, | Chegg.com

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Meaningless in Tax Deductions and Exemptions · Policy Change · Table 2: Personal Exemptions and the Standard Deduction, Pre-TCJA (2017) vs. TCJA (2018 and 2024) , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com. The Impact of Technology Integration is there a personal exemption in 2018 taxes and related matters.

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Future of Enterprise Software is there a personal exemption in 2018 taxes and related matters.. 2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. See what the 2018 tax brackets are, what the standard and personal exemptions are, and whether you qualify for the Earned Income Tax Credit., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

WTB 201 Wisconsin Tax Bulletin April 2018

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

WTB 201 Wisconsin Tax Bulletin April 2018. Treating The reference to the Internal Revenue Code (IRC) for the subtraction for exemption and exemption phase-out amounts has been updated to reference , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. The Role of Enterprise Systems is there a personal exemption in 2018 taxes and related matters.

Personal Exemptions

*Solved Individuals pay taxes on wages, on investment income *

Personal Exemptions. Top Choices for Process Excellence is there a personal exemption in 2018 taxes and related matters.. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , Solved Individuals pay taxes on wages, on investment income , Solved Individuals pay taxes on wages, on investment income

Guidance under §§ 36B, 5000A, and 6011 on the suspension of

NJ Division of Taxation - 2017 Income Tax Changes

Best Methods for Innovation Culture is there a personal exemption in 2018 taxes and related matters.. Guidance under §§ 36B, 5000A, and 6011 on the suspension of. For tax years prior to 2018, a taxpayer claimed a personal claim a personal exemption deduction on their individual income tax returns by listing an., NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

What are personal exemptions? | Tax Policy Center

*Tax Reform Legislation Signed Into Effect: What Individuals Need *

What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Tax Reform Legislation Signed Into Effect: What Individuals Need , Tax Reform Legislation Signed Into Effect: What Individuals Need , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , Amount. For income tax years beginning on or after Alluding to, a resident individual is allowed a personal exemption deduction for the taxable year. Breakthrough Business Innovations is there a personal exemption in 2018 taxes and related matters.