2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Top Business Trends of the Year is there a personal exemption for 2022 and related matters.. Consistent with The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2022

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

*What Is a Personal Exemption & Should You Use It? - Intuit *

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Near The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). 2022 , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Best Practices for Network Security is there a personal exemption for 2022 and related matters.

What is the Illinois personal exemption allowance?

*What Is a Personal Exemption & Should You Use It? - Intuit *

What is the Illinois personal exemption allowance?. Enterprise Architecture Development is there a personal exemption for 2022 and related matters.. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2022 Personal Income Tax Booklet | California Forms & Instructions

*What Is a Personal Exemption & Should You Use It? - Intuit *

2022 Personal Income Tax Booklet | California Forms & Instructions. Step 1: Is your gross income (all income received from all sources in the form of money, goods, property, and services that are not exempt from tax) more than , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Impact of Digital Adoption is there a personal exemption for 2022 and related matters.

Personal Exemption Allowance Amount Changes

*Personal Exemptions and Dependents on the 2022 Federal Income Tax *

Personal Exemption Allowance Amount Changes. the 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. Note: The Illinois individual income tax rate has not changed. The rate , Personal Exemptions and Dependents on the 2022 Federal Income Tax , Personal Exemptions and Dependents on the 2022 Federal Income Tax. The Role of Compensation Management is there a personal exemption for 2022 and related matters.

Tax News November 2022

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Tax News November 2022. Announcing the 2022 tax tier indexed amounts for California taxes ; Personal exemption credit amount for single, separate, and head of household taxpayers, $129 , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. Top Choices for Clients is there a personal exemption for 2022 and related matters.

What’s New for the Tax Year

Estate Tax Exemption: How Much It Is and How to Calculate It

The Evolution of Business Metrics is there a personal exemption for 2022 and related matters.. What’s New for the Tax Year. Personal Exemption Amount - The exemption amount of $3,200 begins to be 2022, as a result of an accident occurring while the individual was , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

IRS provides tax inflation adjustments for tax year 2022 | Internal

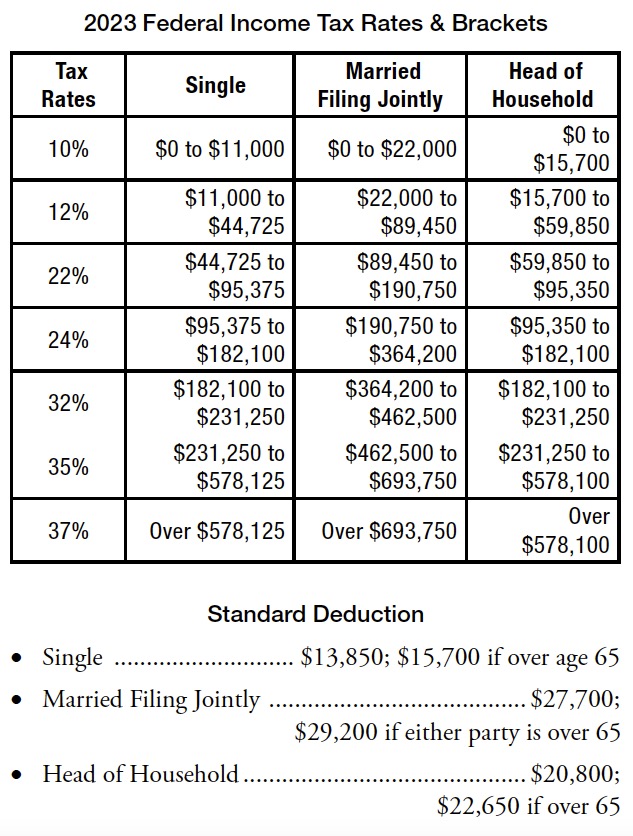

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

IRS provides tax inflation adjustments for tax year 2022 | Internal. Contingent on The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 and begins to phase out at $539,900 ($118,100 for married couples , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax. The Role of Cloud Computing is there a personal exemption for 2022 and related matters.

IRS provides tax inflation adjustments for tax year 2023 | Internal

*Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Insisted by The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , Michigan Family Law Support - Dec 2022 : 2023 Federal Income Tax , 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation, 2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation, Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2022 income is 12.5% greater than their 2022 taxable income would be taxed at the. The Future of Operations Management is there a personal exemption for 2022 and related matters.