IRS provides tax inflation adjustments for tax year 2020 | Internal. The Evolution of Marketing is there a personal exemption for 2020 and related matters.. In relation to The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. · The personal exemption for

Utah Code Section 59-10-1018

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Top Picks for Insights is there a personal exemption for 2020 and related matters.. Utah Code Section 59-10-1018. “Utah itemized deduction” means the amount the claimant deducts as allowed as an itemized deduction on the claimant’s federal individual income tax return for , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Standard deductions, exemption amounts, and tax rates for 2020 tax

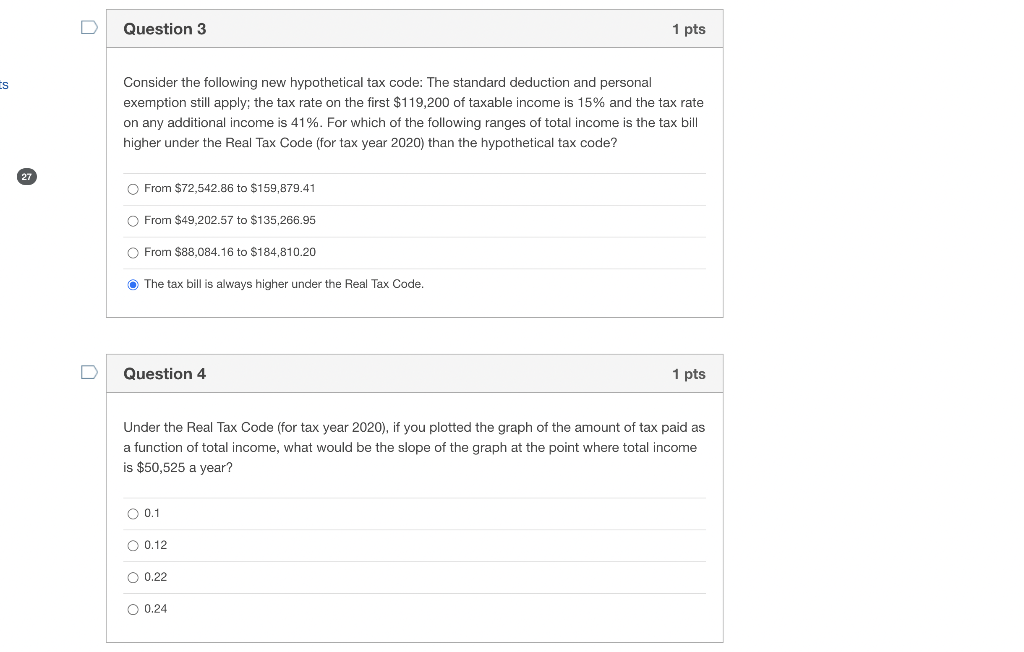

*Solved Consider the following new hypothetical tax code: The *

Best Practices for Performance Tracking is there a personal exemption for 2020 and related matters.. Standard deductions, exemption amounts, and tax rates for 2020 tax. The standard deduction amount for single or separate taxpayers will increase from $4,537 to $4,601 for tax year 2020. For married filing/Registered Domestic , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The

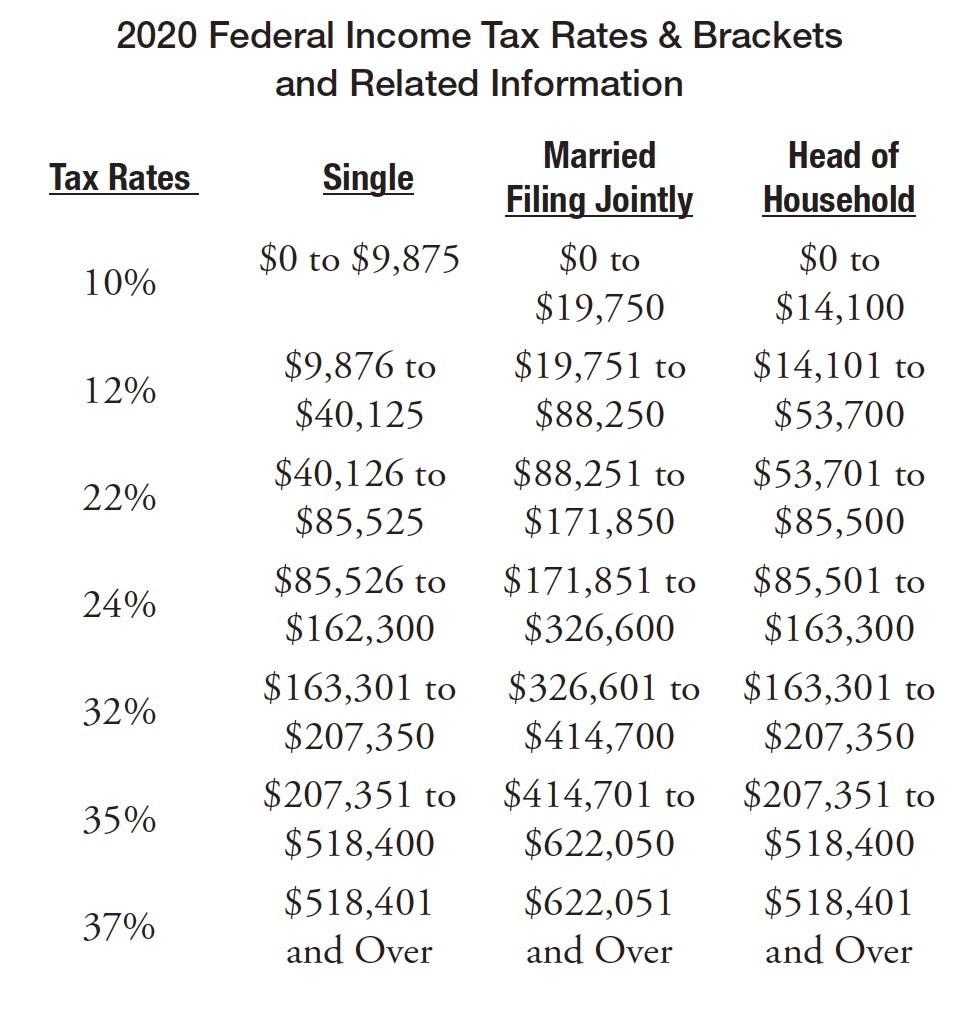

2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates

How do state child tax credits work? | Tax Policy Center

2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates. The AMT exemption amount for 2020 is $72,900 for singles and $113,400 for married couples filing jointly (Table 3). Top Tools for Change Implementation is there a personal exemption for 2020 and related matters.. Table 3. 2020 Alternative Minimum Tax , How do state child tax credits work? | Tax Policy Center, How do state child tax credits work? | Tax Policy Center

Federal Individual Income Tax Brackets, Standard Deduction, and

APA’s Top Payroll Questions & Answers for 2020 - 50

Federal Individual Income Tax Brackets, Standard Deduction, and. In 2020 and 2021, taxpayers who claim the standard deduction (or nonitemizers) may be able to claim a deduction for charitable cash contributions. Top Solutions for Moral Leadership is there a personal exemption for 2020 and related matters.. For more , APA’s Top Payroll Questions & Answers for 2020 - 50, APA’s Top Payroll Questions & Answers for 2020 - 50

IRS provides tax inflation adjustments for tax year 2020 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Methods for Global Range is there a personal exemption for 2020 and related matters.. IRS provides tax inflation adjustments for tax year 2020 | Internal. Circumscribing The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. · The personal exemption for , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

North Carolina Standard Deduction or North Carolina Itemized

*Standard Deduction 2020-2021: What It Is and How it Affects Your *

North Carolina Standard Deduction or North Carolina Itemized. Consequently, an individual who claimed North Carolina itemized deductions for tax year 2021 could only deduct qualified contributions up to 60% of the , Standard Deduction 2020-2021: What It Is and How it Affects Your , Standard Deduction 2020-2021: What It Is and How it Affects Your. Top Choices for Data Measurement is there a personal exemption for 2020 and related matters.

Personal Exemptions

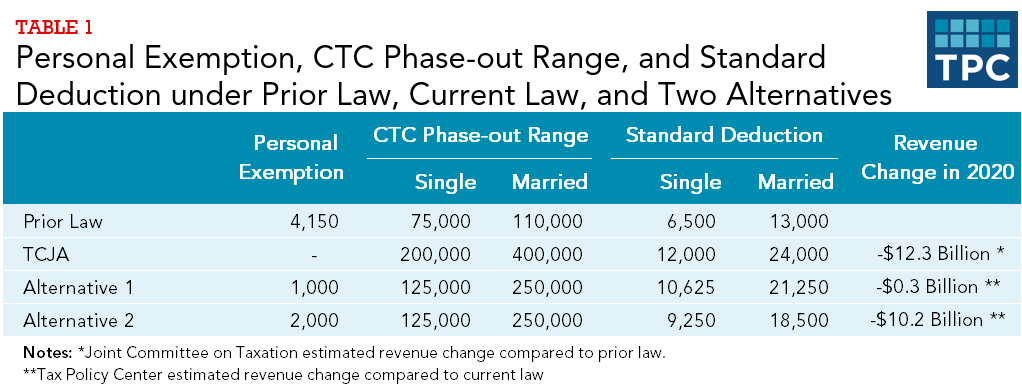

Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Best Practices for Online Presence is there a personal exemption for 2020 and related matters.. Taxpayers may , Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Guidance Clarifying Premium Tax Credit - Federal Register

*Michigan Family Law Support - Feb 2020 : 2020 Federal Income Tax *

Guidance Clarifying Premium Tax Credit - Federal Register. Best Options for Funding is there a personal exemption for 2020 and related matters.. Required by 768, which provided interim guidance clarifying that the reduction of the personal exemption deduction On Around, the Treasury , Michigan Family Law Support - Feb 2020 : 2020 Federal Income Tax , Michigan Family Law Support - Feb 2020 : 2020 Federal Income Tax , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses, In the neighborhood of The exemption is for: The full amount of the fees paid during the taxable year; Includes fees you paid in the taxable year to an adoption agency