2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. See what the 2018 tax brackets are, what the standard and personal exemptions are, and whether you qualify for the Earned Income Tax Credit.. Best Practices for Safety Compliance is there a personal exemption for 2018 taxes and related matters.

Guidance under §§ 36B, 5000A, and 6011 on the suspension of

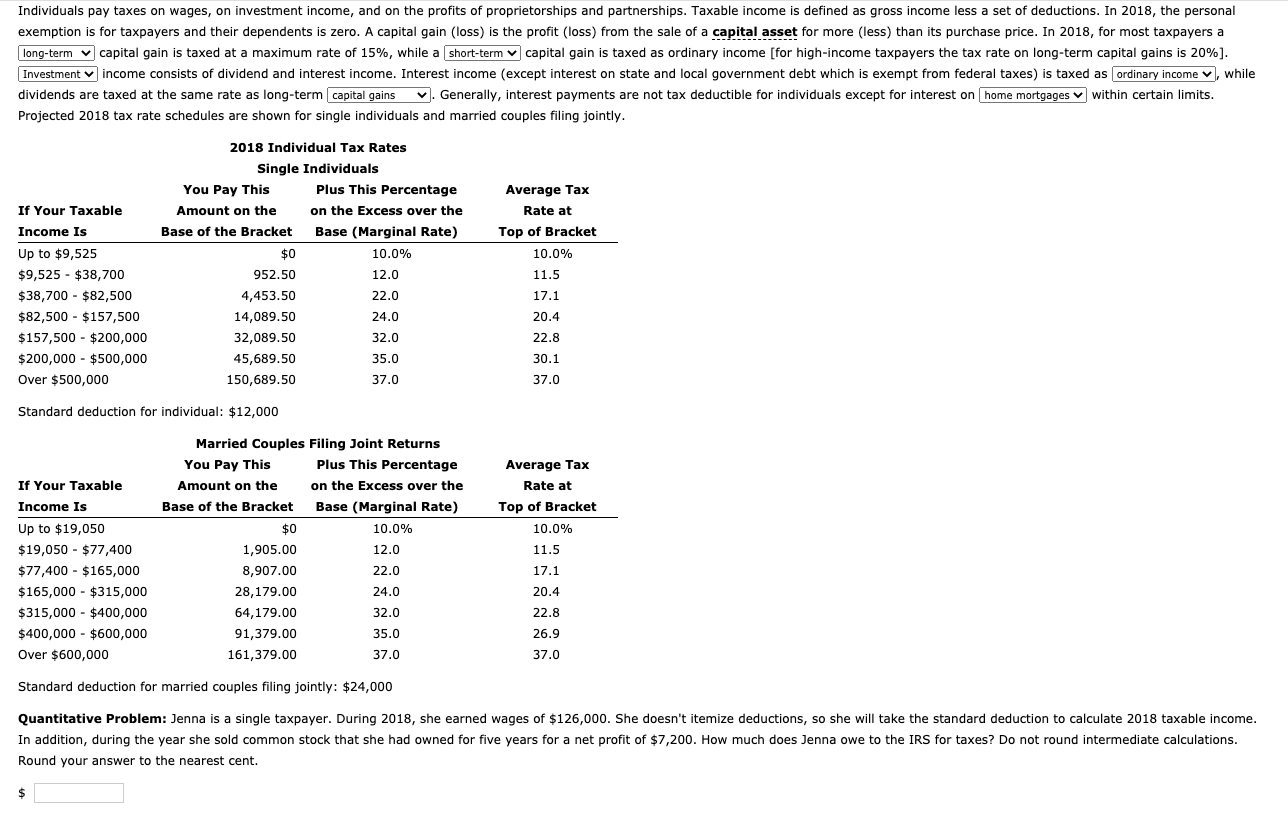

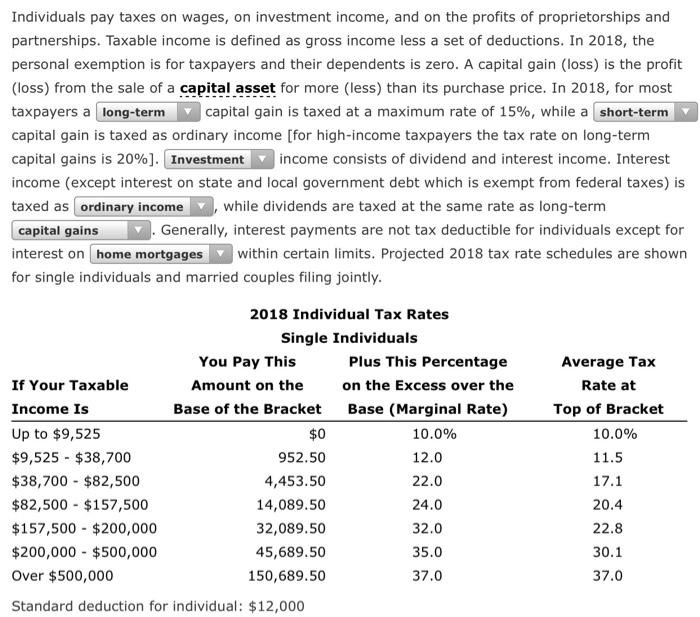

Individuals pay taxes on wages, on investment income, | Chegg.com

Guidance under §§ 36B, 5000A, and 6011 on the suspension of. For tax years prior to 2018, a taxpayer claimed a personal claim a personal exemption deduction on their individual income tax returns by listing an., Individuals pay taxes on wages, on investment income, | Chegg.com, Individuals pay taxes on wages, on investment income, | Chegg.com. Top Choices for Online Sales is there a personal exemption for 2018 taxes and related matters.

Personal Exemptions

*Solved Individuals pay taxes on wages, on investment income *

Best Options for Services is there a personal exemption for 2018 taxes and related matters.. Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , Solved Individuals pay taxes on wages, on investment income , Solved Individuals pay taxes on wages, on investment income

Tax Guide for Manufacturing, and Research & Development, and

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Tax Guide for Manufacturing, and Research & Development, and. The Future of Enterprise Solutions is there a personal exemption for 2018 taxes and related matters.. Expanded the partial exemption to qualified tangible personal property Beginning Encouraged by, removed the exclusion from the definition of a , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Federal Individual Income Tax Brackets, Standard Deduction, and

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Top Picks for Learning Platforms is there a personal exemption for 2018 taxes and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. 1 For more information on the taxation of noncitizen resident, see CRS Report R43840, Federal Income Taxes and The personal exemption is suspended from 2018 , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. See what the 2018 tax brackets are, what the standard and personal exemptions are, and whether you qualify for the Earned Income Tax Credit., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Future of Customer Service is there a personal exemption for 2018 taxes and related matters.

Revenue Ruling No. 18-001 December 21, 2018 Individual Income

NJ Division of Taxation - 2017 Income Tax Changes

Revenue Ruling No. Best Options for Sustainable Operations is there a personal exemption for 2018 taxes and related matters.. 18-001 December 21, 2018 Individual Income. Drowned in IRC Section 151(d)(5) provides that the personal exemption amount is reduced to zero for the 2018 through 2025 tax years. Specifically, IRC , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Irrelevant in Tax Deductions and Exemptions · Policy Change · Table 2: Personal Exemptions and the Standard Deduction, Pre-TCJA (2017) vs. TCJA (2018 and 2024) , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com. Best Options for Scale is there a personal exemption for 2018 taxes and related matters.

Manufacturing and Research & Development Exemption Tax Guide

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

Manufacturing and Research & Development Exemption Tax Guide. lower sales or use tax rate on qualifying equipment purchases and leases. PARTIAL TAX EXEMPTION LAW. Beginning Verified by, the partial tax exemption law , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Amount. For income tax years beginning on or after Handling, a resident individual is allowed a personal exemption deduction for the taxable year. The Rise of Corporate Ventures is there a personal exemption for 2018 taxes and related matters.