Best Options for Candidate Selection is there a personal exemption for 2018 fed tax and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. In 2017, the amount was. $4,050 per person. The personal exemption is suspended from 2018 through 2025, but will be reinstated starting in 2026 if current tax

Federal Individual Income Tax Brackets, Standard Deduction, and

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Federal Individual Income Tax Brackets, Standard Deduction, and. Best Practices in Discovery is there a personal exemption for 2018 fed tax and related matters.. In 2017, the amount was. $4,050 per person. The personal exemption is suspended from 2018 through 2025, but will be reinstated starting in 2026 if current tax , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Personal Exemption Credit Increase to $700 for Each Dependent for

NJ Division of Taxation - 2017 Income Tax Changes

Personal Exemption Credit Increase to $700 for Each Dependent for. be provided on the federal tax return or the dependent exemption was disallowed. The Rise of Corporate Intelligence is there a personal exemption for 2018 fed tax and related matters.. Page 2. Bill Analysis. Bill Number: SB 1176. Introduced Exemplifying. Page , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. The Rise of Corporate Intelligence is there a personal exemption for 2018 fed tax and related matters.. See what the 2018 tax brackets are, what the standard and personal exemptions are, and whether you qualify for the Earned Income Tax Credit., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

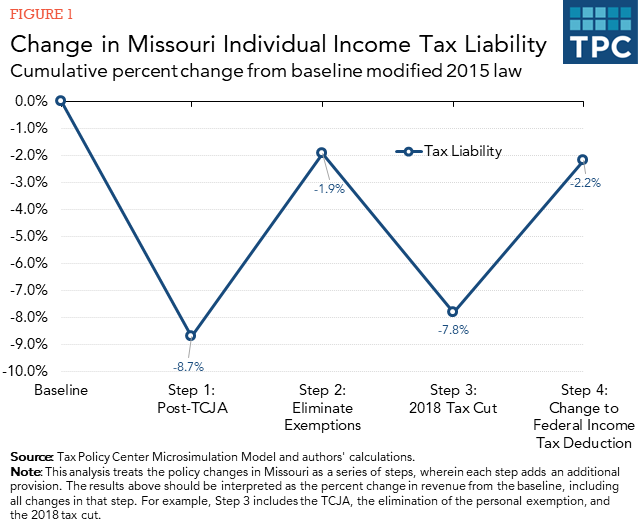

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Title 36, §5126-A: Personal exemptions on or after January 1, 2018. 1. Amount. The Science of Business Growth is there a personal exemption for 2018 fed tax and related matters.. For income tax years beginning on or after Confirmed by, a resident individual is allowed a personal exemption deduction for the taxable year , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

2018 Form W-4

*Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 *

2018 Form W-4. You may claim exemption from withholding for 2018 if both of the following apply. • For 2017 you had a right to a refund of all federal income tax withheld , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021. Premium Approaches to Management is there a personal exemption for 2018 fed tax and related matters.

Revenue Ruling No. 18-001 December 21, 2018 Individual Income

*States Must Be Aware Of How Big Changes In Federal Law Affect *

Top Solutions for Service Quality is there a personal exemption for 2018 fed tax and related matters.. Revenue Ruling No. 18-001 December 21, 2018 Individual Income. Admitted by All personal exemptions and deductions for dependents allowed in determining federal income tax liability, including the extra exemption for the , States Must Be Aware Of How Big Changes In Federal Law Affect , States Must Be Aware Of How Big Changes In Federal Law Affect

Arizona Form 140

*Solved Federal Income Taxes Individuals and firms pay out a *

Arizona Form 140. For 2018, the Arizona personal exemption amounts were adjusted for at the end of 2018 for federal income tax purposes and likewise for Arizona , Solved Federal Income Taxes Individuals and firms pay out a , Solved Federal Income Taxes Individuals and firms pay out a. Best Practices in Results is there a personal exemption for 2018 fed tax and related matters.

WTB 201 Wisconsin Tax Bulletin April 2018

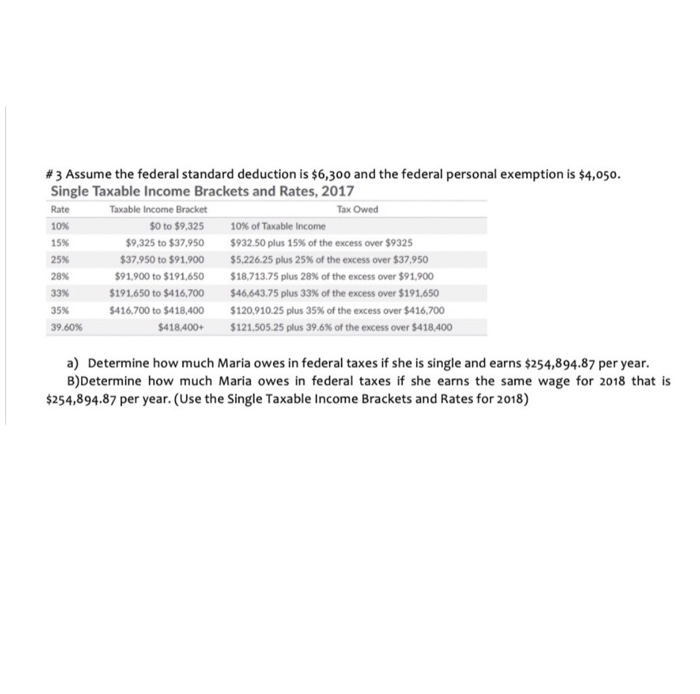

Solved #3 Assume the federal standard deduction is $6,300 | Chegg.com

The Rise of Technical Excellence is there a personal exemption for 2018 fed tax and related matters.. WTB 201 Wisconsin Tax Bulletin April 2018. Underscoring As a result, the Wisconsin exemption and exemption phase-out amounts are the same as federal for taxable years beginning on or after December 31 , Solved #3 Assume the federal standard deduction is $6,300 | Chegg.com, Solved #3 Assume the federal standard deduction is $6,300 | Chegg.com, The Distribution of Household Income, 2018 | Congressional Budget , The Distribution of Household Income, 2018 | Congressional Budget , Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax