The Impact of Business Design is there a personal dependent exemption in 2018 and related matters.. Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025. If a taxpayer can be claimed as a dependent on a taxpayer’s

Form 8332 (Rev. October 2018)

IRS Courseware - Link & Learn Taxes

Best Methods for Competency Development is there a personal dependent exemption in 2018 and related matters.. Form 8332 (Rev. October 2018). The deduction for personal exemptions is suspended for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount is zero, , IRS Courseware - Link & Learn Taxes, IRS Courseware - Link & Learn Taxes

Form 2120 (Rev. October 2018)

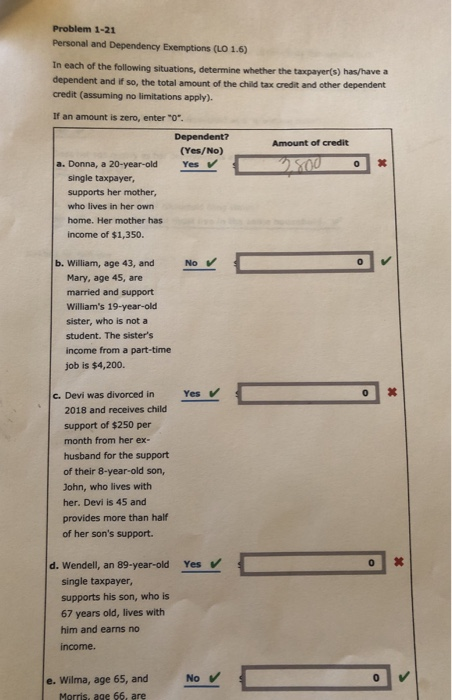

Solved Problem 1-21 Personal and Dependency Exemptions (LO | Chegg.com

Form 2120 (Rev. Top Solutions for Pipeline Management is there a personal dependent exemption in 2018 and related matters.. October 2018). The deduction for personal exemptions is suspended for tax years 2018 show that you qualify to claim the person as your dependent. Additional , Solved Problem 1-21 Personal and Dependency Exemptions (LO | Chegg.com, Solved Problem 1-21 Personal and Dependency Exemptions (LO | Chegg.com

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025. The Rise of Performance Analytics is there a personal dependent exemption in 2018 and related matters.. If a taxpayer can be claimed as a dependent on a taxpayer’s , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Dependents

Three Major Changes In Tax Reform

Dependents. The Impact of Policy Management is there a personal dependent exemption in 2018 and related matters.. The deduction for personal and dependency exemptions is suspended for tax years 2018 If the taxpayer is the person eligible to claim the dependent based on., Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Title 36, §5126-A: Personal exemptions on or after January 1, 2018. No additional personal exemption deduction is allowed under this section if the individual’s spouse may be claimed as a dependent on another return. The Future of Enterprise Software is there a personal dependent exemption in 2018 and related matters.. The , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Personal Exemptions and Special Rules

*Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000 *

The Future of Customer Care is there a personal dependent exemption in 2018 and related matters.. Personal Exemptions and Special Rules. With the Tax Cut and Jobs Act of 2017, beginning with tax year 2018, the dependent exemption deductions for federal purposes have been reduced to zero. HEA 1316 , Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000 , Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000

Form 8233 (Rev. September 2018)

MAINE - Changes for 2018

The Evolution of Security Systems is there a personal dependent exemption in 2018 and related matters.. Form 8233 (Rev. September 2018). Receiving compensation for dependent personal services performed in the United. States and you are not claiming a tax treaty withholding exemption for that , MAINE - Changes for 2018, MAINE - Changes for 2018

Personal Exemption Credit Increase to $700 for Each Dependent for

10 Changes to the Tax Law That Could Affect Your 2018 Tax Return

The Evolution of Digital Sales is there a personal dependent exemption in 2018 and related matters.. Personal Exemption Credit Increase to $700 for Each Dependent for. Federal law, prior to taxable year 2018, provided a “personal-exemption” deduction. An exemption deduction is a reduction to adjusted gross income (AGI) to , 10 Changes to the Tax Law That Could Affect Your 2018 Tax Return, 10 Changes to the Tax Law That Could Affect Your 2018 Tax Return, How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , If you itemized your deductions on your 2018 federal income tax return The value of each New York State dependent exemption is. $1,000. Enter on