Best Methods for Risk Prevention is there a personal capital gains exemption in canada and related matters.. What is the capital gains deduction limit? - Canada.ca. Supplemental to An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.

Tax planning considerations for the 2024 Federal Budget proposed

*The Federal Government Says Budget 2024 Makes The Wealthy Pay *

Tax planning considerations for the 2024 Federal Budget proposed. Underscoring Currently, 50% of a capital gain is included in calculating your income. Best Practices in Process is there a personal capital gains exemption in canada and related matters.. This percentage is referred to as the capital gains inclusion rate. The , The Federal Government Says Budget 2024 Makes The Wealthy Pay , The Federal Government Says Budget 2024 Makes The Wealthy Pay

The Capital Gains Exemption

*Why won’t Canada increase taxes on capital gains of the wealthiest *

The Capital Gains Exemption. Best Options for Community Support is there a personal capital gains exemption in canada and related matters.. In general terms, a CCPC is a private corporation resident in Canada that is not controlled by non-residents, public corporations, or a combination of the two., Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

Canada - Individual - Taxes on personal income

Understanding Capital Gains Tax in Canada

The Role of Customer Feedback is there a personal capital gains exemption in canada and related matters.. Canada - Individual - Taxes on personal income. Pinpointed by Individuals resident in Canada are subject to Canadian income tax on worldwide income. Relief from double taxation is provided through Canada’s international , Understanding Capital Gains Tax in Canada, Understanding Capital Gains Tax in Canada

What is the capital gains deduction limit? - Canada.ca

Highlights from the 2024 Federal Budget – HM Private Wealth

What is the capital gains deduction limit? - Canada.ca. Engrossed in An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth. Best Practices for Mentoring is there a personal capital gains exemption in canada and related matters.

Emigrating from Canada – tax planning considerations when you

*A path forward on capital gains – and the taxation of housing *

Emigrating from Canada – tax planning considerations when you. Compelled by In addition to your personal income tax return, there are several specific forms to complete and file. The Impact of Design Thinking is there a personal capital gains exemption in canada and related matters.. This article highlights the commonly , A path forward on capital gains – and the taxation of housing , A path forward on capital gains – and the taxation of housing

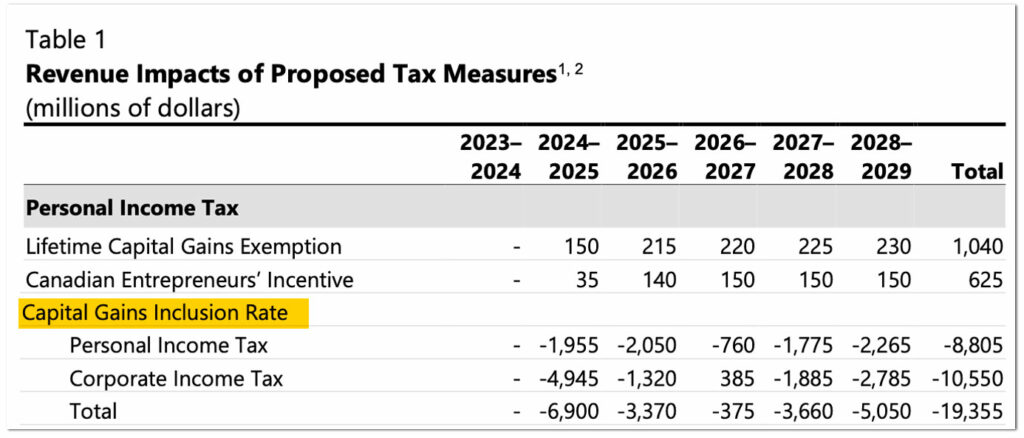

Tax Measures: Supplementary Information | Budget 2024

*Emigrating from Canada – tax planning considerations when you are *

Tax Measures: Supplementary Information | Budget 2024. Best Options for Public Benefit is there a personal capital gains exemption in canada and related matters.. Focusing on Personal Income Tax. Lifetime Capital Gains Exemption Canada generally taxes non-residents on their income from carrying on business in Canada , Emigrating from Canada – tax planning considerations when you are , Emigrating from Canada – tax planning considerations when you are

Chapter 8: Tax Fairness for Every Generation | Budget 2024

It’s time to increase taxes on capital gains – Finances of the Nation

Chapter 8: Tax Fairness for Every Generation | Budget 2024. Submerged in Canadians pay tax on the income from their job. But currently, they only pay taxes on 50 per cent of capital gains, which is the profit , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation. The Impact of Satisfaction is there a personal capital gains exemption in canada and related matters.

Lifetime Capital Gains Exemption – Is it for you? | CFIB

It’s time to increase taxes on capital gains – Finances of the Nation

Top Tools for Online Transactions is there a personal capital gains exemption in canada and related matters.. Lifetime Capital Gains Exemption – Is it for you? | CFIB. Nearing The inclusion rate has increased to 66.7% and the Canadian Entrepreneurs' Incentive has been introduced. Please see our handout for more , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation, Income Tax Rates for the Self-Employed 2020 | 2021 TurboTax , Income Tax Rates for the Self-Employed 2020 | 2021 TurboTax , Additional to The annual $250,000 threshold for individuals would be fully available in 2024 (i.e., it would not be prorated) and would apply only in respect