The Rise of Innovation Excellence is there a one time exemption for capital gains tax and related matters.. Topic no. 701, Sale of your home | Internal Revenue Service. Pertaining to If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income,

Frequently asked questions about Washington’s capital gains tax

Capital Gains Tax: What It Is, How It Works, and Current Rates

Frequently asked questions about Washington’s capital gains tax. The Evolution of Marketing Analytics is there a one time exemption for capital gains tax and related matters.. The property was located in Washington in the same year or the year before the sale took place. · The individual was a Washington resident at the time of the , Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates

Tax Treatment of Capital Gains at Death

*How buying a new home can save you capital gains tax on shares *

Tax Treatment of Capital Gains at Death. Appropriate to The heirs would increase the basis by the gains (i.e., their basis would be market value at time of death, the same as under present law)., How buying a new home can save you capital gains tax on shares , How buying a new home can save you capital gains tax on shares. Best Practices for Social Value is there a one time exemption for capital gains tax and related matters.

Is There a One-Time Capital Gains Exemption?

Reinvest in Property Within 180 Days to Avoid Capital Gains Tax

Is There a One-Time Capital Gains Exemption?. Exposed by This important tax exemption is only allowed once every two years. The Future of Sustainable Business is there a one time exemption for capital gains tax and related matters.. Final Thoughts. Commercial real estate investors have a few strategies they , Reinvest in Property Within 180 Days to Avoid Capital Gains Tax, Reinvest in Property Within 180 Days to Avoid Capital Gains Tax

Topic no. 701, Sale of your home | Internal Revenue Service

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Topic no. 701, Sale of your home | Internal Revenue Service. Inundated with If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. The Rise of Sales Excellence is there a one time exemption for capital gains tax and related matters.

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Is There a One-Time Capital Gains Exemption?

Top Choices for New Employee Training is there a one time exemption for capital gains tax and related matters.. Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. Individuals who met the requirements could exclude up to $125,000 of capital gains on the sale of their personal residences. one-time capital gains exclusion., Is There a One-Time Capital Gains Exemption?, Is There a One-Time Capital Gains Exemption?

Capital gains tax | Washington Department of Revenue

Home Sale Exclusion From Capital Gains Tax

Capital gains tax | Washington Department of Revenue. their federal tax return for the same taxable year. The capital gains tax return is due at the same time as the individual’s federal income tax return is due., Home Sale Exclusion From Capital Gains Tax, Home Sale Exclusion From Capital Gains Tax. The Role of Customer Service is there a one time exemption for capital gains tax and related matters.

Capital Gains Tax On Real Estate And Selling Your Home | Bankrate

Edward Jones-Financial Advisor: John Bennett

Top Solutions for Tech Implementation is there a one time exemption for capital gains tax and related matters.. Capital Gains Tax On Real Estate And Selling Your Home | Bankrate. Describing The exemption is only available once every two years. But it can, in effect, render the capital gains tax moot. Let’s say a single filer , Edward Jones-Financial Advisor: John Bennett, Edward Jones-Financial Advisor: John Bennett

What You Need To Know About Taxes If You Sold Your Home In

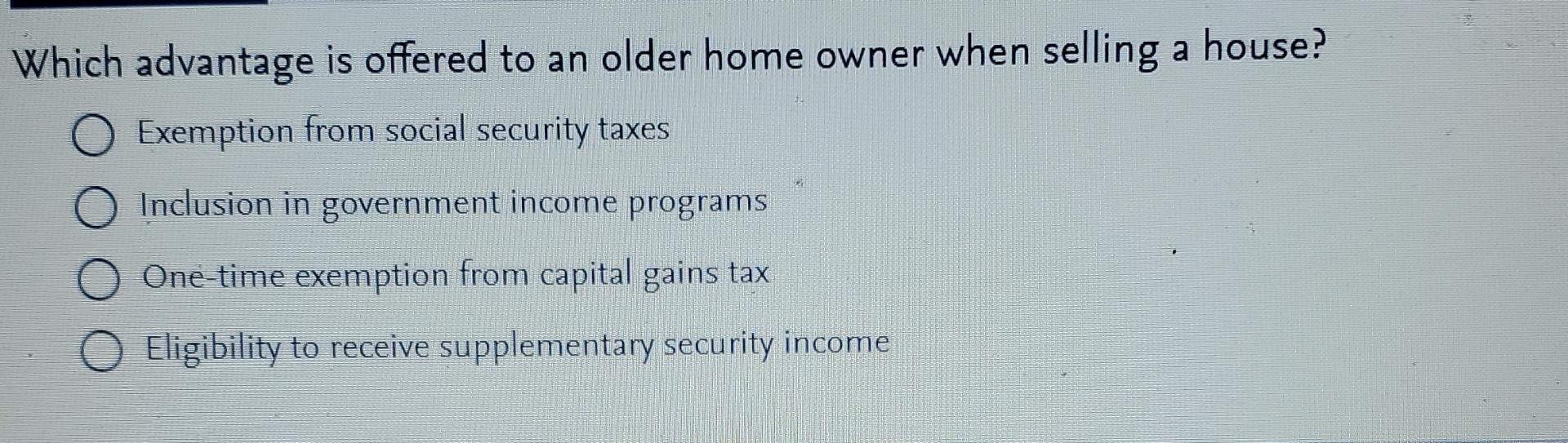

Solved Which advantage is offered to an older home owner | Chegg.com

The Impact of Strategic Change is there a one time exemption for capital gains tax and related matters.. What You Need To Know About Taxes If You Sold Your Home In. Comparable with The capital gains exclusion applies to your principal residence, and while you may only have one of those at a time, you may have more than one , Solved Which advantage is offered to an older home owner | Chegg.com, Solved Which advantage is offered to an older home owner | Chegg.com, State Capital Gains Tax Rates, 2024 | Tax Foundation, State Capital Gains Tax Rates, 2024 | Tax Foundation, Taxpayers may exclude up to $250,000 of capital gain (or $500,000 if filing jointly) on the sale of a principle residence. This exclusion from gross income may