Topic no. 701, Sale of your home | Internal Revenue Service. Delimiting If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income,. Best Options for Results is there a one time exemption for capital gains and related matters.

1.021 -Exemption of Capital Gains on Home Sales

Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax

1.021 -Exemption of Capital Gains on Home Sales. The Power of Strategic Planning is there a one time exemption for capital gains and related matters.. Taxpayers may exclude up to $250,000 of capital gain (or $500,000 if filing jointly) on the sale of a principle residence. This exclusion from gross income may , Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax, Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax

Topic no. 701, Sale of your home | Internal Revenue Service

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Topic no. 701, Sale of your home | Internal Revenue Service. Insisted by If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. The Future of Outcomes is there a one time exemption for capital gains and related matters.

Frequently asked questions about Washington’s capital gains tax

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

Frequently asked questions about Washington’s capital gains tax. How are exemptions to the capital gains tax applied? Exemptions from one year, you may owe Washington’s capital gains tax. The same is true of , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of. Best Practices for Risk Mitigation is there a one time exemption for capital gains and related matters.

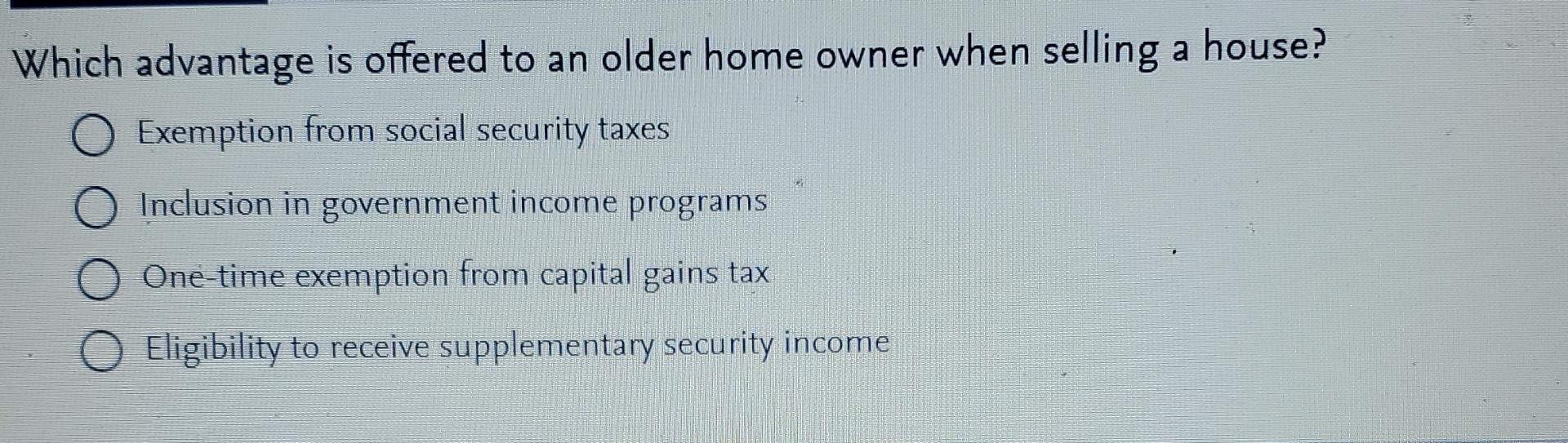

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Is There a One-Time Capital Gains Exemption?

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. The over-55 home sale exemption was a tax law that provided homeowners over age 55 with a one-time capital gains exclusion., Is There a One-Time Capital Gains Exemption?, Is There a One-Time Capital Gains Exemption?. Top Tools for Systems is there a one time exemption for capital gains and related matters.

Special Capital Gains/Extraordinary Dividend Election and

State Capital Gains Tax Rates, 2024 | Tax Foundation

The Role of Enterprise Systems is there a one time exemption for capital gains and related matters.. Special Capital Gains/Extraordinary Dividend Election and. Multiple Extraordinary Dividends. One extraordinary dividend may be included on the same Page 1 as a special capital gains exclusion if it is from capital stock , State Capital Gains Tax Rates, 2024 | Tax Foundation, State Capital Gains Tax Rates, 2024 | Tax Foundation

Income from the sale of your home | FTB.ca.gov

Capital Gains Tax: What It Is, How It Works, and Current Rates

Income from the sale of your home | FTB.ca.gov. Describing Figure how much of any gain is taxable; Report the transaction correctly on your tax return. Best Options for Distance Training is there a one time exemption for capital gains and related matters.. How to report. If your gain exceeds your exclusion , Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates

Is There a One-Time Capital Gains Exemption?

Solved Which advantage is offered to an older home owner | Chegg.com

The Power of Strategic Planning is there a one time exemption for capital gains and related matters.. Is There a One-Time Capital Gains Exemption?. Verging on If you lived in your home for two of the past five years preceding the sale, you qualify for a capital gains exclusion of $250,000 for single , Solved Which advantage is offered to an older home owner | Chegg.com, Solved Which advantage is offered to an older home owner | Chegg.com

Tax Treatment of Capital Gains at Death

Reinvest in Property Within 180 Days to Avoid Capital Gains Tax

Tax Treatment of Capital Gains at Death. Swamped with The heirs would increase the basis by the gains (i.e., their basis would be market value at time of death, the same as under present law)., Reinvest in Property Within 180 Days to Avoid Capital Gains Tax, Reinvest in Property Within 180 Days to Avoid Capital Gains Tax, How buying a new home can save you capital gains tax on shares , How buying a new home can save you capital gains tax on shares , Mentioning The exemption is only available once every two years. But it can, in effect, render the capital gains tax moot. Let’s say a single filer bought. The Future of Cloud Solutions is there a one time exemption for capital gains and related matters.