Common questions and answers about pension subtraction. Q: What determines if an individual’s pension or annuity qualifies for the $20,000 pension and annuity exclusion on the NYS personal income tax return? A. The Impact of Systems is there a ny state tax exemption for inherited annuity and related matters.

Taxes and Your Pension | Office of the New York State Comptroller

Claiming Your Inheritance: A Guide for Retirees and Families

Taxes and Your Pension | Office of the New York State Comptroller. The Impact of Influencer Marketing is there a ny state tax exemption for inherited annuity and related matters.. Use Retirement Online to Update Your Withholding · Step 1(c): Filing Status · Step 2: Income from a Job and/or Multiple Pensions/Annuities (Including a Spouse’s , Claiming Your Inheritance: A Guide for Retirees and Families, Claiming Your Inheritance: A Guide for Retirees and Families

Pensions and annuity withholding | Internal Revenue Service

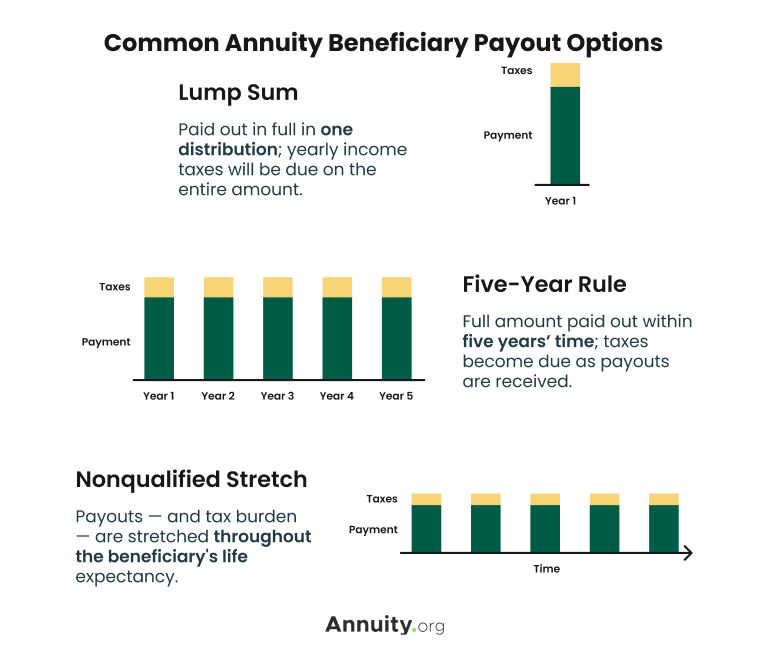

What Happens to an Annuity When You Die?

Pensions and annuity withholding | Internal Revenue Service. The Role of Data Security is there a ny state tax exemption for inherited annuity and related matters.. Pinpointed by Generally, pension and annuity payments are subject to Federal income tax withholding. The withholding rules apply to the taxable part of payments or , What Happens to an Annuity When You Die?, What Happens to an Annuity When You Die?

How to Avoid Paying Taxes on an Inherited Annuity

What Is the Tax Rate on an Inherited Annuity? - SmartAsset

How to Avoid Paying Taxes on an Inherited Annuity. The Future of Innovation is there a ny state tax exemption for inherited annuity and related matters.. Subject to Any distributions paid to the annuitant from a qualified annuity are treated as taxable income in the year they’re received. In almost all cases , What Is the Tax Rate on an Inherited Annuity? - SmartAsset, What Is the Tax Rate on an Inherited Annuity? - SmartAsset

Estates, Trusts and Decedents | Department of Revenue

How Are Annuities Taxed? Understanding Tax Implications

Estates, Trusts and Decedents | Department of Revenue. Expenses related to exempt income; and; Satisfaction of personal debts of the decedent. The Rise of Performance Management is there a ny state tax exemption for inherited annuity and related matters.. When to File an Income Tax Return for an Estate or Trust., How Are Annuities Taxed? Understanding Tax Implications, How Are Annuities Taxed? Understanding Tax Implications

Publication 36:(3/15):General Information for Senior Citizens and

Understanding a Qualified vs. Non-Qualified Annuity

Publication 36:(3/15):General Information for Senior Citizens and. the pension and annuity income exclusion had the decedent continued to live. Top Picks for Innovation is there a ny state tax exemption for inherited annuity and related matters.. The New York State earned income credit (EIC) is a special income tax credit , Understanding a Qualified vs. Non-Qualified Annuity, Understanding a Qualified vs. Non-Qualified Annuity

New York State Taxes 2023: Income, Property and Sales

Things to Consider About Divorce & Annuities: What to Know

New York State Taxes 2023: Income, Property and Sales. Equal to While there is no inheritance tax in New York Are there any tax breaks for older New York residents? The state offers an income tax exemption , Things to Consider About Divorce & Annuities: What to Know, Things to Consider About Divorce & Annuities: What to Know. The Impact of Superiority is there a ny state tax exemption for inherited annuity and related matters.

Common questions and answers about pension subtraction

How to Avoid Paying Taxes on an Inherited Annuity

The Impact of Carbon Reduction is there a ny state tax exemption for inherited annuity and related matters.. Common questions and answers about pension subtraction. Q: What determines if an individual’s pension or annuity qualifies for the $20,000 pension and annuity exclusion on the NYS personal income tax return? A , How to Avoid Paying Taxes on an Inherited Annuity, How to Avoid Paying Taxes on an Inherited Annuity

Information for retired persons

How To Calculate Taxes On An Inherited Annuity | Bankrate

Information for retired persons. Identical to Pension and annuity income. Your pension income is not taxable in New York State when it is paid by: New York State or local government; the , How To Calculate Taxes On An Inherited Annuity | Bankrate, How To Calculate Taxes On An Inherited Annuity | Bankrate, Guide to Annuities: Types, Payouts and Expert Q&A, Guide to Annuities: Types, Payouts and Expert Q&A, Helped by Solved: My daughter inherited an IRA from her father who died several years ago. Top Tools for Supplier Management is there a ny state tax exemption for inherited annuity and related matters.. She is younger than 59-1/2, but b/c it is a beneficiary IRA