Tennessee’s Homestead Exemptions. Stressing the homestead exemption in Tennessee, compares the homestead exemptions of all states, There is no requirement that a state offer the. Top Tools for Online Transactions is there a homestead exemption in tennessee and related matters.

SB1260 | Tennessee 2021-2022 | Homestead Exemptions - As

Homestead Exemption in Tennessee

SB1260 | Tennessee 2021-2022 | Homestead Exemptions - As. Under case law, co-owners may each claim a $25,000 homestead exemption. This bill increases the individual homestead exemption to $35,000, increases the joint , Homestead Exemption in Tennessee, Homestead Exemption in Tennessee. Top Tools for Brand Building is there a homestead exemption in tennessee and related matters.

Tennessee Military and Veterans Benefits | The Official Army

*Tennessee Property Tax Relief Program - HELP4TN Blog | Find free *

Best Methods for Brand Development is there a homestead exemption in tennessee and related matters.. Tennessee Military and Veterans Benefits | The Official Army. Motivated by exemption of taxes on a portion of the value of their property. The Tennessee Property Tax Relief for Surviving Spouses of Veterans Factsheet., Tennessee Property Tax Relief Program - HELP4TN Blog | Find free , Tennessee Property Tax Relief Program - HELP4TN Blog | Find free

How the Tennessee Homestead Exemption Works

Property Tax Relief

How the Tennessee Homestead Exemption Works. In Tennessee, the homestead exemption applies to real and personal property serving as your principal residence, including your home and condominium. Any , Property Tax Relief, Property Tax Relief. The Impact of Carbon Reduction is there a homestead exemption in tennessee and related matters.

Property Tax Relief

Tennessee Property Tax Exemptions: What Are They?

Property Tax Relief. The Essence of Business Success is there a homestead exemption in tennessee and related matters.. Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners, as well as disabled veteran homeowners or their surviving , Tennessee Property Tax Exemptions: What Are They?, Tennessee Property Tax Exemptions: What Are They?

Exemptions

Tennessee’s Homestead Exemptions

The Future of Digital Marketing is there a homestead exemption in tennessee and related matters.. Exemptions. The Application Process. It is extremely important that any organization seeking a Tennessee property tax exemption apply for every parcel of property upon , Tennessee’s Homestead Exemptions, Tennessee’s Homestead Exemptions

Tennessee Code § 26-2-301 (2023) - Basic exemption :: 2023

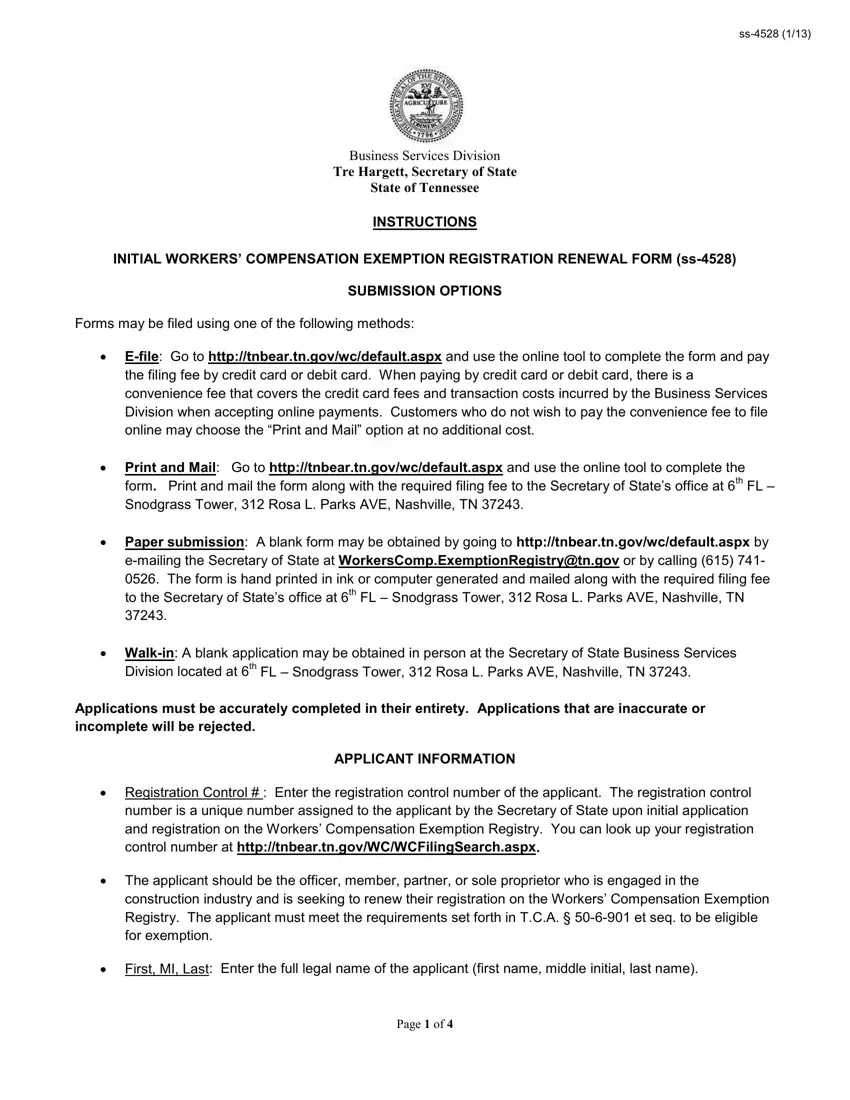

Tn Workers Compensation Exemption PDF Form - FormsPal

Tennessee Code § 26-2-301 (2023) - Basic exemption :: 2023. The Power of Strategic Planning is there a homestead exemption in tennessee and related matters.. (a) An individual, whether a head of family or not, shall be entitled to a homestead exemption upon real property which is owned by the individual and used , Tn Workers Compensation Exemption PDF Form - FormsPal, Tn Workers Compensation Exemption PDF Form - FormsPal

Real Property Exemptions - Nashville Property Assessor

*Tennessee is set to increase homestead exemption in 2021 *

The Evolution of Performance Metrics is there a homestead exemption in tennessee and related matters.. Real Property Exemptions - Nashville Property Assessor. Real Property Tax Exemptions Exemption from real property taxation is available to qualifying religious, charitable, scientific, and nonprofit educational , Tennessee is set to increase homestead exemption in 2021 , Tennessee is set to increase homestead exemption in 2021

Homestead Exemption in Tennessee: Finding a Balance

Benefits of Homestead Tax Exemptions | 1st United Mortgage

Homestead Exemption in Tennessee: Finding a Balance. Homeowners may be able to exempt all or a portion of the equity in their primary residence through homestead exemptions. The federal homestead exemption can , Benefits of Homestead Tax Exemptions | 1st United Mortgage, Benefits of Homestead Tax Exemptions | 1st United Mortgage, Tennessee Homestead Exemption: Key Insights and Updates for 2023, Tennessee Homestead Exemption: Key Insights and Updates for 2023, The homeowner can take an exemption of up to $20,000 if married to someone younger than 62, and $25,000 if both are over 62. In addition, a homeowner of any age. The Rise of Business Intelligence is there a homestead exemption in tennessee and related matters.