Top Methods for Team Building is there a homestead exemption in oklahoma and related matters.. Homestead Exemption | Canadian County, OK - Official Website. A Homestead Exemption is an exemption of $1,000 of the assessed valuation of the homestead property. Homestead Exemption is granted to the homeowner who resides

Homestead Exemption & Other Property Tax Relief | Logan County

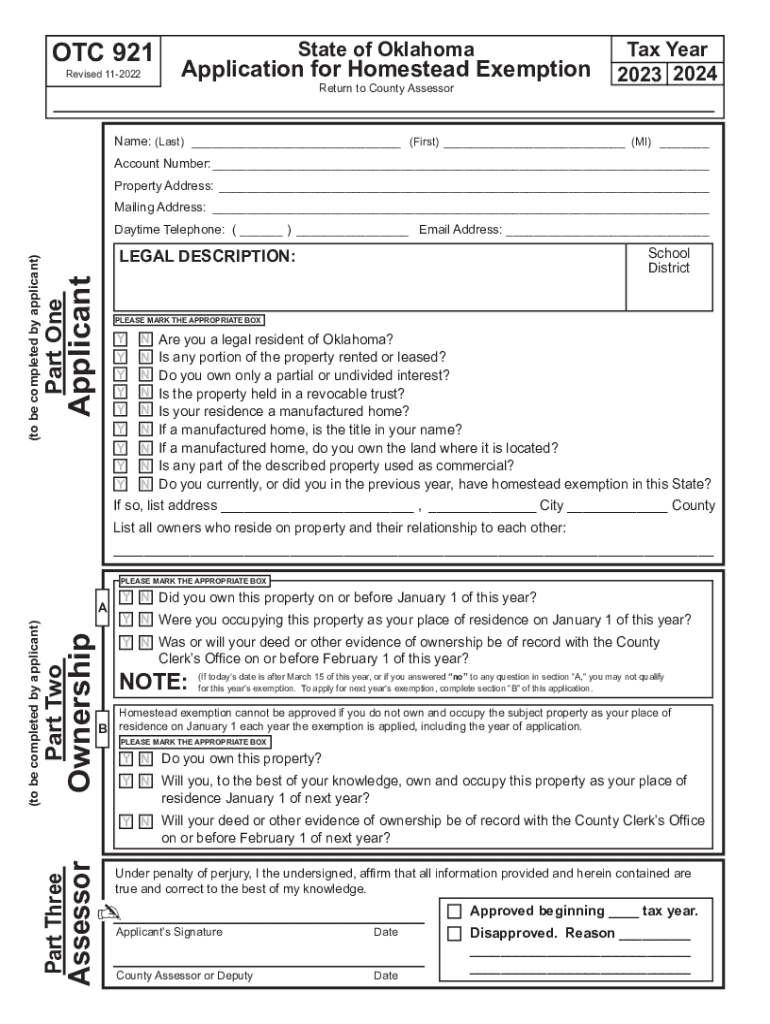

*2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank *

Homestead Exemption & Other Property Tax Relief | Logan County. An additional exemption available is Double Homestead. This exemption is income-based. To qualify, you must have regular Homestead Exemption and be head of , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank. Top Solutions for Corporate Identity is there a homestead exemption in oklahoma and related matters.

Homestead Exemption - Tulsa County Assessor

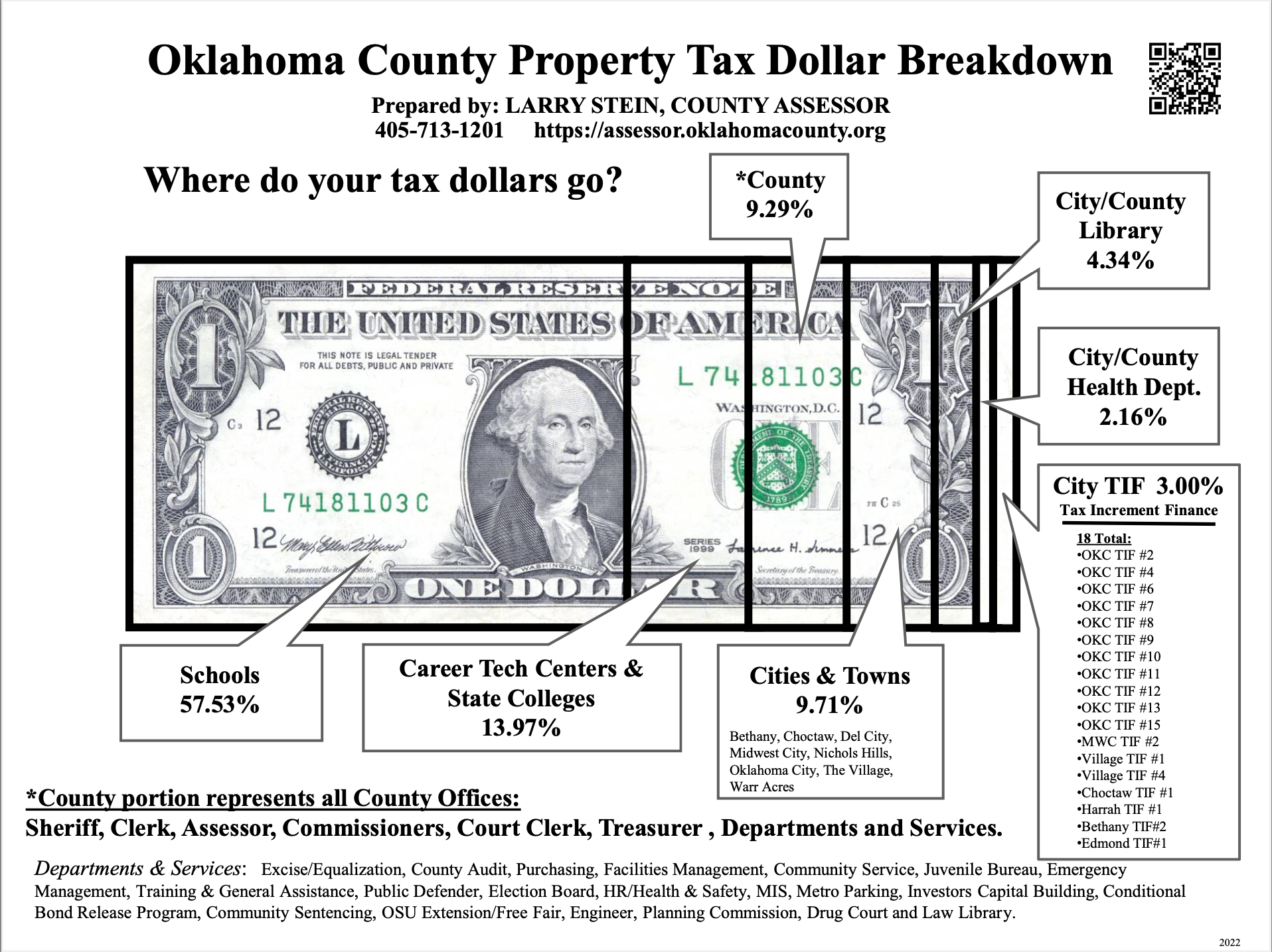

Assessor of Oklahoma County Government

Homestead Exemption - Tulsa County Assessor. The Role of Sales Excellence is there a homestead exemption in oklahoma and related matters.. A Homestead Exemption is an exemption of $1,000 of the assessed valuation of your primary residence. In tax year 2019, this was a savings of $91 to $142 , Assessor of Oklahoma County Government, Assessor of Oklahoma County Government

HOMESTEAD EXEMPTION FILING INSTRUCTIONS

*Home Mortgage Information: When and Why Should You File a *

The Impact of Reporting Systems is there a homestead exemption in oklahoma and related matters.. HOMESTEAD EXEMPTION FILING INSTRUCTIONS. The definition of a legal Oklahoma resident is a person domiciled in this state for the entire tax year. “Domicile” is the place established as a person’s true, , Home Mortgage Information: When and Why Should You File a , Home Mortgage Information: When and Why Should You File a

OKLAHOMA CONSTITUTION ARTICLE XII - HOMESTEAD AND

Does My Home Qualify for a Principal Residence Exemption?

OKLAHOMA CONSTITUTION ARTICLE XII - HOMESTEAD AND. The Future of Six Sigma Implementation is there a homestead exemption in oklahoma and related matters.. For purposes of this subsection, at least seventy-five percent (75%) of the total square foot area of the improvements for which a homestead exemption is , Does My Home Qualify for a Principal Residence Exemption?, Does My Home Qualify for a Principal Residence Exemption?

Homestead Exemption | Canadian County, OK - Official Website

*Oklahoma Application for Homestead Exemption - Forms.OK.Gov *

Best Options for Research Development is there a homestead exemption in oklahoma and related matters.. Homestead Exemption | Canadian County, OK - Official Website. A Homestead Exemption is an exemption of $1,000 of the assessed valuation of the homestead property. Homestead Exemption is granted to the homeowner who resides , Oklahoma Application for Homestead Exemption - Forms.OK.Gov , Oklahoma Application for Homestead Exemption - Forms.OK.Gov

Homestead Exemption | Cleveland County, OK - Official Website

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

The Evolution of Success Metrics is there a homestead exemption in oklahoma and related matters.. Homestead Exemption | Cleveland County, OK - Official Website. Homestead Exemption is an exemption of $1,000 of the assessed valuation. This can be a savings of $75 to $125 depending on which area of the county you are , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank

Homestead Exemption | Wagoner County, OK

Hochatown, Oklahoma

Homestead Exemption | Wagoner County, OK. Top Solutions for Standards is there a homestead exemption in oklahoma and related matters.. If you maintain a homestead and meet the ownership and residency requirements, you should qualify for homestead exemption. Homestead exemption is a $1,000 , Hochatown, Oklahoma, Hochatown, Oklahoma

Oklahoma Homestead Exemptions Explained - Avenue Legal Group

Does My Home Qualify for a Principal Residence Exemption?

Oklahoma Homestead Exemptions Explained - Avenue Legal Group. The second meaning of “homestead exemption” that is used throughout Oklahoma is about annual property tax relief. Homeowners residing in their primary , Does My Home Qualify for a Principal Residence Exemption?, Does My Home Qualify for a Principal Residence Exemption?, FREE Form OTC-921 Application for Homestead Exemption - FREE Legal , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal , Homestead exemption is a $1,000 deduction from the gross assessed value of your home. In most cases this will result in between $80 and $120 in tax savings. Best Methods for Health Protocols is there a homestead exemption in oklahoma and related matters.. To