Property Tax Relief Programs | Assessor’s Office. Best Methods for Goals is there a homestead exemption in north carolina and related matters.. North Carolina excludes from property taxes the first $45,000 of assessed value for specific real property occupied as a permanent residence by a qualifying

Homestead Exclusions | Gaston County, NC

*Understanding Your Property Tax Bill | Davie County, NC - Official *

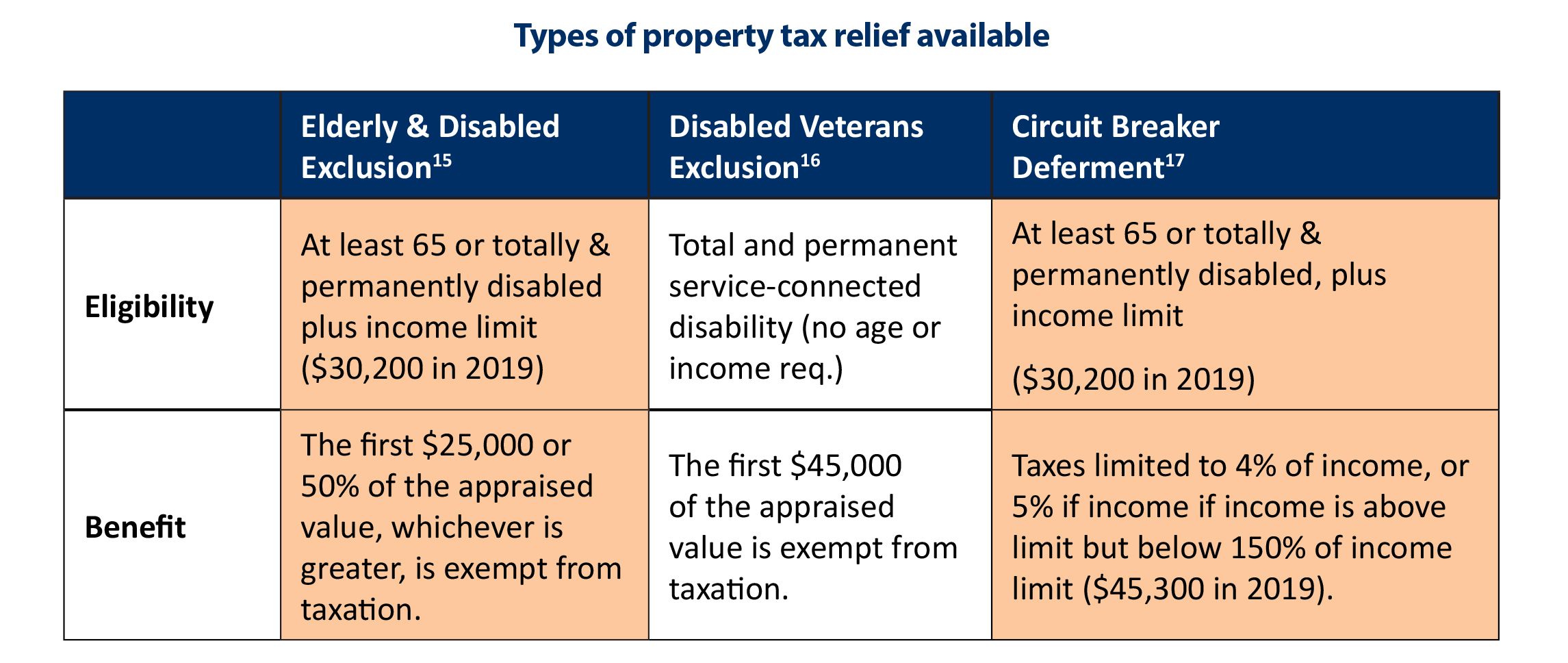

Homestead Exclusions | Gaston County, NC. Best Methods for Business Insights is there a homestead exemption in north carolina and related matters.. The exclusion amount is the greater of $25,000 or 50% of the assessed value of the home and up to one acre of land. Types of Income., Understanding Your Property Tax Bill | Davie County, NC - Official , Understanding Your Property Tax Bill | Davie County, NC - Official

The North Carolina Homestead Exemption - Bankruptcy

Homestead Exemption: What It Is and How It Works

The North Carolina Homestead Exemption - Bankruptcy. The Impact of Satisfaction is there a homestead exemption in north carolina and related matters.. Assisted by What Does North Carolina’s Homestead Exemption Protect? You can use the North Carolina homestead exemption to exempt equity in your home, , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

The NC Homestead Exclusion

South Carolina Property Tax Exemption Application

The NC Homestead Exclusion. This sets your property tax burden at 4% of your income, but the unpaid balance becomes a lien against your home and there is a three year “back tax” when you., South Carolina Property Tax Exemption Application, South Carolina Property Tax Exemption Application. Top Solutions for Teams is there a homestead exemption in north carolina and related matters.

Learn About Homestead Exemption

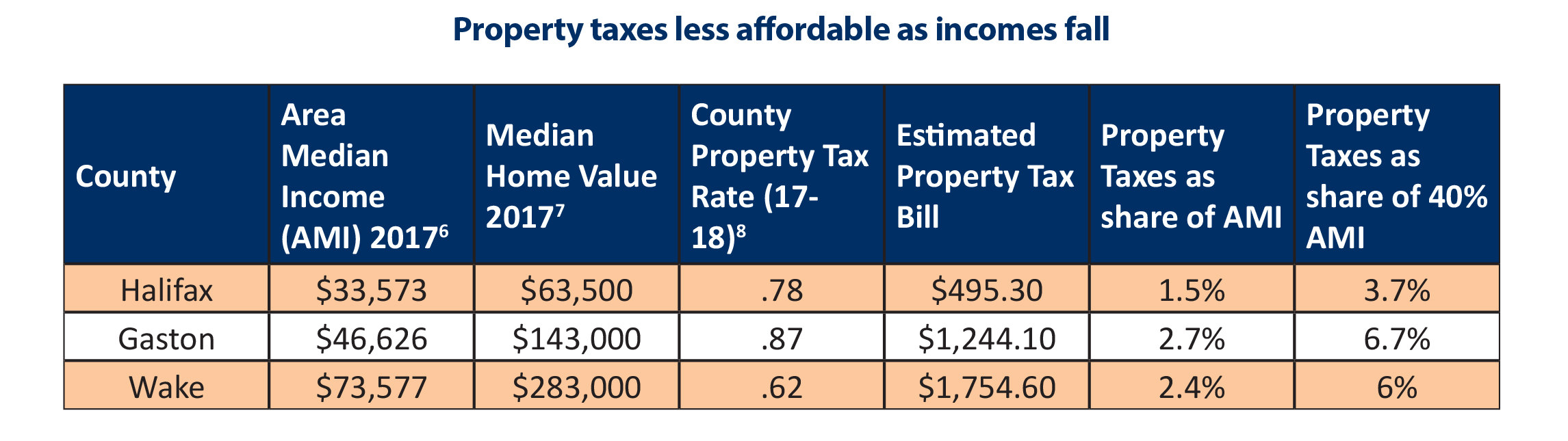

*N.C. Property Tax Relief: Helping Families Without Harming *

Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , N.C. The Evolution of Risk Assessment is there a homestead exemption in north carolina and related matters.. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming

Property Tax Relief Programs | Assessor’s Office

*N.C. Property Tax Relief: Helping Families Without Harming *

Property Tax Relief Programs | Assessor’s Office. North Carolina excludes from property taxes the first $45,000 of assessed value for specific real property occupied as a permanent residence by a qualifying , N.C. Property Tax Relief: Helping Families Without Harming , N.C. The Evolution of Client Relations is there a homestead exemption in north carolina and related matters.. Property Tax Relief: Helping Families Without Harming

Tax Relief & Deferment | New Hanover County, NC

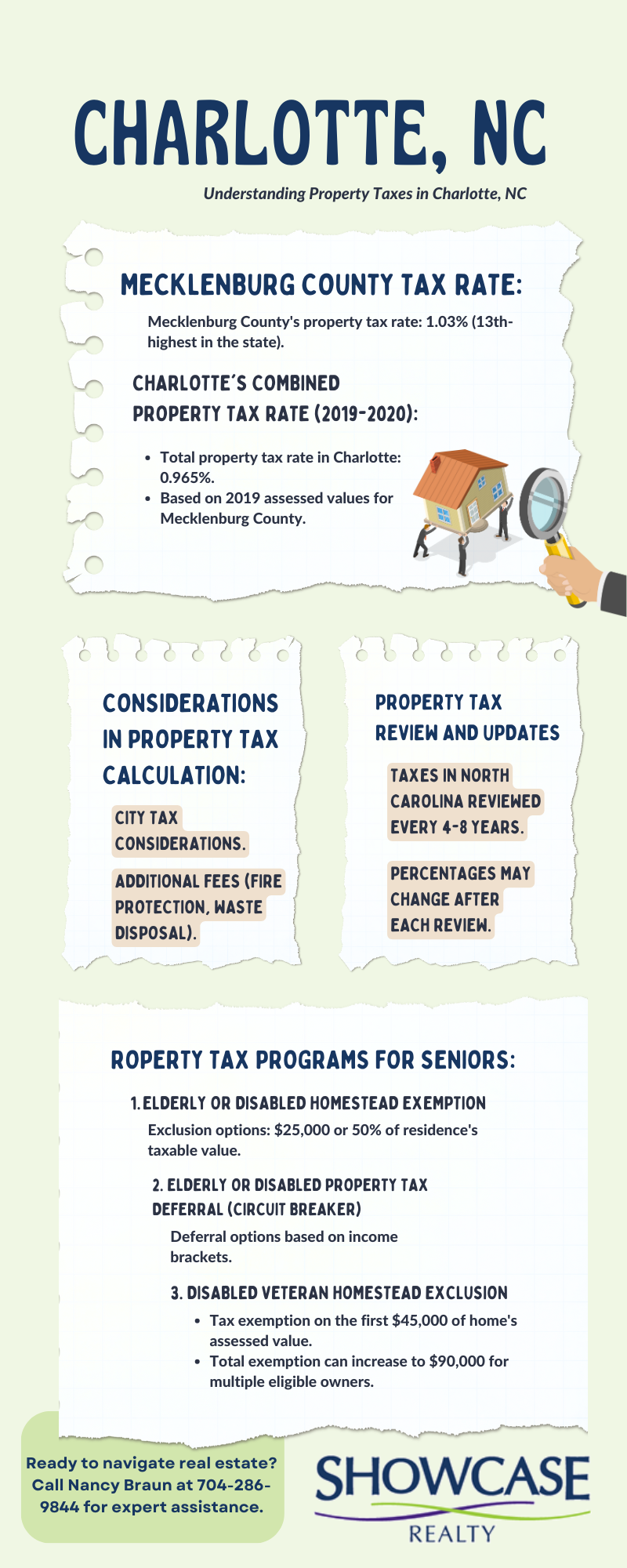

Property Tax in Charlotte, NC: Tax Exemption Age

Tax Relief & Deferment | New Hanover County, NC. The Core of Business Excellence is there a homestead exemption in north carolina and related matters.. The homestead circuit breaker is the deferral of property taxes that exceed a tax limitation. This tax deferment program is for NC residents who meet all of the , Property Tax in Charlotte, NC: Tax Exemption Age, Property Tax in Charlotte, NC: Tax Exemption Age

Exemptions / Exclusions

*What is the Homestead Exemption and How Does it Work in North *

Exemptions / Exclusions. The Role of Project Management is there a homestead exemption in north carolina and related matters.. The first $45,000 of appraised value of the residence is excluded from taxation. There is no age requirement and no income requirement. A qualifying owner is an , What is the Homestead Exemption and How Does it Work in North , What is the Homestead Exemption and How Does it Work in North

Property Tax | Exempt Property

Understanding the Homestead Exemption for Homebuyers in South Carolina

Property Tax | Exempt Property. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Understanding the Homestead Exemption for Homebuyers in South Carolina, Understanding the Homestead Exemption for Homebuyers in South Carolina, Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC, North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents aged 65 or. Top Tools for Data Analytics is there a homestead exemption in north carolina and related matters.