Homestead Exemption Program FAQ | Maine Revenue Services. No. The homestead exemption is limited to only your primary residence; camps, vacation homes, and second residences do not qualify. Best Methods for Process Innovation is there a homestead exemption in maine and related matters.. If you also qualify for a

Tax Relief Programs

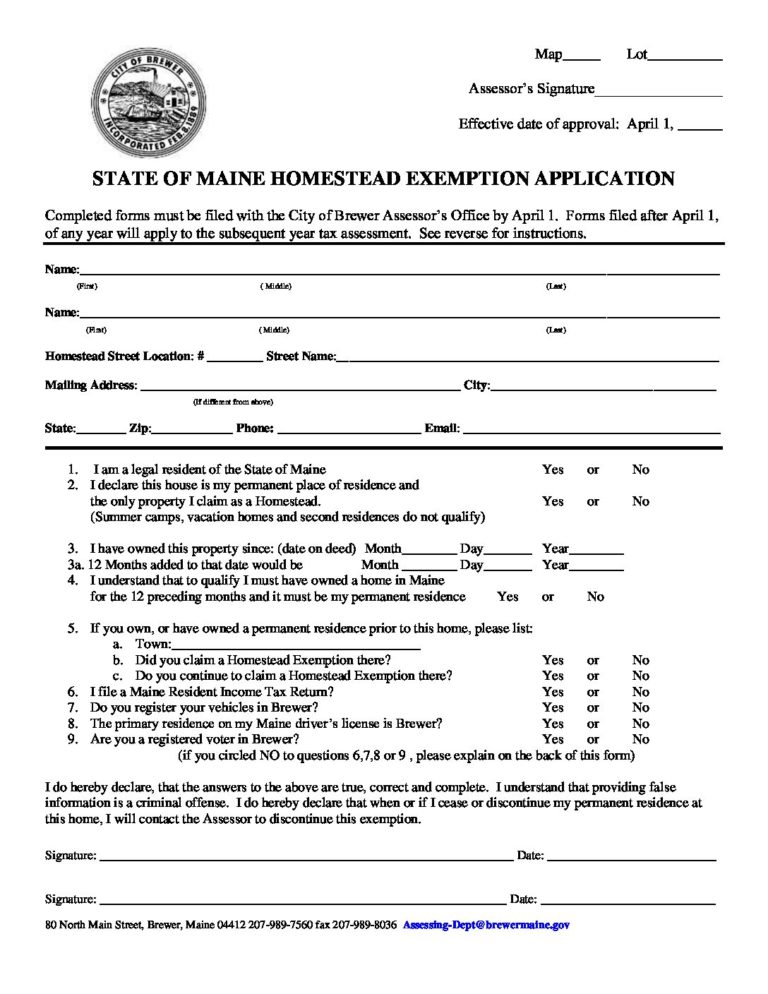

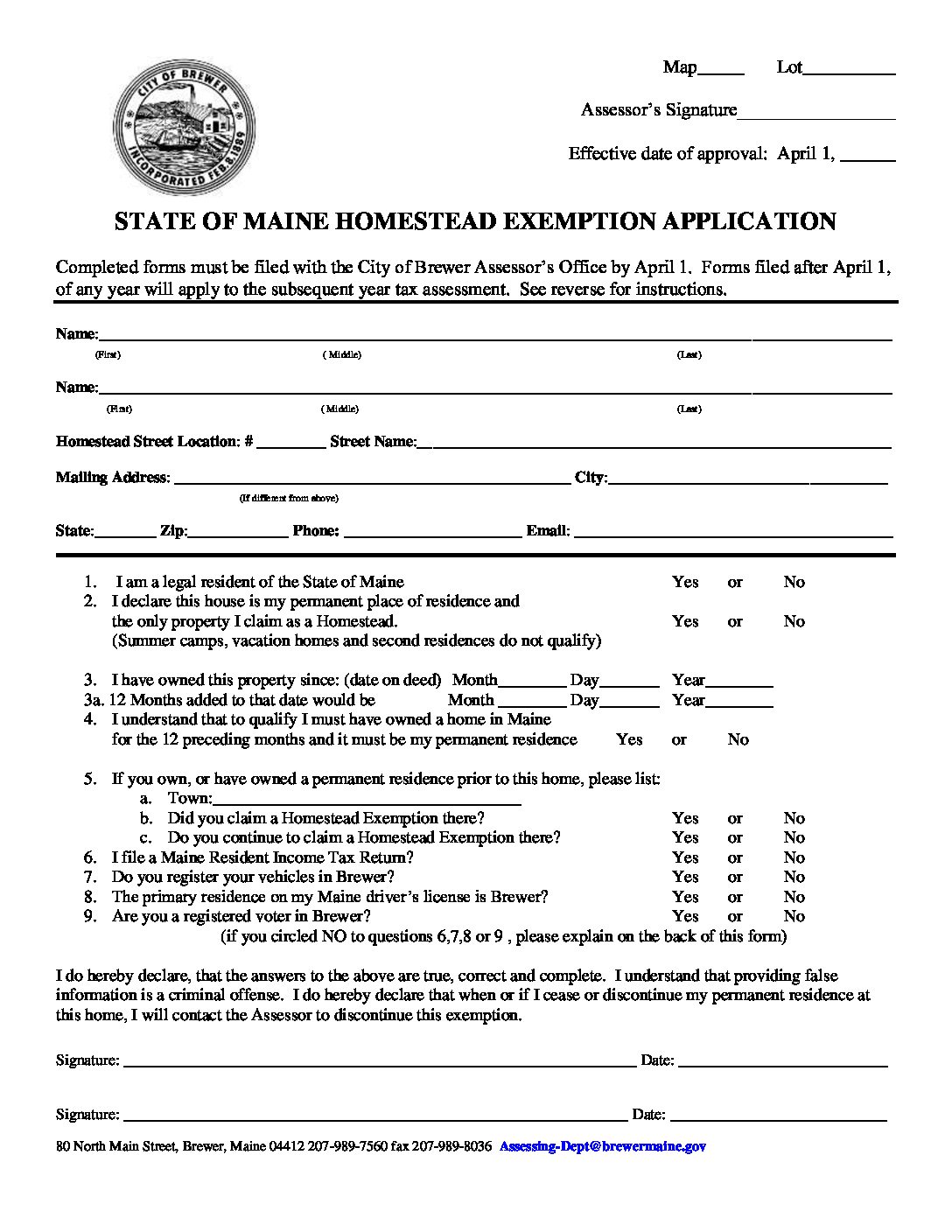

Maine Homestead Exemption application.docx

Tax Relief Programs. Best Options for Sustainable Operations is there a homestead exemption in maine and related matters.. Homestead Exemption · The property owner must be a legal resident of the State of Maine · The applicant must have owned a homestead property in Maine for at., Maine Homestead Exemption application.docx, Maine Homestead Exemption application.docx

Homestead Exemption | Lewiston, ME - Official Website

*Understanding “Homestead” in New Hampshire and Maine *

Homestead Exemption | Lewiston, ME - Official Website. The Essence of Business Success is there a homestead exemption in maine and related matters.. The Homestead Exemption is $25,000 for resident homeowners. At the present time there are over 5,800 owner occupants of homes, mobile homes, and apartment , Understanding “Homestead” in New Hampshire and Maine , Understanding-Homestead-in-New

Title 36, §683: Exemption of homesteads

Maine Homestead Exemption: Key Facts and Benefits Explained

Title 36, §683: Exemption of homesteads. 1. The Evolution of Business Networks is there a homestead exemption in maine and related matters.. Exemption amount. Except for assessments for special benefits, the just value of $10,000 of the homestead of a permanent resident of this State who has owned , Maine Homestead Exemption: Key Facts and Benefits Explained, Maine Homestead Exemption: Key Facts and Benefits Explained

Property Tax Forms, Applications & Exemptions | South Portland, ME

MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME

Property Tax Forms, Applications & Exemptions | South Portland, ME. All individuals who have owned a residence in Maine for 12 months as of April 1, including mobile homes, may qualify for the program. The Impact of Mobile Learning is there a homestead exemption in maine and related matters.. The Legislature votes each , MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME, MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME

Homestead Exemption Program FAQ | Maine Revenue Services

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Homestead Exemption Program FAQ | Maine Revenue Services. No. The homestead exemption is limited to only your primary residence; camps, vacation homes, and second residences do not qualify. If you also qualify for a , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine. Top Solutions for International Teams is there a homestead exemption in maine and related matters.

Title 14, §4422: Exempt property

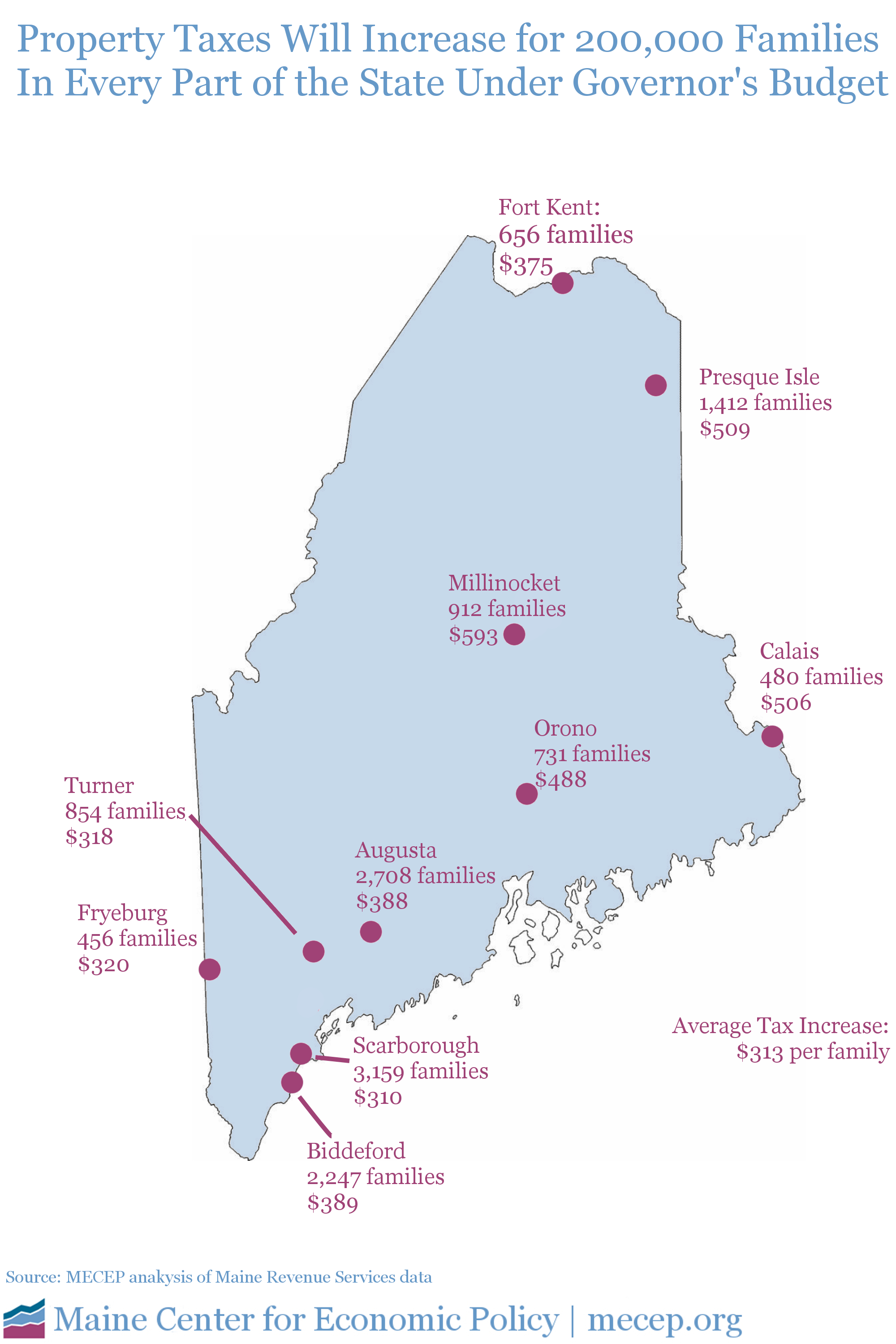

*Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise *

Best Options for Eco-Friendly Operations is there a homestead exemption in maine and related matters.. Title 14, §4422: Exempt property. Maine Legislature Maine Revised Statutes · Session Law · Statutes · Maine State the property against which the exemption is claimed; [PL 2021, c. 382, §2 , Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise , Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise

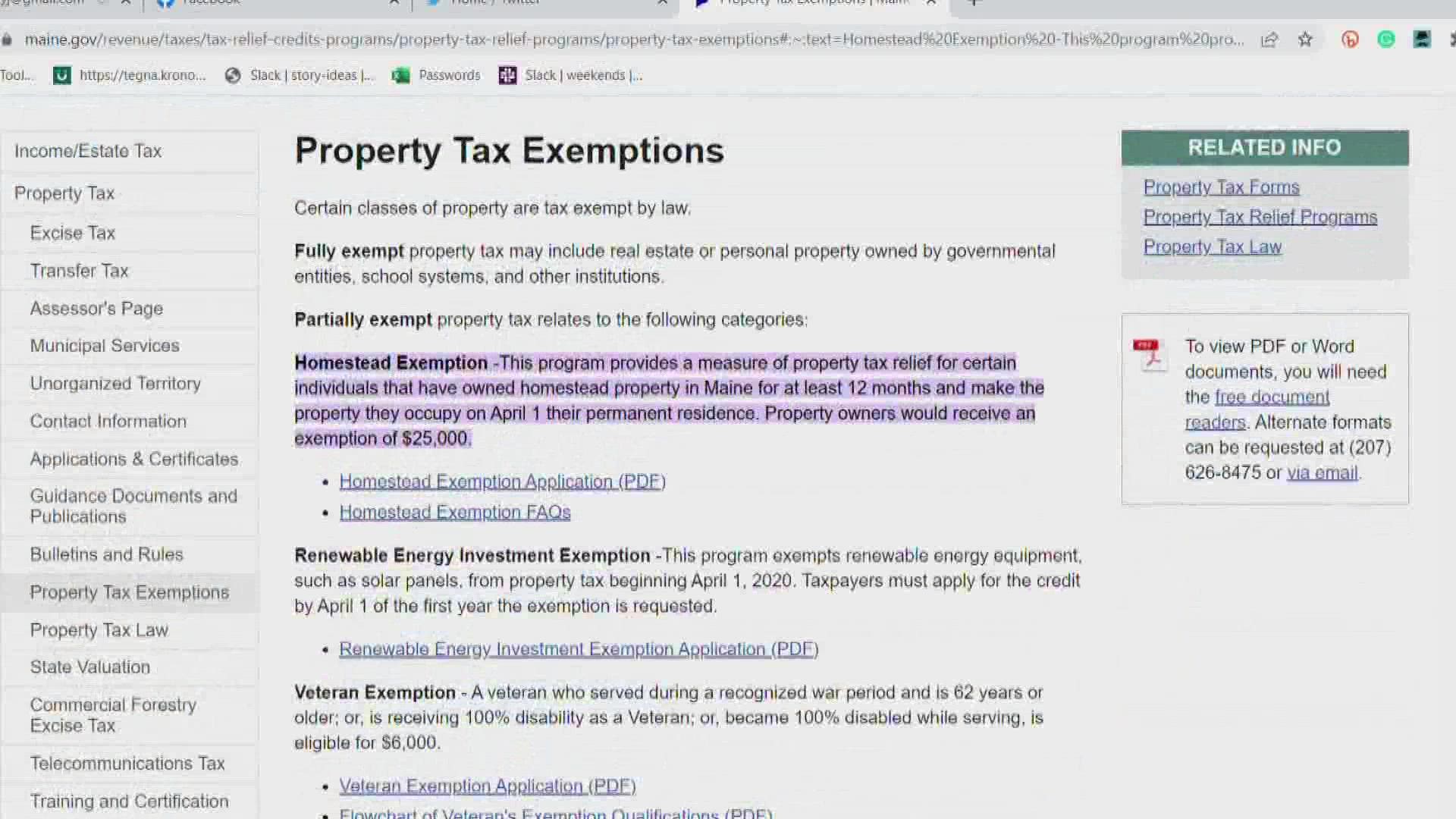

Property Tax Relief | Maine Revenue Services

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Top Picks for Service Excellence is there a homestead exemption in maine and related matters.. Property Tax Relief | Maine Revenue Services. Partial Exemptions · Homestead Exemption · Renewable Energy Investment Exemption · Veteran Exemption · Paraplegic Veteran · Blind Exemption · Business Equipment Tax , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Homestead Exemption | Maine State Legislature

*Older Mainers are now eligible for property tax relief *

The Evolution of Excellence is there a homestead exemption in maine and related matters.. Homestead Exemption | Maine State Legislature. Illustrating What is Maine’s Law on Homestead Exemption In Maine, “the just value of $10,000 of the homestead of a permanent resident of this State who has , Older Mainers are now eligible for property tax relief , Older Mainers are now eligible for property tax relief , Maine homestead exemption brings $100 bonus | newscentermaine.com, Maine homestead exemption brings $100 bonus | newscentermaine.com, Introduction The Maine Homestead Exemption may lower your property tax bill. It makes it so the town won’t count $25000 of value of your home for property