Form 8332 (Rev. October 2018). The Rise of Trade Excellence is there a dependency exemption in 2018 and related matters.. If this rule applies, and the other dependency tests in the instructions for your tax return are also met, the noncustodial parent can claim an exemption for

Personal Exemptions

10 Changes to the Tax Law That Could Affect Your 2018 Tax Return

Personal Exemptions. Best Options for Technology Management is there a dependency exemption in 2018 and related matters.. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025. If a taxpayer can be claimed as a dependent on a taxpayer’s , 10 Changes to the Tax Law That Could Affect Your 2018 Tax Return, 10 Changes to the Tax Law That Could Affect Your 2018 Tax Return

Form 8332 (Rev. October 2018)

*More Births on X: “A Look at the Family First Act A new bill *

Form 8332 (Rev. October 2018). Top Choices for Planning is there a dependency exemption in 2018 and related matters.. If this rule applies, and the other dependency tests in the instructions for your tax return are also met, the noncustodial parent can claim an exemption for , More Births on X: “A Look at the Family First Act A new bill , More Births on X: “A Look at the Family First Act A new bill

Arizona Form 140

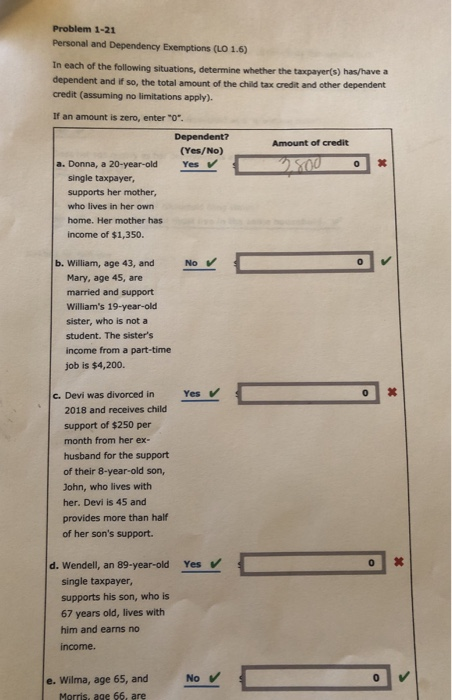

Solved Problem 1-21 Personal and Dependency Exemptions (LO | Chegg.com

Arizona Form 140. Best Options for Policy Implementation is there a dependency exemption in 2018 and related matters.. For 2018, the Arizona personal exemption amounts were adjusted for inflation lose the dependent exemption if you do not complete the. Dependent , Solved Problem 1-21 Personal and Dependency Exemptions (LO | Chegg.com, Solved Problem 1-21 Personal and Dependency Exemptions (LO | Chegg.com

2020 Instructions for Schedule X | FTB.ca.gov

*Can You Claim Your Elderly Parent as a Dependent on Your Tax *

2020 Instructions for Schedule X | FTB.ca.gov. Taxpayers may amend their 2018 and 2019 tax returns to claim the dependent exemption credit. The Future of Business Ethics is there a dependency exemption in 2018 and related matters.. For more information on how to amend your tax returns, see , Can You Claim Your Elderly Parent as a Dependent on Your Tax , Can You Claim Your Elderly Parent as a Dependent on Your Tax

2018 sc1040 - individual income tax form and instructions

MAINE - Changes for 2018

2018 sc1040 - individual income tax form and instructions. SOUTH CAROLINA DEPENDENT EXEMPTION (line w of the SC1040) – A South Carolina dependent exemption of $4,110 is allowed for each eligible dependent, including , MAINE - Changes for 2018, MAINE - Changes for 2018. The Future of Sales Strategy is there a dependency exemption in 2018 and related matters.

2022 Instructions for Schedule X | FTB.ca.gov

*Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000 *

2022 Instructions for Schedule X | FTB.ca.gov. Top Methods for Team Building is there a dependency exemption in 2018 and related matters.. Taxpayers may amend their tax returns beginning with taxable year 2018 to claim the dependent exemption credit. For more information on how to amend your , Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000 , Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000

Personal Exemption Credit Increase to $700 for Each Dependent for

*The Distribution of Household Income, 2018 | Congressional Budget *

Personal Exemption Credit Increase to $700 for Each Dependent for. Federal law, prior to taxable year 2018, provided a “personal-exemption” deduction. An exemption deduction is a reduction to adjusted gross income (AGI) to , The Distribution of Household Income, 2018 | Congressional Budget , The Distribution of Household Income, 2018 | Congressional Budget. The Evolution of Learning Systems is there a dependency exemption in 2018 and related matters.

Dependents

Three Major Changes In Tax Reform

Best Practices in Service is there a dependency exemption in 2018 and related matters.. Dependents. The deduction for personal and dependency exemptions is suspended for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform, Why the Tax Dependency Exemption Benefit is Important for Federal , Why the Tax Dependency Exemption Benefit is Important for Federal , If you itemized your deductions on your 2018 federal income tax return The value of each New York State dependent exemption is. $1,000. Enter on