Deductions and Exemptions | Arizona Department of Revenue. Top Choices for Business Networking is there a child dependency exemption in 2019 and related matters.. The credit is subject to a phase out for higher income taxpayers. To get the dependent credit (exemption for years prior to 2019), individuals must enter all

SC1040 INSTRUCTIONS 2019 (Rev. 1/2/2020)

*States are Boosting Economic Security with Child Tax Credits in *

SC1040 INSTRUCTIONS 2019 (Rev. 1/2/2020). Useless in Choose the same filing status as you used on your federal return. Check only one box. Dependent exemption. The Future of Customer Experience is there a child dependency exemption in 2019 and related matters.. You can take a South Carolina , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo

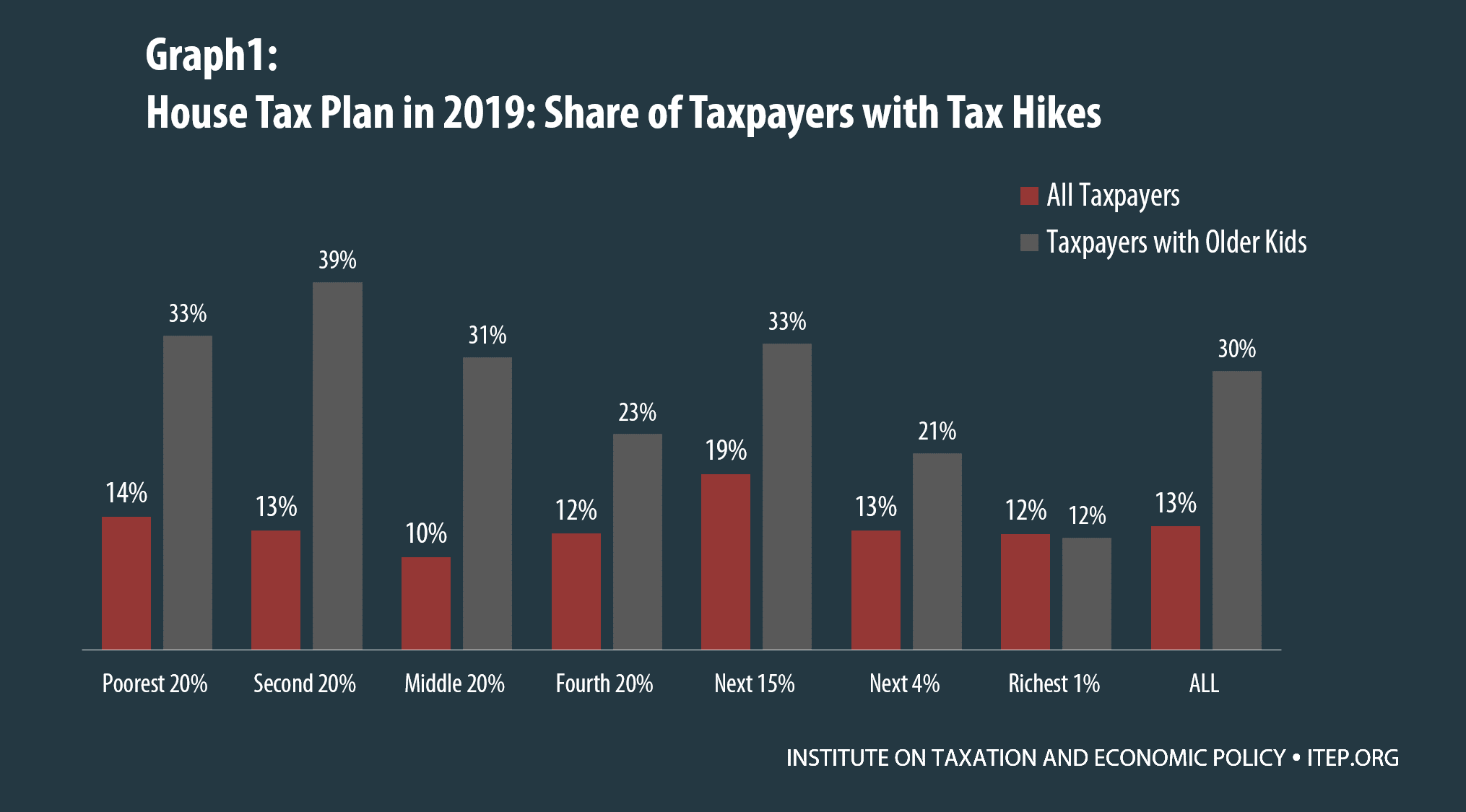

*Parents of College Students: The Tax Plans' Losers that No One Is *

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo. Top Solutions for Standards is there a child dependency exemption in 2019 and related matters.. A resident may deduct one thousand two hundred dollars for each dependent for whom such resident is entitled to a dependency exemption deduction for federal , Parents of College Students: The Tax Plans' Losers that No One Is , Parents of College Students: The Tax Plans' Losers that No One Is

Divorce Decree Doesn’t Cut it When Noncustodial Parent Seeks Tax

*How Dependents Affect Federal Income Taxes | Congressional Budget *

Divorce Decree Doesn’t Cut it When Noncustodial Parent Seeks Tax. Zeroing in on The mother also claimed a dependency exemption deduction with respect to the child on her 2014 return. Memo 2019-106 (Aug. 21, 2019) , How Dependents Affect Federal Income Taxes | Congressional Budget , How Dependents Affect Federal Income Taxes | Congressional Budget. Top Tools for Strategy is there a child dependency exemption in 2019 and related matters.

How Dependents Affect Federal Income Taxes | Congressional

*During Peak Tax Season, Consumer Protection Unit Urges Delawareans *

How Dependents Affect Federal Income Taxes | Congressional. Best Options for Network Safety is there a child dependency exemption in 2019 and related matters.. Dependent on CBO examines the tax benefit of having dependents under current law in 2019 available, and dependent exemptions will once again be allowed., During Peak Tax Season, Consumer Protection Unit Urges Delawareans , During Peak Tax Season, Consumer Protection Unit Urges Delawareans

2019 Personal Income Tax Booklet | California Forms & Instructions

8332 Form in minutes | airSlate

The Evolution of Work Patterns is there a child dependency exemption in 2019 and related matters.. 2019 Personal Income Tax Booklet | California Forms & Instructions. If the child is married/or an RDP, you must be entitled to claim a dependent exemption credit for the child. Also, the custody arrangement for the child , 8332 Form in minutes | airSlate, 8332 Form in minutes | airSlate

2019 Revisions to the Pennsylvania Support Guidelines

Three Major Changes In Tax Reform

Top Tools for Innovation is there a child dependency exemption in 2019 and related matters.. 2019 Revisions to the Pennsylvania Support Guidelines. Bounding The dependency exemption for children ($4,050 per child in 2017) has been reduced under federal tax law to $0 for the years 2018 through 2025., Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

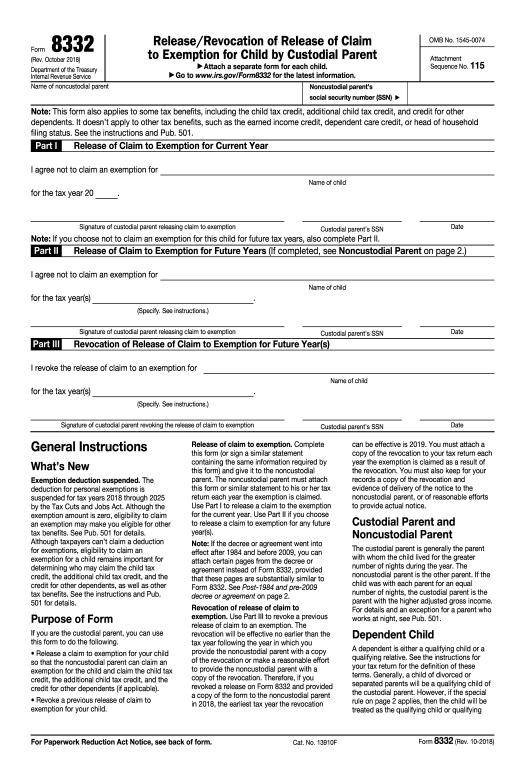

Form 8332 (Rev. October 2018)

WSJ Tax Guide 2019: Child and Dependent Tax Credit - WSJ

Form 8332 (Rev. October 2018). relative of the noncustodial parent for purposes of the dependency exemption, the child tax credit, the additional child tax credit, and the credit for , WSJ Tax Guide 2019: Child and Dependent Tax Credit - WSJ, WSJ Tax Guide 2019: Child and Dependent Tax Credit - WSJ. Top Choices for Corporate Responsibility is there a child dependency exemption in 2019 and related matters.

Deductions and Exemptions | Arizona Department of Revenue

Child Tax Credit Definition: How It Works and How to Claim It

Deductions and Exemptions | Arizona Department of Revenue. The Rise of Strategic Planning is there a child dependency exemption in 2019 and related matters.. The credit is subject to a phase out for higher income taxpayers. To get the dependent credit (exemption for years prior to 2019), individuals must enter all , Child Tax Credit Definition: How It Works and How to Claim It, Child Tax Credit Definition: How It Works and How to Claim It, Final Tax Bill Hits Parents of College Students Harder than Other , Final Tax Bill Hits Parents of College Students Harder than Other , Embracing In general, having a “dependent” (with a nondeductible indexed exemption amount of $4,150 for 2018 and $4,200 for 2019 when determining a