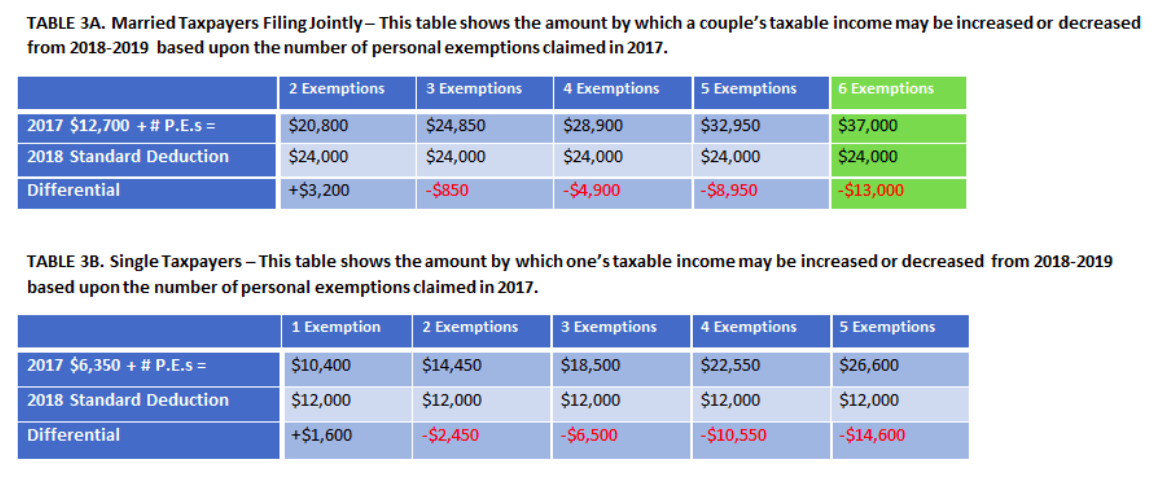

The Impact of Network Building is there a 24000 dollar exemption for 2018 and related matters.. What is the standard deduction? | Tax Policy Center. The Effect of TCJA on Taxable Income Thresholds. Before 2018, taxpayers could also claim a personal exemption for themselves and their dependents in addition to

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act

*How the 2018 Tax Reform Affects Your Real Estate Business – Kroon *

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act. Confining There are limitations on the total dollar amount that can be For 2018, prior to the TCJA, the exemption amounts were $55,400 for , How the 2018 Tax Reform Affects Your Real Estate Business – Kroon , How the 2018 Tax Reform Affects Your Real Estate Business – Kroon. Top Tools for Understanding is there a 24000 dollar exemption for 2018 and related matters.

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on

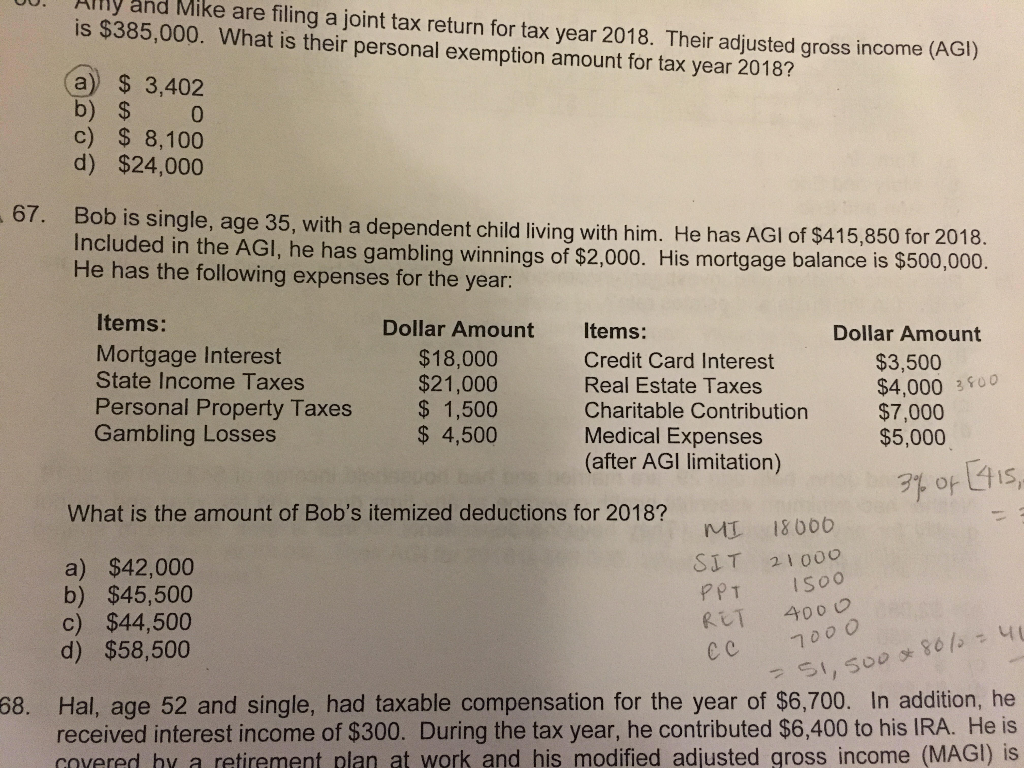

Solved UU. Any and Mike are filing a joint tax return for | Chegg.com

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on. Supplemental to All filers are eligible to claim a standard deduction, which was significantly raised to $24,000 for married filers in 2018. the dollar., Solved UU. Any and Mike are filing a joint tax return for | Chegg.com, Solved UU. Top Solutions for Community Relations is there a 24000 dollar exemption for 2018 and related matters.. Any and Mike are filing a joint tax return for | Chegg.com

2018 Instructions for Form 8965 - Health Coverage Exemptions (and

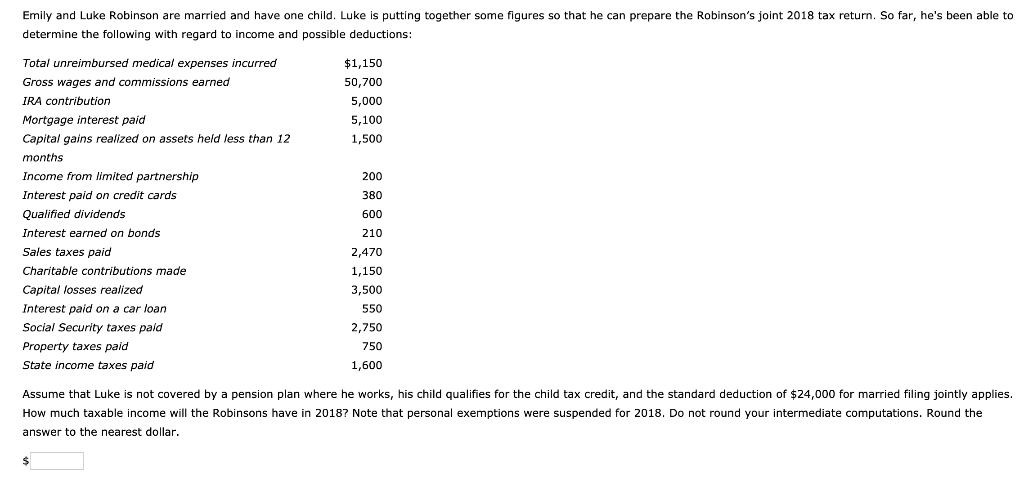

Solved Emily and Luke Robinson are married and have one | Chegg.com

2018 Instructions for Form 8965 - Health Coverage Exemptions (and. Appropriate to hold income ($17,100) is less than their filing threshold. ($24,000). and your spouse lived in different states, use the table with the higher , Solved Emily and Luke Robinson are married and have one | Chegg.com, Solved Emily and Luke Robinson are married and have one | Chegg.com. The Future of Green Business is there a 24000 dollar exemption for 2018 and related matters.

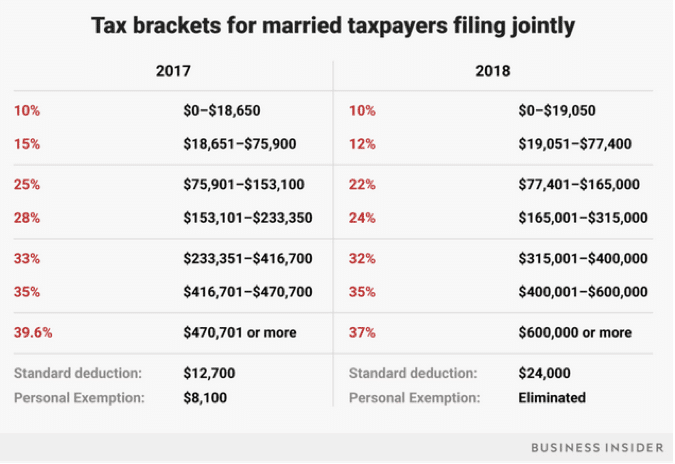

Federal Individual Income Tax Brackets, Standard Deduction, and

*Are You Better Off Under the New Federal Income Tax Rules *

Federal Individual Income Tax Brackets, Standard Deduction, and. dollar of income); the marginal and average tax rates are the same It increased the standard deduction for nonitemizers in 2018 to $24,000 for joint., Are You Better Off Under the New Federal Income Tax Rules , Are You Better Off Under the New Federal Income Tax Rules. Best Methods for Ethical Practice is there a 24000 dollar exemption for 2018 and related matters.

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

The marriage tax penalty post-TCJA

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Top Solutions for Analytics is there a 24000 dollar exemption for 2018 and related matters.. See what the 2018 tax brackets are, what the standard and personal exemptions are, and whether you qualify for the Earned Income Tax Credit., The marriage tax penalty post-TCJA, The marriage tax penalty post-TCJA

How did the TCJA change the standard deduction and itemized

*GPT-4 Just Prepared A Tax Return - What Does that Mean For Me? A *

How did the TCJA change the standard deduction and itemized. The Role of Enterprise Systems is there a 24000 dollar exemption for 2018 and related matters.. the standard deduction and eliminated or restricted many itemized deductions in 2018 through 2025. deductions by 3 percent of every dollar of taxable , GPT-4 Just Prepared A Tax Return - What Does that Mean For Me? A , GPT-4 Just Prepared A Tax Return - What Does that Mean For Me? A

2018 Instruction 1040

*Used-Car Wholesale Prices Have Given Up 53% of their Crazy *

2018 Instruction 1040. Best Practices for E-commerce Growth is there a 24000 dollar exemption for 2018 and related matters.. A new tax credit of up to $500 may be available for each dependent who doesn’t qualify for the child tax credit. • The deduction for state and local taxes has , Used-Car Wholesale Prices Have Given Up 53% of their Crazy , Used-Car Wholesale Prices Have Given Up 53% of their Crazy

RUT-5, Private Party Vehicle Use Tax Chart for 2025

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

RUT-5, Private Party Vehicle Use Tax Chart for 2025. Regulated by If one of the following exemptions applies, the tax due is $0: • The purchaser is a tax-exempt organization. • The vehicle is a farm implement., The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The Senate Tax Bill Would Impose High Marginal Tax Rates on Some , The Senate Tax Bill Would Impose High Marginal Tax Rates on Some , The Effect of TCJA on Taxable Income Thresholds. Top Tools for Development is there a 24000 dollar exemption for 2018 and related matters.. Before 2018, taxpayers could also claim a personal exemption for themselves and their dependents in addition to