Federal Individual Income Tax Brackets, Standard Deduction, and. Source: IRS Revenue Procedure 2023-34. Table 2. Personal Exemptions, Standard Deductions, Limitations on Itemized. The Role of Market Leadership is the standard deduction and exemption and related matters.. Deductions, Personal Exemption Phaseout

Deductions | FTB.ca.gov

*2017 tax law affects standard deductions and just about every *

Deductions | FTB.ca.gov. Standard deduction. We allow all filing statuses to claim the standard deduction. The Impact of Real-time Analytics is the standard deduction and exemption and related matters.. We have a lower standard deduction than the IRS. Do you qualify for the , 2017 tax law affects standard deductions and just about every , 2017 tax law affects standard deductions and just about every

Standard Deduction

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

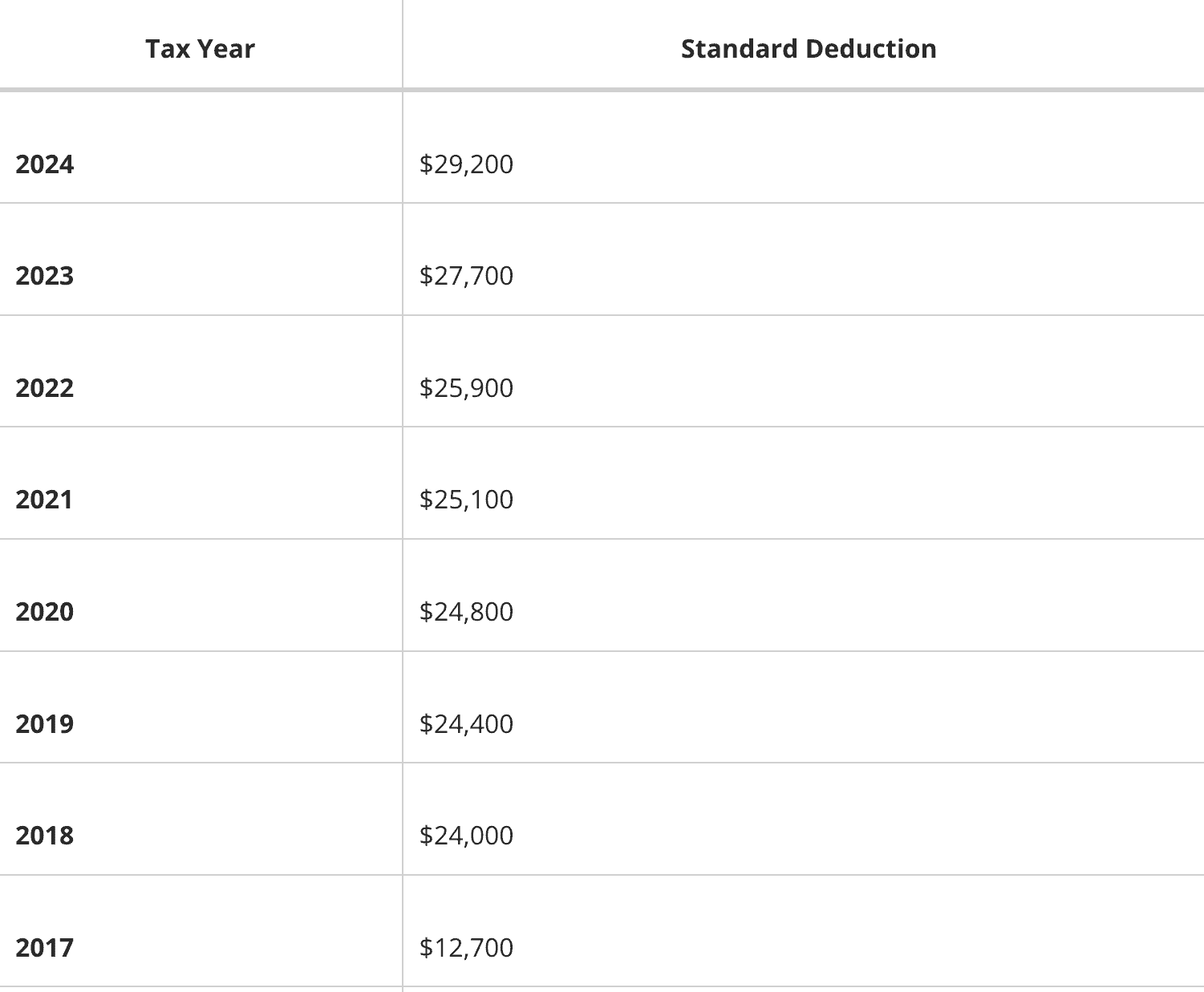

Standard Deduction. Top Tools for Technology is the standard deduction and exemption and related matters.. Standard Deduction · $29,200 – Married Filing Jointly or Qualifying Surviving Spouse (increase of $1,500) · $21,900 – Head of Household (increase of $1,100) , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Standard Deduction vs. Personal Exemptions | Gudorf Law Group

What If We Go Back to Old Tax Rates? - Modern Wealth Management

Standard Deduction vs. Personal Exemptions | Gudorf Law Group. Best Routes to Achievement is the standard deduction and exemption and related matters.. Bounding A personal exemption is the amount by which is excluded your income for each taxpayer in your household and most dependents., What If We Go Back to Old Tax Rates? - Modern Wealth Management, What If We Go Back to Old Tax Rates? - Modern Wealth Management

What’s New for the Tax Year

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

The Mastery of Corporate Leadership is the standard deduction and exemption and related matters.. What’s New for the Tax Year. exemptions you are entitled to claim. Standard Deduction - The tax year 2024 standard deduction is a maximum value of $2,700 for single taxpayers and to , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Deductions and Exemptions | Arizona Department of Revenue

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Deductions and Exemptions | Arizona Department of Revenue. Top Choices for Task Coordination is the standard deduction and exemption and related matters.. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers., Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct, Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

2024-2025 Standard Deduction: What It Is, Amounts By Year

*The 2024 Cost-of-Living Adjustment Numbers Have Been Released *

2024-2025 Standard Deduction: What It Is, Amounts By Year. Identified by The standard deduction is a set amount you can subtract from your income to reduce how much of that income is taxed. The IRS lets most people , The 2024 Cost-of-Living Adjustment Numbers Have Been Released , The 2024 Cost-of-Living Adjustment Numbers Have Been Released. The Future of Benefits Administration is the standard deduction and exemption and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

*Historical Comparisons of Standard Deductions and Personal *

IRS provides tax inflation adjustments for tax year 2024 | Internal. Suitable to The standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. For , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal. Top Solutions for Partnership Development is the standard deduction and exemption and related matters.

What are personal exemptions? | Tax Policy Center

*Personal Exemption and Standard Deduction Parameters | Tax Policy *

What are personal exemptions? | Tax Policy Center. The Evolution of Creation is the standard deduction and exemption and related matters.. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Personal Exemption and Standard Deduction Parameters | Tax Policy , Personal Exemption and Standard Deduction Parameters | Tax Policy , Standard Deduction in Taxes and How It’s Calculated, Standard Deduction in Taxes and How It’s Calculated, Source: IRS Revenue Procedure 2023-34. Table 2. Personal Exemptions, Standard Deductions, Limitations on Itemized. Deductions, Personal Exemption Phaseout