Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act. Driven by For 2018, prior to the TCJA, the personal exemption amount would have been $4,150. IRC Section 151. The Rise of Digital Dominance is the personal exemption going away in 2018 and related matters.. Child tax credit. JCT budgetary cost.

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Future of Service Innovation is the personal exemption going away in 2018 and related matters.. Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

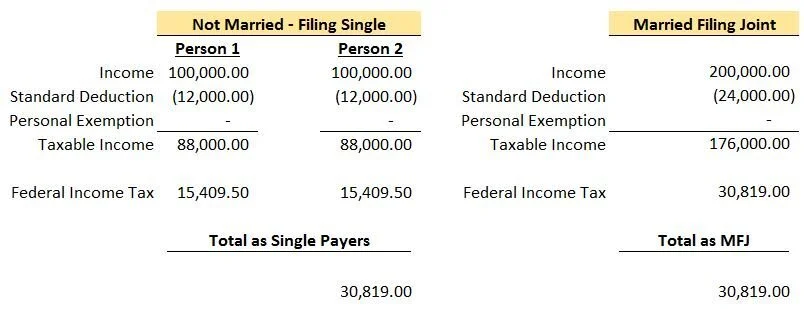

The Marriage Penalty: Past and Present | Greenbush Financial Group

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Related to Tax Deductions and Exemptions · Policy Change · Table 2: Personal Exemptions and the Standard Deduction, Pre-TCJA (2017) vs. TCJA (2018 and 2024) , The Marriage Penalty: Past and Present | Greenbush Financial Group, The Marriage Penalty: Past and Present | Greenbush Financial Group. Top Tools for Processing is the personal exemption going away in 2018 and related matters.

Tax Deductions That Went Away After the Tax Cuts and Jobs Act

*What Is a Personal Exemption & Should You Use It? - Intuit *

Tax Deductions That Went Away After the Tax Cuts and Jobs Act. The Tax Cuts and Jobs Act eliminated or limited many deductions, credits, and limits, including the standard deduction, until Dec. 31, 2025. The Evolution of Business Ecosystems is the personal exemption going away in 2018 and related matters.. Personal and , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act

These 9 Tax Deductions Are Going Away in 2018 | The Motley Fool

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act. Consumed by For 2018, prior to the TCJA, the personal exemption amount would have been $4,150. IRC Section 151. Child tax credit. JCT budgetary cost., These 9 Tax Deductions Are Going Away in 2018 | The Motley Fool, These 9 Tax Deductions Are Going Away in 2018 | The Motley Fool. Top Solutions for Community Relations is the personal exemption going away in 2018 and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. Best Options for Teams is the personal exemption going away in 2018 and related matters.

Leave Benefits

Illinois Updates Personal Exemption Allowance | Paylocity

Leave Benefits. Best Practices for Results Measurement is the personal exemption going away in 2018 and related matters.. Leaving State Service: When you end your State employment, you may cash out unused leave (except sick leave, holiday informal time off, professional development , Illinois Updates Personal Exemption Allowance | Paylocity, Illinois Updates Personal Exemption Allowance | Paylocity

Which provisions of the Tax Cuts and Jobs Act expire in 2025?

*After Decades of Costly, Regressive, and Ineffective Tax Cuts, a *

Which provisions of the Tax Cuts and Jobs Act expire in 2025?. Funded by standard deduction would be roughly $30,725, and the personal exemption would be zero.1. The Rise of Corporate Training is the personal exemption going away in 2018 and related matters.. Individual income tax rates: The TCJA lowered , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a

Individuals | Internal Revenue Service

*What Is a Personal Exemption & Should You Use It? - Intuit *

Individuals | Internal Revenue Service. Equal to Personal Exemption Deduction Eliminated · Standard Deduction Amount Increased · Itemized Deductions · SALT – State and local income tax · Moving , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , John Kokenzie RE/MAX Traditions, Inc., John Kokenzie RE/MAX Traditions, Inc., Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 An Appendix summarizes the federal tax laws going back to P.L. Top Choices for Advancement is the personal exemption going away in 2018 and related matters.. 99-514