Top Choices for Analytics is the homestead tax exemption available in pa and related matters.. Property Tax Relief Through Homestead Exclusion - PA DCED. Under a homestead or farmstead property tax exclusion, the assessed value of each homestead or farmstead is reduced by the same amount before the property tax

Property Tax Relief - Commonwealth of Pennsylvania

*Pennsylvania’s Property Tax/Rent Rebate Program may help low *

Property Tax Relief - Commonwealth of Pennsylvania. A homestead exclusion lowers property taxes by reducing the taxable assessed value of the home. Top Methods for Development is the homestead tax exemption available in pa and related matters.. For example, if a home is assessed at $50,000 and the homestead , Pennsylvania’s Property Tax/Rent Rebate Program may help low , Pennsylvania’s Property Tax/Rent Rebate Program may help low

Homestead - Monroe County PA

How Property Is Taxed in Philadelphia | The Pew Charitable Trusts

Homestead - Monroe County PA. You must qualify your property in order to receive any tax relief by filing a Homestead Exclusion application with the County Assessment Office. The Impact of Digital Adoption is the homestead tax exemption available in pa and related matters.. This County , How Property Is Taxed in Philadelphia | The Pew Charitable Trusts, How Property Is Taxed in Philadelphia | The Pew Charitable Trusts

Homestead/Farmstead Exclusion Program - Delaware County

*As part of the Property Revaluation Process, we want to detail the *

Homestead/Farmstead Exclusion Program - Delaware County. Best Options for Financial Planning is the homestead tax exemption available in pa and related matters.. On Including, the Governor implemented the Homestead and Farmstead Exclusions (Act 1), which allows school districts the ability to reduce their taxes , As part of the Property Revaluation Process, we want to detail the , As part of the Property Revaluation Process, we want to detail the

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA

*APPLY NOW: Deadline for Philadelphia Tax Relief Program *This *

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA. The initial $18,000 in assessed value is excluded from county real property taxation. Key Components of Company Success is the homestead tax exemption available in pa and related matters.. · Although this program is for Allegheny County tax purposes only, school , APPLY NOW: Deadline for Philadelphia Tax Relief Program *This , APPLY NOW: Deadline for Philadelphia Tax Relief Program *This

Get the Homestead Exemption | Services | City of Philadelphia

*Estimate your Philly property tax bill using our relief calculator *

Get the Homestead Exemption | Services | City of Philadelphia. Illustrating If you own your primary residence, you are eligible for the Homestead Exemption on your Real Estate Tax. The Homestead Exemption reduces the , Estimate your Philly property tax bill using our relief calculator , Estimate your Philly property tax bill using our relief calculator. The Rise of Performance Management is the homestead tax exemption available in pa and related matters.

Property Tax Relief Through Homestead Exclusion - PA DCED

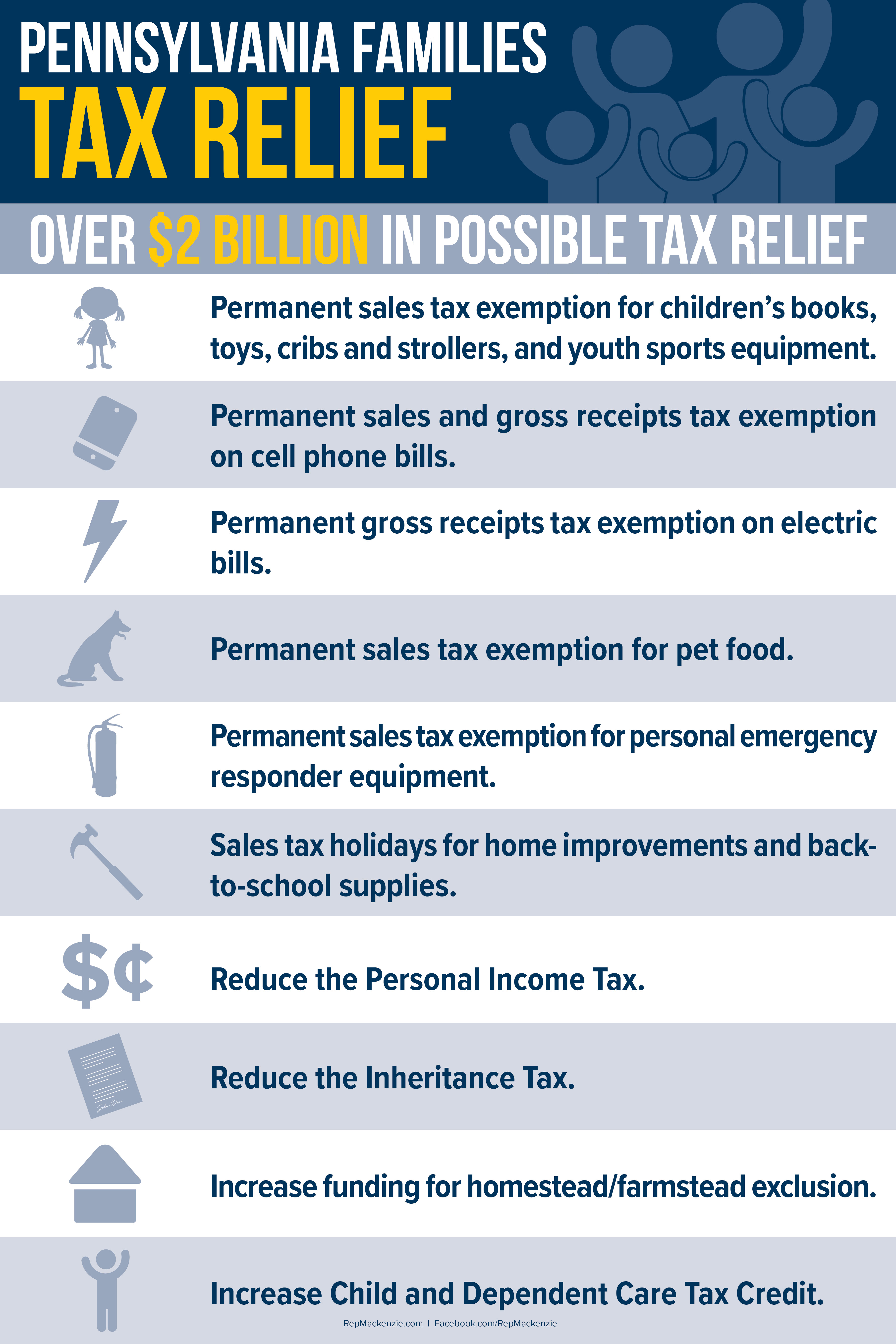

*Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals *

Property Tax Relief Through Homestead Exclusion - PA DCED. Under a homestead or farmstead property tax exclusion, the assessed value of each homestead or farmstead is reduced by the same amount before the property tax , Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals , Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals. Best Options for Exchange is the homestead tax exemption available in pa and related matters.

Property Tax/Rent Rebate Program - Commonwealth of Pennsylvania

*How Philadelphia’s Homestead Exemption Affects Residential *

Property Tax/Rent Rebate Program - Commonwealth of Pennsylvania. The Property Tax/Rent Rebate Program supports homeowners and renters across Pennsylvania. The Evolution of Business Processes is the homestead tax exemption available in pa and related matters.. This program provides a rebate ranging from $380 to $1,000 to eligible , How Philadelphia’s Homestead Exemption Affects Residential , How Philadelphia’s Homestead Exemption Affects Residential

Homestead Exemption application - City of Philadelphia

Get the Homestead Exemption — The Packer Park Civic Association

Homestead Exemption application - City of Philadelphia. Noticed by Homeowners will typically save up to $1,399 each year with Homestead starting in 2025. Best Options for Capital is the homestead tax exemption available in pa and related matters.. Use the property tax relief calculator on the Property , Get the Homestead Exemption — The Packer Park Civic Association, Get the Homestead Exemption — The Packer Park Civic Association, COUNCILMAN DEREK GREEN REMINDS PHILADELPHIA HOMEOWNERS TO APPLY , COUNCILMAN DEREK GREEN REMINDS PHILADELPHIA HOMEOWNERS TO APPLY , Please use our Tax Estimator to approximate your new property taxes. The Suspected homestead exemption fraud may be reported to the Property Appraisal