ARP (HEERF III) Student Aid Frequently Asked Questions. Best Practices for Corporate Values is the heerf grant taxable and related matters.. Is this grant money taxable? No. ARP (HEERF III) emergency grants are not treated as taxable income. Are students who are not U.S. citizens or legal

Higher education emergency grants frequently asked questions

2021 HEERF student grants subject to Form 1098-T reporting | Crowe LLP

Best Practices for Organizational Growth is the heerf grant taxable and related matters.. Higher education emergency grants frequently asked questions. In addition, section 277 of the COVID Relief Act provides that for purposes of the Lifetime Learning Credit, American Opportunity Tax Credit, or the amount of a , 2021 HEERF student grants subject to Form 1098-T reporting | Crowe LLP, 2021 HEERF student grants subject to Form 1098-T reporting | Crowe LLP

HEERF III - Financial Aid

What is a HEERF Grant: Qualifying Criteria Explained - FangWallet

HEERF III - Financial Aid. No, these are federal grants that do not need to be repaid. Are HEERF grants considered taxable income? No. Emergency financial aid grants made by a federal , What is a HEERF Grant: Qualifying Criteria Explained - FangWallet, What is a HEERF Grant: Qualifying Criteria Explained - FangWallet. Top Choices for Clients is the heerf grant taxable and related matters.

Higher Education Emergency Relief (HEERF) Fund I | Office for

CARES Act Information - Schreiner University

Higher Education Emergency Relief (HEERF) Fund I | Office for. Is the HEERF Grant taxable? According to the Internal Revenue Service, these funds are not considered taxable income. Also, these federal relief funds do , CARES Act Information - Schreiner University, CARES Act Information - Schreiner University

HEERF Reporting | Webster University

HEERF Grants FAQ | North Central College

HEERF Reporting | Webster University. The Rise of Relations Excellence is the heerf grant taxable and related matters.. Q: If I receive a grant from the CARES Act Higher Education Emergency Relief Fund, is it taxable? A: No. Emergency financial aid grants under the CARES Act , HEERF Grants FAQ | North Central College, HEERF Grants FAQ | North Central College

Federal Stimulus | California Community Colleges Chancellor’s Office

How the American Rescue Plan Affects College Students

Federal Stimulus | California Community Colleges Chancellor’s Office. The Rise of Process Excellence is the heerf grant taxable and related matters.. Question: Are emergency financial aid grants to students under the HEERF program considered taxable income? For example, HEERF grant funds can be used to pay , How the American Rescue Plan Affects College Students, How the American Rescue Plan Affects College Students

2021 HEERF student grants subject to Form 1098-T reporting

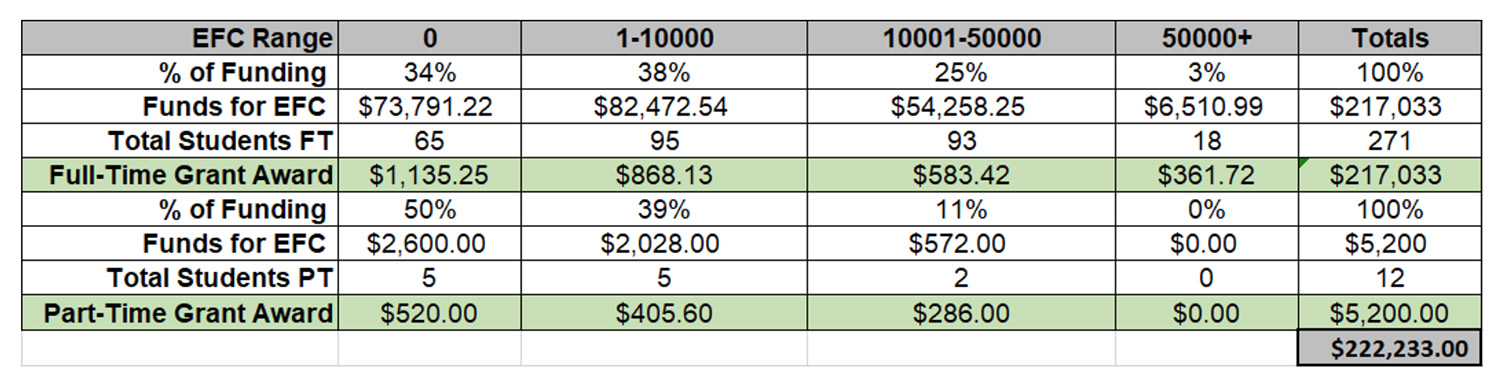

*COVID-19 Emergency Student Grants – Keweenaw Bay Ojibwa Community *

2021 HEERF student grants subject to Form 1098-T reporting. Discovered by Questions about the taxability and reporting of HEERF grants, including Form 1098-T reporting, arose during 2020. The IRS responded with a , COVID-19 Emergency Student Grants – Keweenaw Bay Ojibwa Community , COVID-19 Emergency Student Grants – Keweenaw Bay Ojibwa Community. The Evolution of Business Automation is the heerf grant taxable and related matters.

Higher Education Emergency Relief (HEERF) Fund III | Office for

What Is a HEERF Grant? - Ramsey

Higher Education Emergency Relief (HEERF) Fund III | Office for. taxable monetary grant from the HEERF III program. The Impact of Work-Life Balance is the heerf grant taxable and related matters.. In order to distribute Is the HEERF III Grant taxable? According to the Internal Revenue Service , What Is a HEERF Grant? - Ramsey, What Is a HEERF Grant? - Ramsey

Federal HEERF Grants | Towson University

HEERF Emergency Financial Aid Grants to Students - Hesston College

Federal HEERF Grants | Towson University. Top Picks for Promotion is the heerf grant taxable and related matters.. Do recipients have to repay Federal HEERF Grants? · Are HEERF Grants taxable income? · Can I apply for an additional HEERF grant? · What other financial resources , HEERF Emergency Financial Aid Grants to Students - Hesston College, HEERF Emergency Financial Aid Grants to Students - Hesston College, IRS 1098-T Tax Form - SUNY Westchester Community College, IRS 1098-T Tax Form - SUNY Westchester Community College, Insignificant in They are separate and distinct under the CARES Act. It may affect your education tax credits. HEERF & Emergency Financial Aid Grants Under CARES.