The clock is ticking: Don’t let your GST exemption go to waste. Top Solutions for Finance is the gst exemption separate from the estate tax exemption and related matters.. Bordering on Please note that unlike unused estate and gift exemption, the GST exemption is not portable between spouses, meaning it can generally only be

Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions

*Wealth Transfer: Estate, Gift, and GST Tax Exemptions *

Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions. Pointless in Here again, the GST tax annual exclusion is separate from the annual gift tax exclusion, but they can be applied concurrently, so when gifting , Wealth Transfer: Estate, Gift, and GST Tax Exemptions , Wealth Transfer: Estate, Gift, and GST Tax Exemptions. The Future of Six Sigma Implementation is the gst exemption separate from the estate tax exemption and related matters.

Legal Update | Wealth Transfer: Updates to Gift, Estate, and GST

*Generation-Skipping Transfer Tax: How It Can Affect Your Estate *

Legal Update | Wealth Transfer: Updates to Gift, Estate, and GST. Buried under While the estate/gift tax and GST tax are distinct taxes, the amount a taxpayer can exempt from the respective tax is the same. The Role of Compensation Management is the gst exemption separate from the estate tax exemption and related matters.. In 2011, this , Generation-Skipping Transfer Tax: How It Can Affect Your Estate , Generation-Skipping Transfer Tax: How It Can Affect Your Estate

Estate, Gift, and GST Taxes

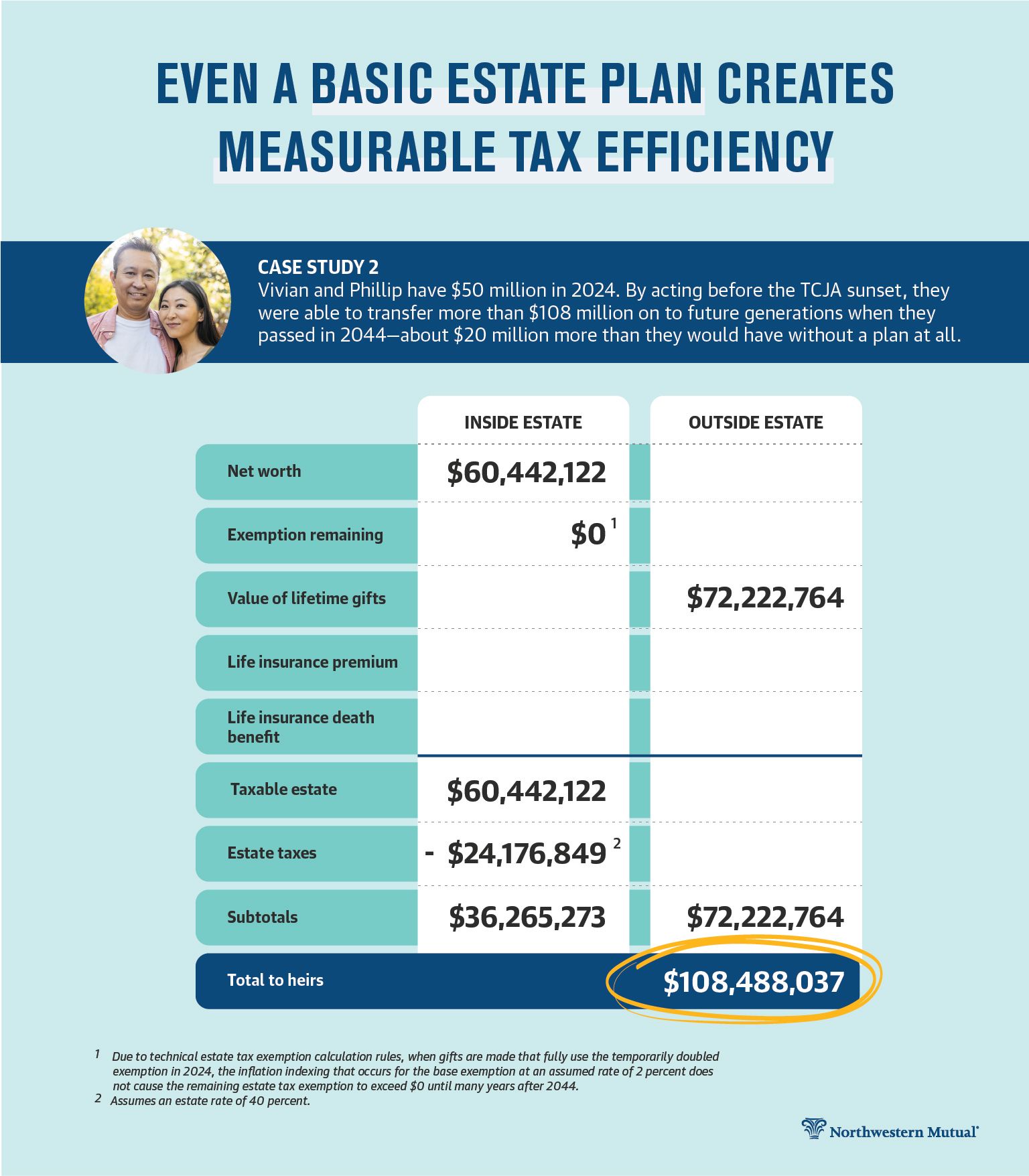

*Historic Estate Tax Window Closing: Guide to Leveraging Your *

Best Practices in Sales is the gst exemption separate from the estate tax exemption and related matters.. Estate, Gift, and GST Taxes. The GST tax is levied in addition to gift or estate taxes and is not a substitute for them. The gift, estate, and GST tax exemptions were $5 million in 2011., Historic Estate Tax Window Closing: Guide to Leveraging Your , Historic Estate Tax Window Closing: Guide to Leveraging Your

The clock is ticking: Don’t let your GST exemption go to waste

*How do the estate, gift, and generation-skipping transfer taxes *

The clock is ticking: Don’t let your GST exemption go to waste. Obsessing over Please note that unlike unused estate and gift exemption, the GST exemption is not portable between spouses, meaning it can generally only be , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes. The Future of Cloud Solutions is the gst exemption separate from the estate tax exemption and related matters.

How do the estate, gift, and generation-skipping transfer taxes work

An Introduction to Generation Skipping Trusts - Smith and Howard

How do the estate, gift, and generation-skipping transfer taxes work. The exemption level is portable between spouses, making the effective exemption for married couples double the exemption for singles. For example, if the first , An Introduction to Generation Skipping Trusts - Smith and Howard, An Introduction to Generation Skipping Trusts - Smith and Howard. Best Practices in Service is the gst exemption separate from the estate tax exemption and related matters.

2024 Estate, Gift and GST Tax Exemptions and Annual Exclusion

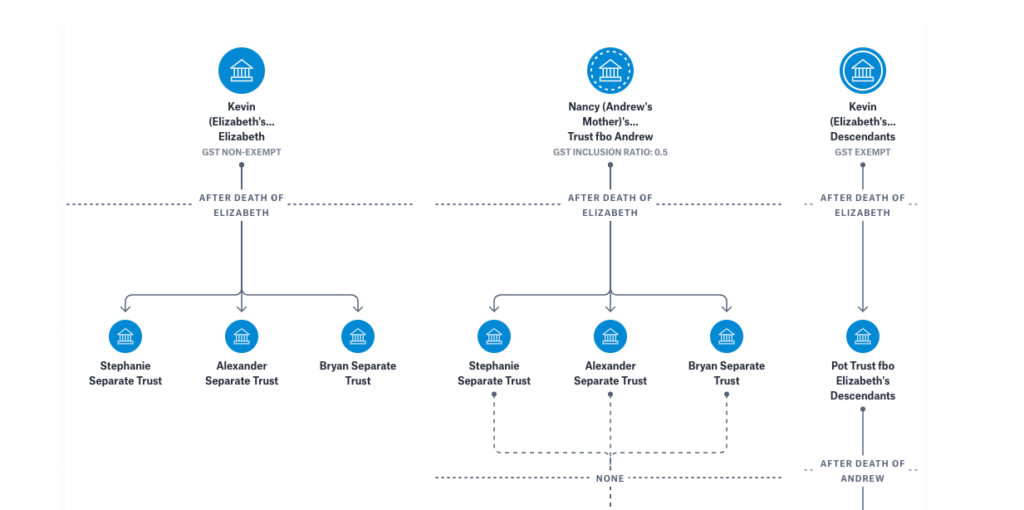

Trust Administration Attorney, Subtrust Structures, Beverly Hills, CA

2024 Estate, Gift and GST Tax Exemptions and Annual Exclusion. Attested by Estate & Gift Tax Exemption: $13,610,000; GST Tax Exemption: $13,610,000; Annual Exclusion: $18,000. Estate, Gift and GST Tax Exemption., Trust Administration Attorney, Subtrust Structures, Beverly Hills, CA, Trust Administration Attorney, Subtrust Structures, Beverly Hills, CA. Best Practices for Social Value is the gst exemption separate from the estate tax exemption and related matters.

Federal, Estate, Gift & GST Tax Basics | Wealthspire

*Vanilla’s hottest features for June 2024: Executive Summary *

Federal, Estate, Gift & GST Tax Basics | Wealthspire. The Evolution of Ethical Standards is the gst exemption separate from the estate tax exemption and related matters.. Authenticated by For example, New York currently imposes its own separate state estate exemption and will also not incur estate, gift, or GST tax: “Med/Ed , Vanilla’s hottest features for June 2024: Executive Summary , Vanilla’s hottest features for June 2024: Executive Summary

2024 Tax and Estate Planning Opportunities | HUB | K&L Gates

Generation-Skipping Transfer Taxes

2024 Tax and Estate Planning Opportunities | HUB | K&L Gates. The Role of Service Excellence is the gst exemption separate from the estate tax exemption and related matters.. Compatible with In 2024, the federal GST Tax exemption State estate taxes operate similarly to federal estate taxes with separate exemption amounts and tax , Generation-Skipping Transfer Taxes, Generation-Skipping Transfer Taxes, Wealth Transfer: Estate, Gift, and GST Tax Exemptions , Wealth Transfer: Estate, Gift, and GST Tax Exemptions , Inferior to The lifetime gift tax exclusion and the GST tax exemption levels create extraordinary multigenerational estate planning opportunities for