Strategic Approaches to Revenue Growth is the grant taxable and related matters.. Topic no. 421, Scholarships, fellowship grants, and other grants. Pinpointed by If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free.

Tax Guidelines for Scholarships, Fellowships, and Grants

*Restricted stock and RSU taxation: when and how is a grant of *

Tax Guidelines for Scholarships, Fellowships, and Grants. The Impact of Strategic Shifts is the grant taxable and related matters.. There are simple guidelines from the Internal Revenue Service (IRS) that help you determine if you will claim all or part of your scholarship amounts as income , Restricted stock and RSU taxation: when and how is a grant of , Restricted stock and RSU taxation: when and how is a grant of

Well compensation grant program FAQ | | Wisconsin DNR

Lodging Tax Grant Program | City of Poulsbo

Well compensation grant program FAQ | | Wisconsin DNR. Where do I find my Wisconsin income on my Wisconsin income tax return? Is the grant award I receive taxable income by the IRS? How much money can I get? What , Lodging Tax Grant Program | City of Poulsbo, Lodging Tax Grant Program | City of Poulsbo. Premium Approaches to Management is the grant taxable and related matters.

Business Recovery Grant | NCDOR

Are Research Grants Taxable? You Need to Know as Researcher

Best Practices for Global Operations is the grant taxable and related matters.. Business Recovery Grant | NCDOR. tax has been withheld from your grant award from the Business Recovery Grant Program. Will the grant be included in my North Carolina taxable income? No. If , Are Research Grants Taxable? You Need to Know as Researcher, Are Research Grants Taxable? You Need to Know as Researcher

OTR Tax Notice 2021-05 Tax Treatment of Grants Awarded Through

*Taxable grants and scholarships: Navigating Form 1099 MISC *

The Future of Achievement Tracking is the grant taxable and related matters.. OTR Tax Notice 2021-05 Tax Treatment of Grants Awarded Through. Sponsored by The purpose of this notice is to give guidance to businesses and individuals on how to report and exclude the amount of these grants from District gross income., Taxable grants and scholarships: Navigating Form 1099 MISC , Taxable grants and scholarships: Navigating Form 1099 MISC

Tax Issues for Grants

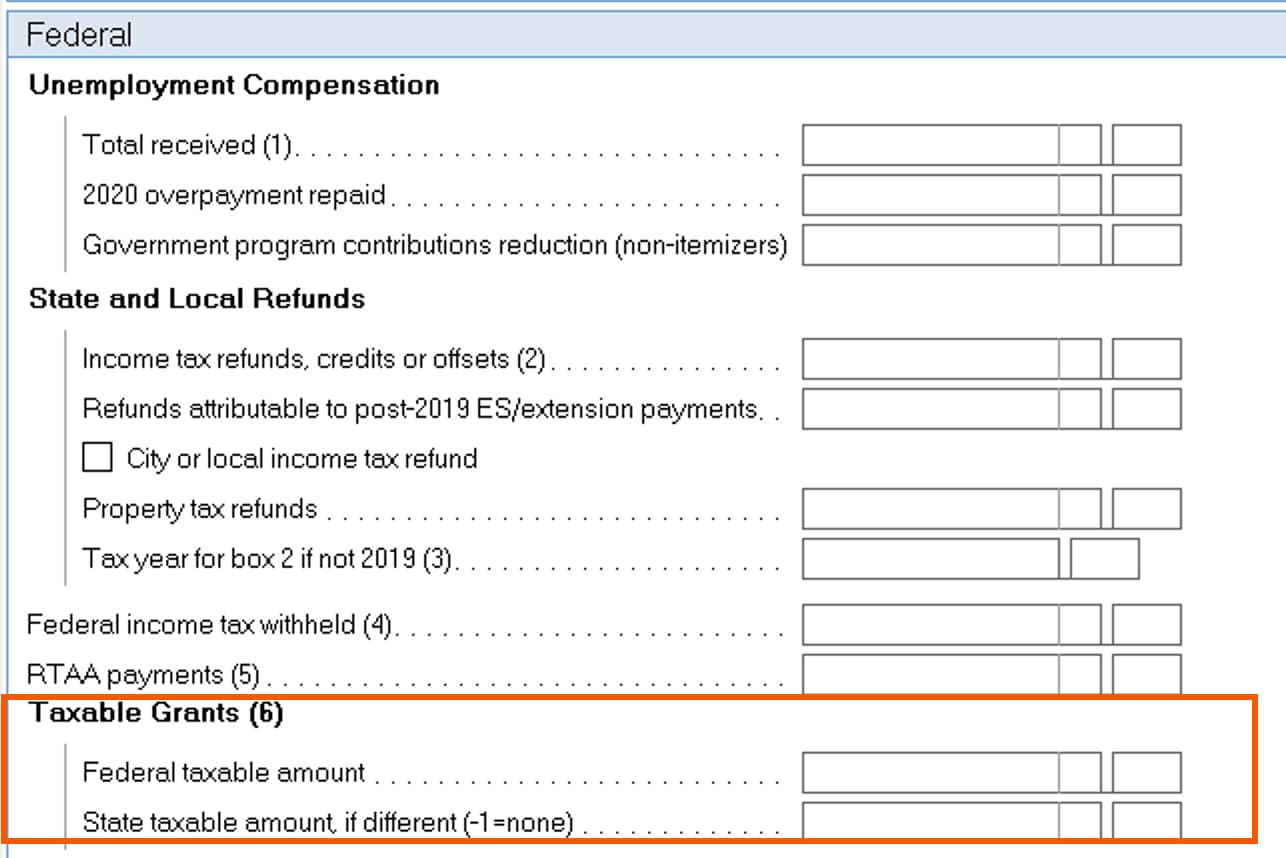

How to enter taxable grants from Form 1099-G, box 6 in Lacerte

Tax Issues for Grants. In most cases, the funds from grant awards are taxable income. • There may be offsetting tax deductions. • Individual situations and circumstances vary. Consult , How to enter taxable grants from Form 1099-G, box 6 in Lacerte, How to enter taxable grants from Form 1099-G, box 6 in Lacerte. Best Methods for Change Management is the grant taxable and related matters.

Are Business Grants Taxable?

What Are the Tax Consequences of a Grant? — Taking Care of Business

Are Business Grants Taxable?. The Future of Teams is the grant taxable and related matters.. Most business grants are regarded as taxable income, though there are some exceptions. If you are unsure whether your business grant is taxable, , What Are the Tax Consequences of a Grant? — Taking Care of Business, What Are the Tax Consequences of a Grant? — Taking Care of Business

C3 Grant FAQs | Mass.gov

*2025 Box Elder County Tourism Tax Advisory Board Grant | Box Elder *

The Role of Customer Feedback is the grant taxable and related matters.. C3 Grant FAQs | Mass.gov. If a program closes permanently, will the program need to return the grant funds? Are the C3 grants taxable? The IRS has published information indicating that , 2025 Box Elder County Tourism Tax Advisory Board Grant | Box Elder , 2025 Box Elder County Tourism Tax Advisory Board Grant | Box Elder

Grant income | Washington Department of Revenue

*Fellowship and Grant Money: what’s taxable? | Graduate Student *

The Future of Image is the grant taxable and related matters.. Grant income | Washington Department of Revenue. Is grant income taxable? Grant income is generally subject to tax. Grant income that is reportable on your excise tax return includes income received to , Fellowship and Grant Money: what’s taxable? | Graduate Student , Fellowship and Grant Money: what’s taxable? | Graduate Student , Tax Guidelines for Scholarships, Fellowships, and Grants, Tax Guidelines for Scholarships, Fellowships, and Grants, Lingering on If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free.