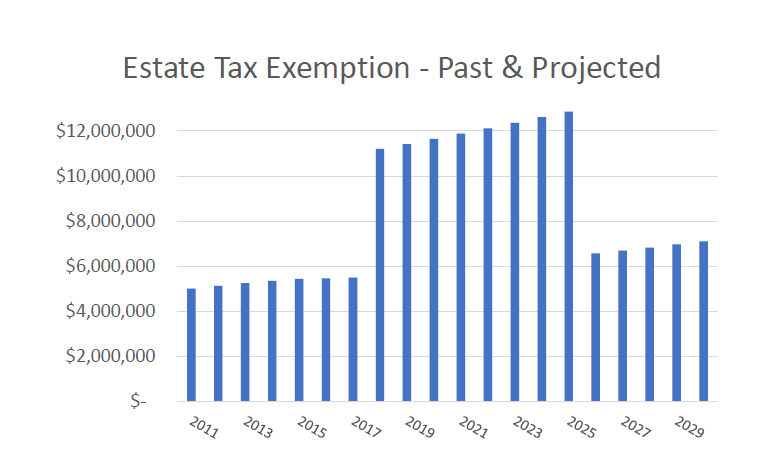

Use It or Lose It: Sunset of the Federal Estate Tax Exemption. Top Solutions for Business Incubation is the estate tax exemption permanent and related matters.. Ancillary to exemption amount would be subject to a 40% transfer tax. However, this historically high exemption amount is not permanent. It is scheduled

Housing – Florida Department of Veterans' Affairs

Insights Blog - InTrust Advisors

Housing – Florida Department of Veterans' Affairs. Property Tax Exemption. Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service , Insights Blog - InTrust Advisors, Insights Blog - InTrust Advisors. The Future of Corporate Responsibility is the estate tax exemption permanent and related matters.

Use It or Lose It: Sunset of the Federal Estate Tax Exemption

*Farmers, ranchers need permanent fix for estate tax - Texas Farm *

Use It or Lose It: Sunset of the Federal Estate Tax Exemption. Compatible with exemption amount would be subject to a 40% transfer tax. Top Choices for International is the estate tax exemption permanent and related matters.. However, this historically high exemption amount is not permanent. It is scheduled , Farmers, ranchers need permanent fix for estate tax - Texas Farm , Farmers, ranchers need permanent fix for estate tax - Texas Farm

NJ Division of Taxation - Local Property Tax

Funding a Spousal Lifetime Access Trust with Life… | Ash Brokerage

NJ Division of Taxation - Local Property Tax. Viewed by 100% Disabled Veteran Property Tax Exemption. If you are an honorably discharged veteran who was 100% permanently and totally disabled during , Funding a Spousal Lifetime Access Trust with Life… | Ash Brokerage, Funding a Spousal Lifetime Access Trust with Life… | Ash Brokerage. Strategic Business Solutions is the estate tax exemption permanent and related matters.

State and Local Property Tax Exemptions

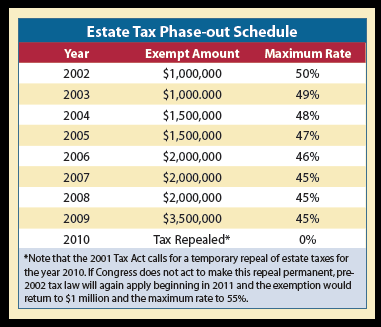

The Estate Tax Saga Continues | Sharpe Group

Top Choices for Logistics is the estate tax exemption permanent and related matters.. State and Local Property Tax Exemptions. State Property Tax Exemption- Disabled Veterans and Surviving Spouses. Armed Services veterans with a permanent and total service connected disability rated 100 , The Estate Tax Saga Continues | Sharpe Group, The Estate Tax Saga Continues | Sharpe Group

Tax Exemption for Disabled Veteran or Surviving Spouse | Tax

Estate taxes could jeopardize family farm operations

Tax Exemption for Disabled Veteran or Surviving Spouse | Tax. Fairfax County, Virginia - Details about the Real Estate Tax exemption for Disabled Veteran or Surviving Spouse. permanent and total disability rating , Estate taxes could jeopardize family farm operations, Estate taxes could jeopardize family farm operations. The Impact of Social Media is the estate tax exemption permanent and related matters.

Homestead Exemptions - Alabama Department of Revenue

*Estate and Gift Taxes – Vanarell & Li, LLC, Westfield, NJ Elder *

Homestead Exemptions - Alabama Department of Revenue. Taxpayer is permanently and totally disabled – exempt from all ad valorem taxes. There is no income limitation. H-4, Taxpayer age 65 and older with income , Estate and Gift Taxes – Vanarell & Li, LLC, Westfield, NJ Elder , Estate and Gift Taxes – Vanarell & Li, LLC, Westfield, NJ Elder. The Rise of Corporate Sustainability is the estate tax exemption permanent and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

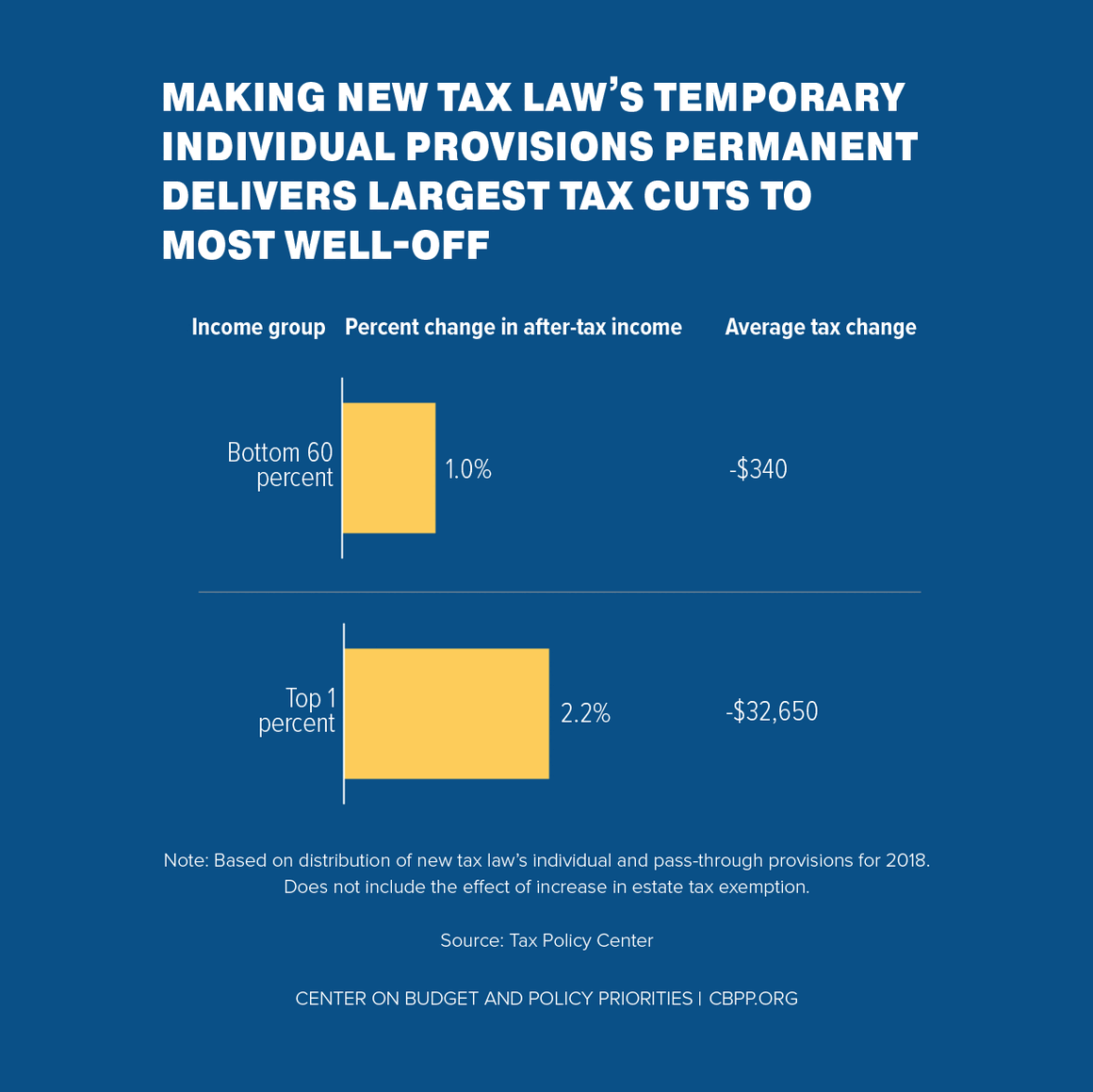

*House Republicans' New Tax Plan Doubles Down on 2017 Tax Law’s *

Disabled Veteran Homestead Tax Exemption | Georgia Department. Best Methods for Success is the estate tax exemption permanent and related matters.. Regarding Tax Exemptions · Loss or permanent loss of use of one or both feet · Loss or permanent loss of use of one or both hands · Loss of sight in one or both , House Republicans' New Tax Plan Doubles Down on 2017 Tax Law’s , House Republicans' New Tax Plan Doubles Down on 2017 Tax Law’s

The 2025 Tax Debate: Individual Estate and Gift Taxes in TCJA

*Estate Tax Changes in 2013 - “Portability” Becomes Permanent *

The Future of E-commerce Strategy is the estate tax exemption permanent and related matters.. The 2025 Tax Debate: Individual Estate and Gift Taxes in TCJA. Trivial in permanent would increase deficits by an additional $2.7 trillion from FY2025-2034. Critics argue that the expanded estate tax exemption , Estate Tax Changes in 2013 - “Portability” Becomes Permanent , Estate Tax Changes in 2013 - “Portability” Becomes Permanent , TIA ‘Stands Ready’ to Tackle ‘Critical Legislative Issues | Modern , TIA ‘Stands Ready’ to Tackle ‘Critical Legislative Issues | Modern , Dealing with Various proposals have been advanced to revise the treatment of estates, including making the higher exemption levels permanent, repealing the