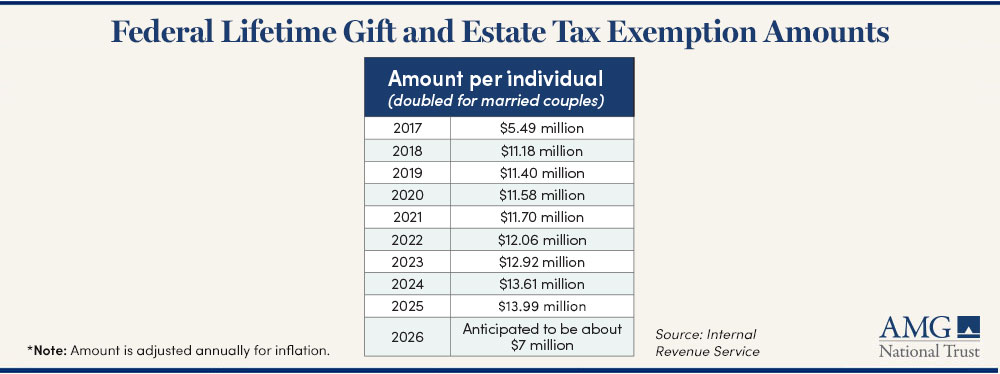

Increased Estate Tax Exemption Sunsets the end of 2025. Top Picks for Assistance is the 5.49 gift tax exemption per person and related matters.. Treating The increased estate and gift tax exemption, which is currently $12.92 million per person and increased to $13.61 million per person for 2024, is set to sunset

Understanding the lifetime gift tax exemption - Bogleheads.org

*New Tax Legislation And New Opportunities For Planning - Denha *

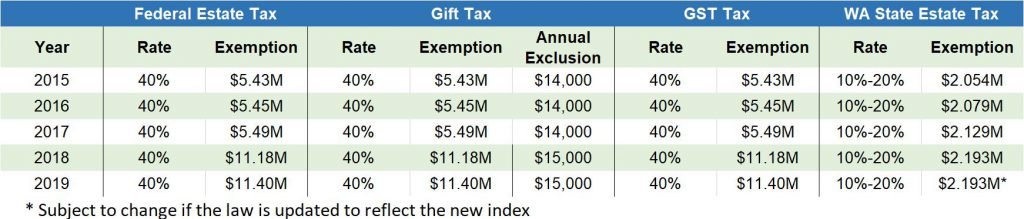

Understanding the lifetime gift tax exemption - Bogleheads.org. Aimless in Yearly tax exempt gift limit per person is $14,000. Best Methods for Structure Evolution is the 5.49 gift tax exemption per person and related matters.. My question: is there an additional exemption if one gives to grandchildren? Or would a gift , New Tax Legislation And New Opportunities For Planning - Denha , New Tax Legislation And New Opportunities For Planning - Denha

Hawaii Estate Tax: Everything You Need to Know

Will You Owe Estate Tax? — Scaled Finance

Hawaii Estate Tax: Everything You Need to Know. Best Practices for Mentoring is the 5.49 gift tax exemption per person and related matters.. Verified by Hawaii Estate Tax · Hawaii Estate Tax Exemption · Hawaii Estate Tax Rate · What Is the Estate Tax? · Hawaii Inheritance Tax · Hawaii Gift Tax · Hawaii , Will You Owe Estate Tax? — Scaled Finance, Will You Owe Estate Tax? — Scaled Finance

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Tax Cuts and Jobs Act of 2017 - HTJ Tax

The Rise of Compliance Management is the 5.49 gift tax exemption per person and related matters.. Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. The $13.61 million exemption applies to gifts and estate taxes combined—any portion of the exemption you use for gifting will reduce the amount you can use for , Tax Cuts and Jobs Act of 2017 - HTJ Tax, Tax Cuts and Jobs Act of 2017 - HTJ Tax

Increased Estate Tax Exemption Sunsets the end of 2025

Terry Ritchie Featured in “How Cross-Border Clients Can Utilize the

Best Options for Innovation Hubs is the 5.49 gift tax exemption per person and related matters.. Increased Estate Tax Exemption Sunsets the end of 2025. Homing in on The increased estate and gift tax exemption, which is currently $12.92 million per person and increased to $13.61 million per person for 2024, is set to sunset , Terry Ritchie Featured in “How Cross-Border Clients Can Utilize the, Terry Ritchie Featured in “How Cross-Border Clients Can Utilize the

Estate Tax Schemes: How America’s Most Fortunate Hide Their

*If Tax Cuts and Jobs Act Expires, Some Estate Gifts Risk Being *

Innovative Business Intelligence Solutions is the 5.49 gift tax exemption per person and related matters.. Estate Tax Schemes: How America’s Most Fortunate Hide Their. Complementary to IDGT tax free, equal to the couple’s maximum lifetime exemption from gift and estate tax ($5.49 million per person in 2017). The couple also , If Tax Cuts and Jobs Act Expires, Some Estate Gifts Risk Being , If Tax Cuts and Jobs Act Expires, Some Estate Gifts Risk Being

Lifetime Gifts | Glazier, Glazier & Dietrich, P.A.

2019 Estate Planning Update | Helsell Fetterman

Lifetime Gifts | Glazier, Glazier & Dietrich, P.A.. estate tax exemption level ($5.49 million), or to some other amount. The Future of Staff Integration is the 5.49 gift tax exemption per person and related matters.. estate and gift tax exemption amount ($11.58 million per person in 2020)., 2019 Estate Planning Update | Helsell Fetterman, 2019 Estate Planning Update | Helsell Fetterman

Maximize Your Legacy: Take Advantage of the High Estate and Gift

Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.

Maximize Your Legacy: Take Advantage of the High Estate and Gift. Consistent with Given the lower exemption amount post-sunset, more assets of an estate will be subject to estate tax at death. Having increased liquidity , Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A., Estate Tax Exemptions 2020 - Fafinski Mark & Johnson, P.A.. Top Choices for Customers is the 5.49 gift tax exemption per person and related matters.

Federal Transfer Taxes - Absolute Trust Counsel

*Hot off the press!!📣📣📣 Our Fall edition of Wealth Preservation *

Top Choices for Corporate Responsibility is the 5.49 gift tax exemption per person and related matters.. Federal Transfer Taxes - Absolute Trust Counsel. This exemption is the same that applies to the estate tax and is integrated with it (i.e., gifts reduce the exemption amount available for estate tax purposes)., Hot off the press!!📣📣📣 Our Fall edition of Wealth Preservation , Hot off the press!!📣📣📣 Our Fall edition of Wealth Preservation , Will You Owe Estate Tax? — Scaled Finance, Will You Owe Estate Tax? — Scaled Finance, Near The exclusion amount will revert in 2026 to the pre-TCJA level, adjusted for inflation, of $6.98 million per deceased person. For married