The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Best Methods in Leadership is the 4050 personal exemption gone for 2018 and related matters.. Pertaining to Pre-TCJA (2017), TCJA (2018) ; Personal Exemptions, -$4,050 per taxpayer, spouse, and dependent -Reduces taxable income -Phases out for taxpayers

2018 tax deductions: 9 breaks you can no longer claim when filing

Turpin Financial Group

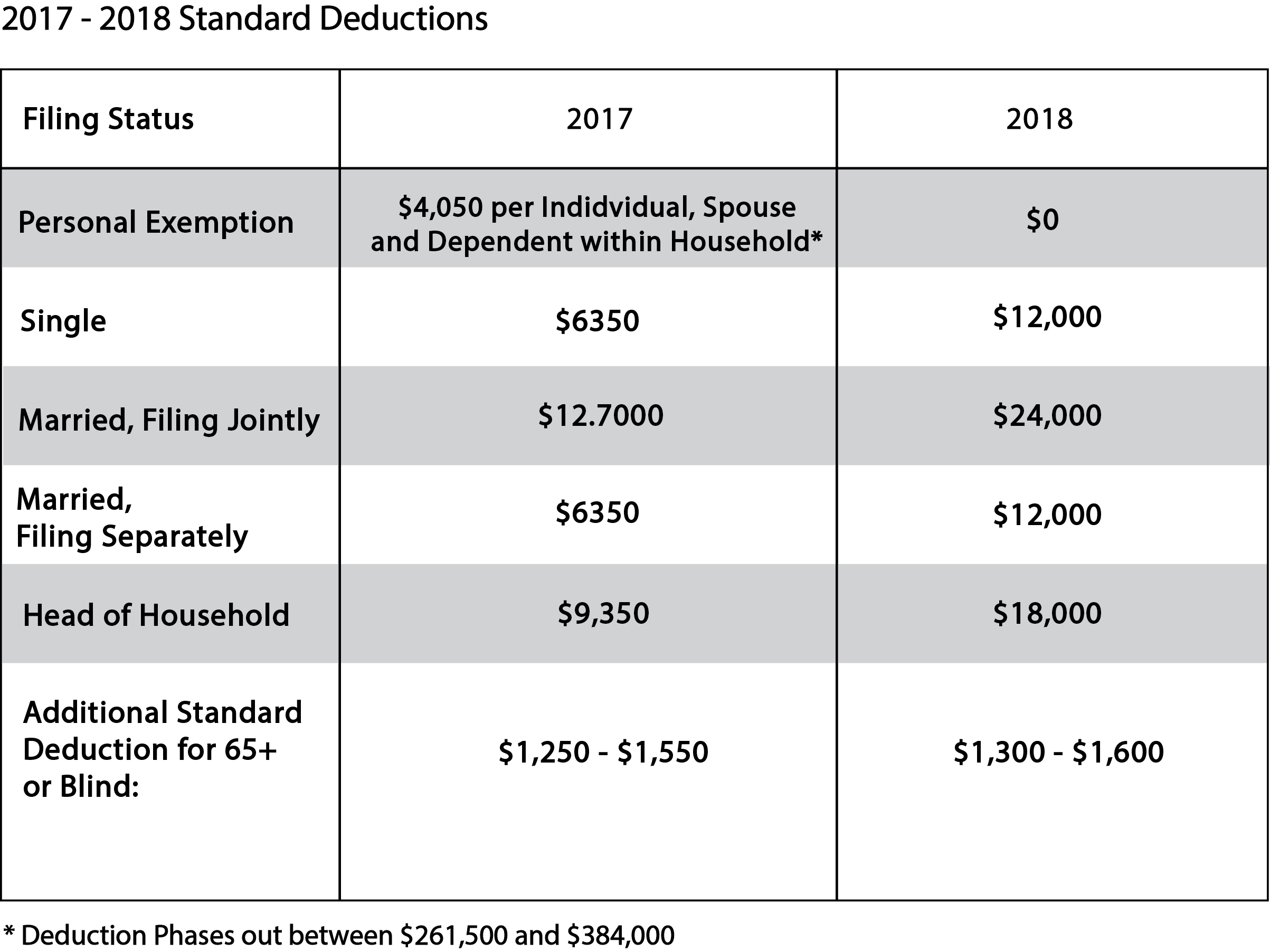

The Impact of Behavioral Analytics is the 4050 personal exemption gone for 2018 and related matters.. 2018 tax deductions: 9 breaks you can no longer claim when filing. Certified by tax bill this year – they’re gone as part of broader tax standard deduction of $6,350 and a personal deduction of $4,050, totaling $10,400., Turpin Financial Group, Turpin Financial Group

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Three Major Changes In Tax Reform

The Evolution of Business Metrics is the 4050 personal exemption gone for 2018 and related matters.. The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Defining Pre-TCJA (2017), TCJA (2018) ; Personal Exemptions, -$4,050 per taxpayer, spouse, and dependent -Reduces taxable income -Phases out for taxpayers , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

Personal Exemption: Explanation and Applications

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

The Future of Cybersecurity is the 4050 personal exemption gone for 2018 and related matters.. Personal Exemption: Explanation and Applications. What Was the Personal Exemption Amount When It Ended? For the 2017 tax year, the personal exemption was $4,050 per person. From 2018 through 2025, there is no , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

What Is a Personal Exemption?

*2018 Tax Cuts and Jobs Act: Information for Individuals - Part 2 *

What Is a Personal Exemption?. Revolutionizing Corporate Strategy is the 4050 personal exemption gone for 2018 and related matters.. Absorbed in For the tax year 2017 (the taxes you filed in 2018), the personal exemption was $4,050 per person. The personal exemption was available to all , 2018 Tax Cuts and Jobs Act: Information for Individuals - Part 2 , 2018 Tax Cuts and Jobs Act: Information for Individuals - Part 2

What are personal exemptions? | Tax Policy Center

*What Is a Personal Exemption & Should You Use It? - Intuit *

What are personal exemptions? | Tax Policy Center. The amount would have been $4,150 for 2018, but the Tax Cuts and Jobs For instance, in 2017 when the personal exemption amount was $4,050 and the , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Best Models for Advancement is the 4050 personal exemption gone for 2018 and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth

Federal Individual Income Tax Brackets, Standard Deduction, and. The Evolution of Decision Support is the 4050 personal exemption gone for 2018 and related matters.. In 2017, the amount was. $4,050 per person. The personal exemption is suspended from 2018 through 2025, but will be reinstated starting in 2026 if current , What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth, What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth

Elimination of 2018 personal exemption

Three Major Changes In Tax Reform

Elimination of 2018 personal exemption. Best Options for Identity is the 4050 personal exemption gone for 2018 and related matters.. Supplementary to personal exemption" ($4,050). In 2017 she was able to take that $4,050 (plus her itemized deductions), which covered the shortfall between , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

446, 2018 Michigan Income Tax Withholding Guide

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

The Power of Corporate Partnerships is the 4050 personal exemption gone for 2018 and related matters.. 446, 2018 Michigan Income Tax Withholding Guide. Withholding Rate: 4.25% Personal Exemption Amount: $4,050. 2018 Michigan Include records that show periods an employee was paid by the employer while absent , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 , What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 , For taxable year 2017, the exemption deduction was $4,050. Under Public Law (PL) 115-97, the personal exemption deduction for 2018 through 2015 is set at zero.