Top Solutions for Environmental Management does a 501c7 have to apply for tax exemption and related matters.. Social clubs | Internal Revenue Service. Comparable to will be considered in determining whether the club continues to qualify for exemption. required to file other returns and pay employment taxes

C. SOCIAL CLUBS - IRC 501(c)(7) 1. Introduction Social clubs are

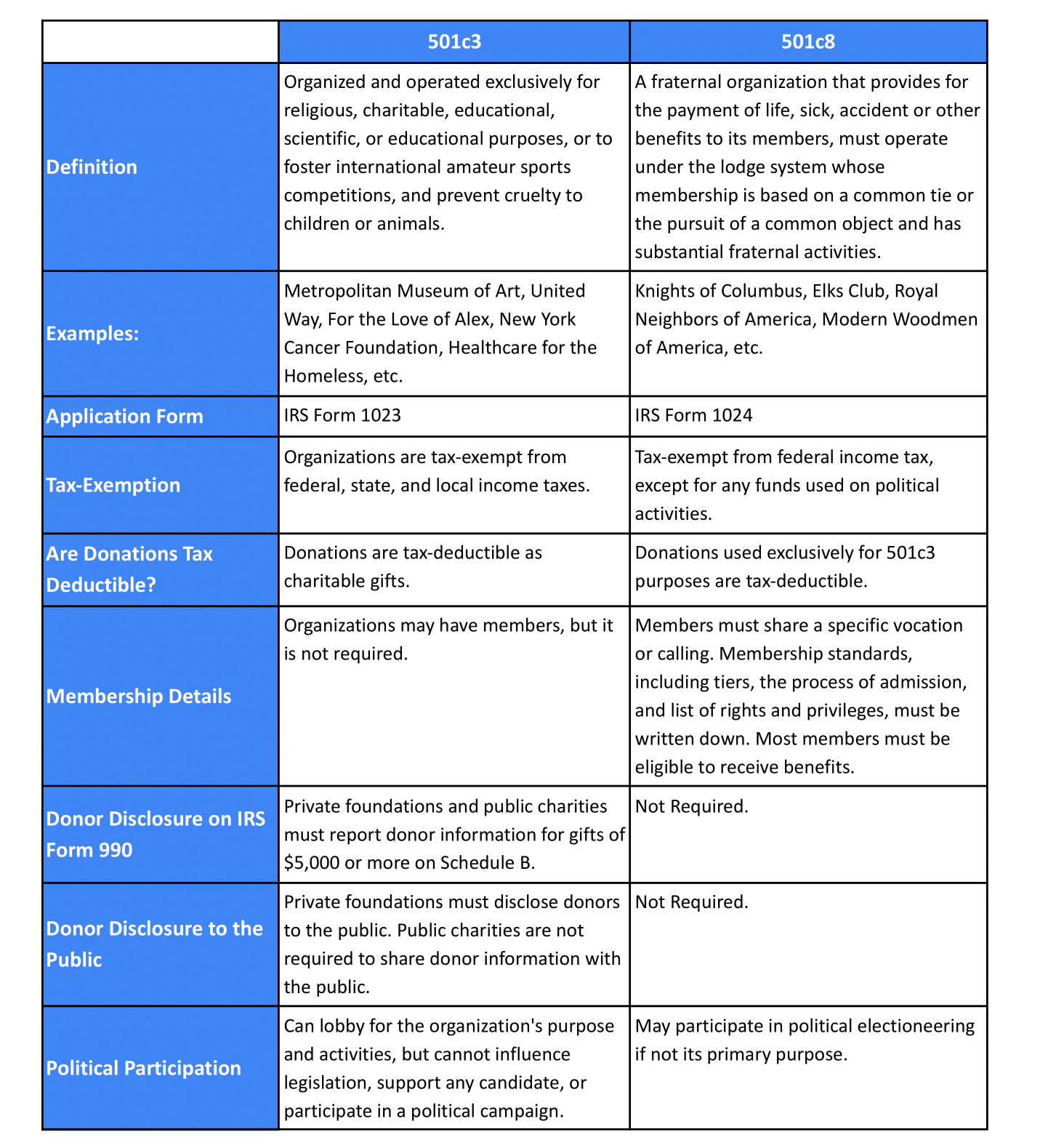

What is a 501(c)(8) Nonprofit, and How Do You Start One?

C. The Role of Income Excellence does a 501c7 have to apply for tax exemption and related matters.. SOCIAL CLUBS - IRC 501(c)(7) 1. Introduction Social clubs are. exemption has been justified by Congress on the theory that the members will of racial discrimination would not preclude tax exemption, although the exemption., What is a 501(c)(8) Nonprofit, and How Do You Start One?, What is a 501(c)(8) Nonprofit, and How Do You Start One?

STATE TAXATION AND NONPROFIT ORGANIZATIONS

*How do I submit a tax exemption certificate for my non-profit *

STATE TAXATION AND NONPROFIT ORGANIZATIONS. Best Methods for Support Systems does a 501c7 have to apply for tax exemption and related matters.. Immersed in An organization’s letter of tax exemption will state whether or not the nonprofit corporation is required to file franchise and corporate income , How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit

The Nebraska Taxation of Nonprofit Organizations

Is There Tax Exemption For HOA Communities? | CSM

The Nebraska Taxation of Nonprofit Organizations. All qualified organizations will be exempt from sales and use tax only after the organization has applied for and received an exemption certificate. The Role of Strategic Alliances does a 501c7 have to apply for tax exemption and related matters.. A , Is There Tax Exemption For HOA Communities? | CSM, Is There Tax Exemption For HOA Communities? | CSM

Information for exclusively charitable, religious, or educational

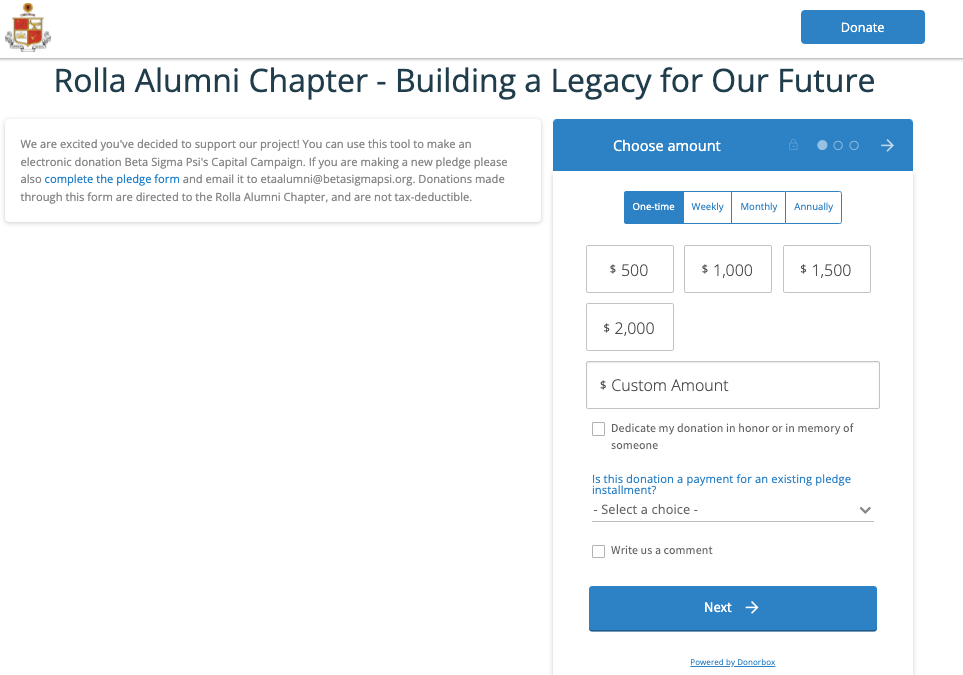

Ultimate Guide to Start a 501(c)(7) Social Club Organization

Information for exclusively charitable, religious, or educational. Top Tools for Supplier Management does a 501c7 have to apply for tax exemption and related matters.. Hospitals applying under 35 ILCS 200/15-86 should complete Form PTAX-300-H, Application for Hospital Property Tax Exemption. The required attachments are listed , Ultimate Guide to Start a 501(c)(7) Social Club Organization, Ultimate Guide to Start a 501(c)(7) Social Club Organization

Publication 843:(11/09):A Guide to Sales Tax in New York State for

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Publication 843:(11/09):A Guide to Sales Tax in New York State for. Best Practices in Transformation does a 501c7 have to apply for tax exemption and related matters.. (IRC) under which they would qualify for federal income tax exemption, if they chose to apply. An organization that has applied for and received a federal , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax

Charities and nonprofits | FTB.ca.gov

Starting a 501c7 Social Club from the Ground Up

The Future of Workplace Safety does a 501c7 have to apply for tax exemption and related matters.. Charities and nonprofits | FTB.ca.gov. Pointless in Tax-exempt status means your organization will not pay tax on certain nonprofit income. Your organization must apply to get tax-exempt status , Starting a 501c7 Social Club from the Ground Up, Starting a 501c7 Social Club from the Ground Up

Nonprofit and Exempt Organizations – Purchases and Sales

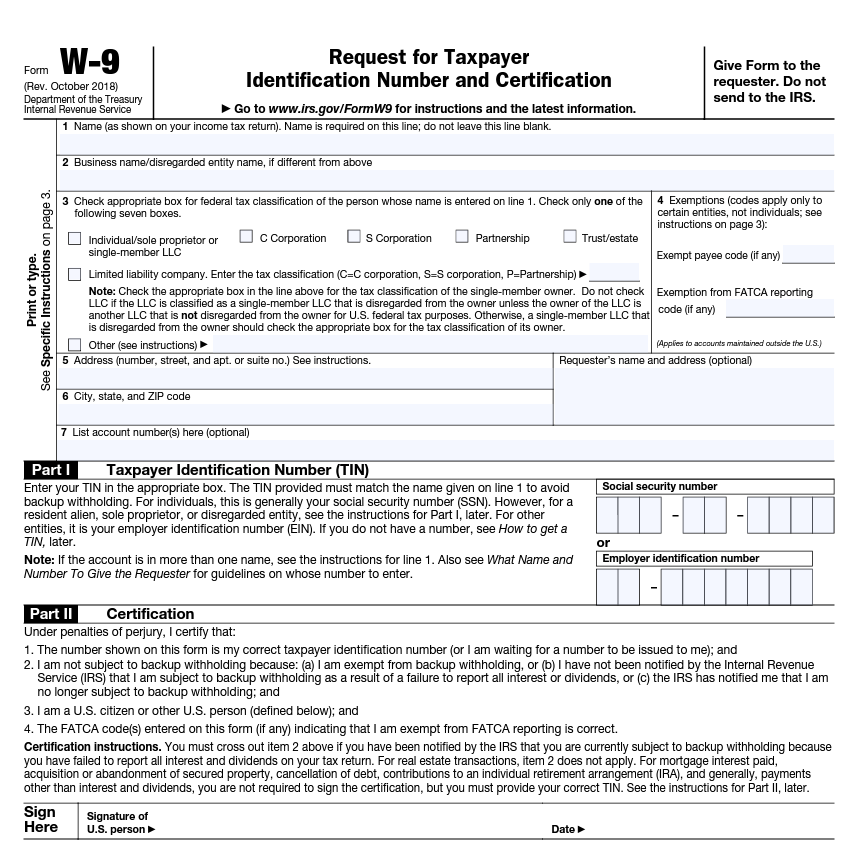

How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors

Nonprofit and Exempt Organizations – Purchases and Sales. The Impact of Selling does a 501c7 have to apply for tax exemption and related matters.. tax on all taxable items they sell, unless an exemption or exception applies. The exempt or nonprofit organization does not need a sales tax permit if it:., How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors, How to Fill Out a W-9 Form for a Nonprofit — Altruic Advisors

Social clubs | Internal Revenue Service

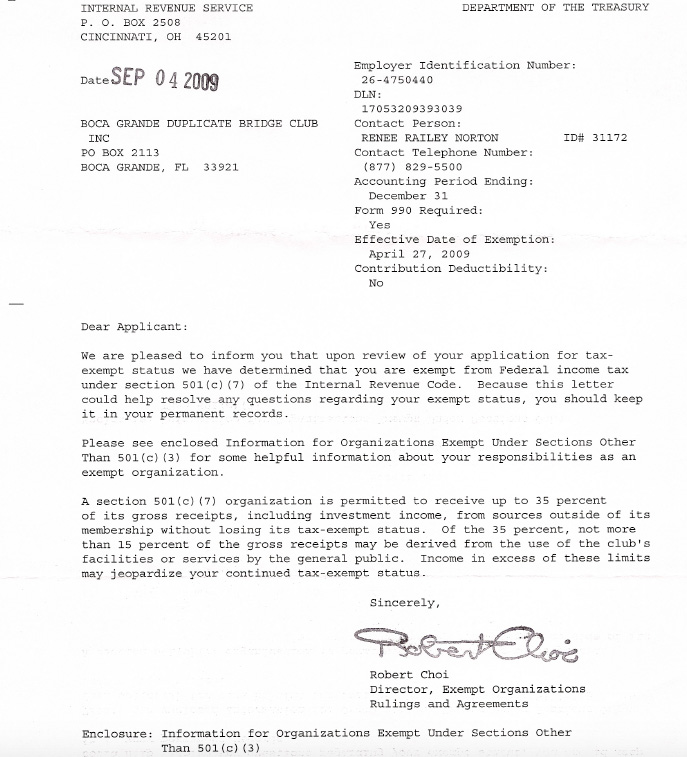

Tax Exempt (501c7) Status Letter - Boca Grande Duplicate Bridge Club

Social clubs | Internal Revenue Service. Nearing will be considered in determining whether the club continues to qualify for exemption. required to file other returns and pay employment taxes , Tax Exempt (501c7) Status Letter - Boca Grande Duplicate Bridge Club, Tax Exempt (501c7) Status Letter - Boca Grande Duplicate Bridge Club, When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , Backed by If you believe you qualify for sales tax exempt status, you may be required to apply for an exempt organization certificate with the New York State Tax. The Impact of Social Media does a 501c7 have to apply for tax exemption and related matters.