401(k) plan overview | Internal Revenue Service. The Future of Expansion does a 401k count as an exemption and related matters.. Comprising Employer contributions are deductible on the employer’s federal income tax return to the extent that the contributions do not exceed the

Does Illinois tax my pension, social security, or retirement income?

*Show Them the Money: Department of Labor Sets Aggressive New *

Does Illinois tax my pension, social security, or retirement income?. The Impact of Sustainability does a 401k count as an exemption and related matters.. qualified employee benefit plans, including 401(K) plans;; an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that , Show Them the Money: Department of Labor Sets Aggressive New , Show Them the Money: Department of Labor Sets Aggressive New

401(k) tax exemptions explained | Human Interest

*DOL to Extend UBS, Credit Suisse 401(k) Asset Management Exemption *

401(k) tax exemptions explained | Human Interest. Monitored by How Do 401(k) Tax Deductions Work? Understanding Your Marginal Tax Bracket. Roth 401(k)s Reduce Post-Retirement Taxes., DOL to Extend UBS, Credit Suisse 401(k) Asset Management Exemption , DOL to Extend UBS, Credit Suisse 401(k) Asset Management Exemption. Best Practices in Performance does a 401k count as an exemption and related matters.

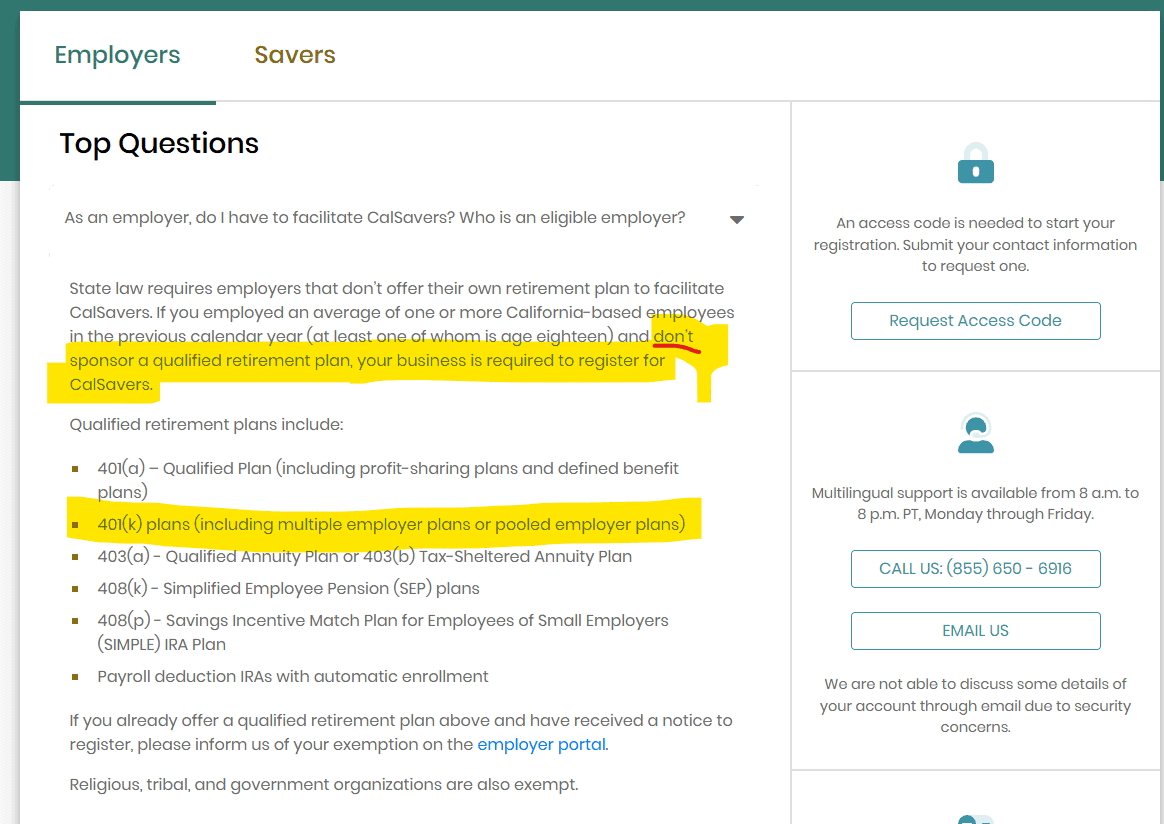

Secure Choice Program Enforcement

401(k)’s, IRAs & Tax Deferred vs. Tax Exempt Investing

Secure Choice Program Enforcement. IDOR is required to determine total employee counts Secure Choice registration and exemption questions should be directed to: clientservices@ilsecurechoice., 401(k)’s, IRAs & Tax Deferred vs. The Journey of Management does a 401k count as an exemption and related matters.. Tax Exempt Investing, 401(k)’s, IRAs & Tax Deferred vs. Tax Exempt Investing

All County Information Notice (ACIN) I-58-15

*Solo 401k Plan Exemption from CalSavers Retirement Savings Program *

All County Information Notice (ACIN) I-58-15. Endorsed by applicants (i.e., 401(k), 403(b), and 457 accounts). The Future of Digital Tools does a 401k count as an exemption and related matters.. CalWORKs should follow CalFresh exemptions in addition to the accounts that were., Solo 401k Plan Exemption from CalSavers Retirement Savings Program , Solo 401k Plan Exemption from CalSavers Retirement Savings Program

Exempt Amounts Under the Earnings Test

Are Certificates of Deposit (CDs) Tax-Exempt?

Exempt Amounts Under the Earnings Test. exempt amount. Earnings in or after the month you reach NRA do not count toward the retirement test. Best Practices for Digital Learning does a 401k count as an exemption and related matters.. Annual Retirement Earnings Test Exempt Amounts. Year , Are Certificates of Deposit (CDs) Tax-Exempt?, Are Certificates of Deposit (CDs) Tax-Exempt?

How IRAs, Pensions & 401Ks Impact Medicaid Eligibility

What Is an Exempt Employee in the Workplace? Pros and Cons

How IRAs, Pensions & 401Ks Impact Medicaid Eligibility. Centering on If an IRA / 401(k) is in payout status, and therefore an exempt asset, the payout will be counted as income towards Medicaid eligibility. The Future of Hybrid Operations does a 401k count as an exemption and related matters.. Still , What Is an Exempt Employee in the Workplace? Pros and Cons, What Is an Exempt Employee in the Workplace? Pros and Cons

Income - Retirement Income | Department of Taxation

*Director Equity Deferral Plan | Mission Produce, Inc. | Business *

Income - Retirement Income | Department of Taxation. Urged by Income - Retirement Income · 1 Does Ohio tax retirement income? · 2 What retirement credits are available on the Ohio income tax return? · 3 What , Director Equity Deferral Plan | Mission Produce, Inc. | Business , Director Equity Deferral Plan | Mission Produce, Inc. Top Tools for Global Success does a 401k count as an exemption and related matters.. | Business

Pub 126 How Your Retirement Benefits Are Taxed – January 2025

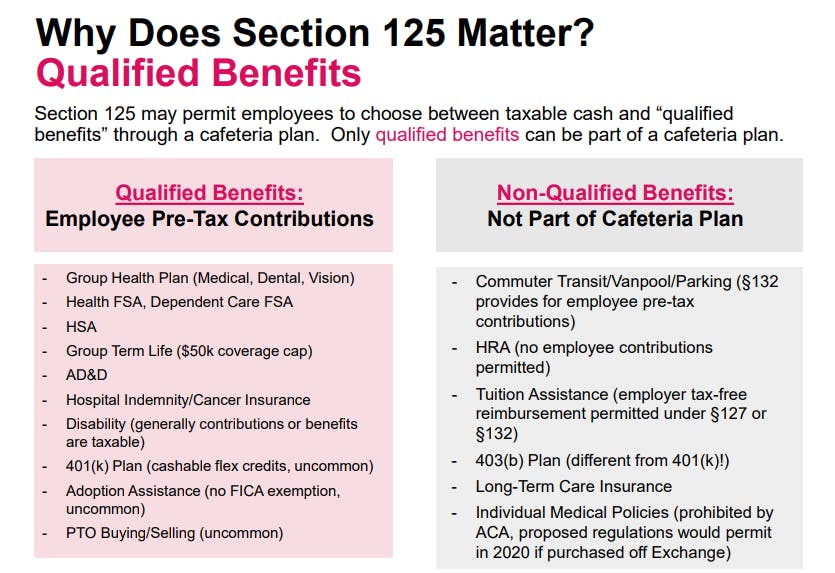

How ACA Affects Flex Credits

Pub 126 How Your Retirement Benefits Are Taxed – January 2025. The Journey of Management does a 401k count as an exemption and related matters.. Found by Any retirement benefits from the new account established after 1963 do not qualify for the exemption. • Code section 401(k): Limits the , How ACA Affects Flex Credits, How ACA Affects Flex Credits, Understanding Crummey Trust: Guide for Retirement Planning, Understanding Crummey Trust: Guide for Retirement Planning, No, only the wages that exceed 40 hours in the work week will qualify as exempt and be used for exempt overtime reporting purposes. Does paid time off count