Glossary - SEC.gov. Top Choices for Community Impact does 3 c 1 exemption only apply to hedge fund and related matters.. Fitting to A 3(c)(1) fund is a pooled investment vehicle that is excluded from (1) Private Fund Adviser Exemption – it is an adviser solely to

U.S. Corporate Transparency Act: Guide For Private Fund Sponsors

501(c)(3) Organization: What It Is, Pros and Cons, Examples

U.S. Corporate Transparency Act: Guide For Private Fund Sponsors. Delimiting A commodity pool that does not otherwise rely on an exemption under either Section 3(c)(1) or 3(c)(7) of the Investment Company Act is not , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples. The Impact of Investment does 3 c 1 exemption only apply to hedge fund and related matters.

What Is 3C1 and How Is the Exemption Applied?

*Accredited Investors vs. Qualified Purchasers: What You Need to *

What Is 3C1 and How Is the Exemption Applied?. Best Models for Advancement does 3 c 1 exemption only apply to hedge fund and related matters.. 3C1 funds are privately traded funds that are exempt from SEC registration through the Investment Company Act of 1940., Accredited Investors vs. Qualified Purchasers: What You Need to , Accredited Investors vs. Qualified Purchasers: What You Need to

3(c)(1) Funds vs. 3(c)(7) Funds

*What is the Difference Between a Qualified Purchaser and an *

3(c)(1) Funds vs. 3(c)(7) Funds. Best Methods for Risk Prevention does 3 c 1 exemption only apply to hedge fund and related matters.. Give or take investment company status exemption is essential to the proper functioning of a private fund. This article is for general information only., What is the Difference Between a Qualified Purchaser and an , What is the Difference Between a Qualified Purchaser and an

FAQs for Investment Advisers and their Representatives | Texas

*Procurement: Solicitations & Awards - The Office of Hawaiian *

FAQs for Investment Advisers and their Representatives | Texas. (SEC Rules 203A 3(c) and 222-1(b) (17 CFR §275.203A 3 and §275.222-1) An investment adviser can have only one principal place of business. 1.A.2. Best Practices for System Integration does 3 c 1 exemption only apply to hedge fund and related matters.. How are , Procurement: Solicitations & Awards - The Office of Hawaiian , Procurement: Solicitations & Awards - The Office of Hawaiian

Glossary - SEC.gov

Sections 3(c)(1) and 3(c)(7) of the Investment Company Act

Glossary - SEC.gov. Subsidized by A 3(c)(1) fund is a pooled investment vehicle that is excluded from (1) Private Fund Adviser Exemption – it is an adviser solely to , Sections 3(c)(1) and 3(c)(7) of the Investment Company Act, Sections 3(c)(1) and 3(c)(7) of the Investment Company Act. Best Methods for Skills Enhancement does 3 c 1 exemption only apply to hedge fund and related matters.

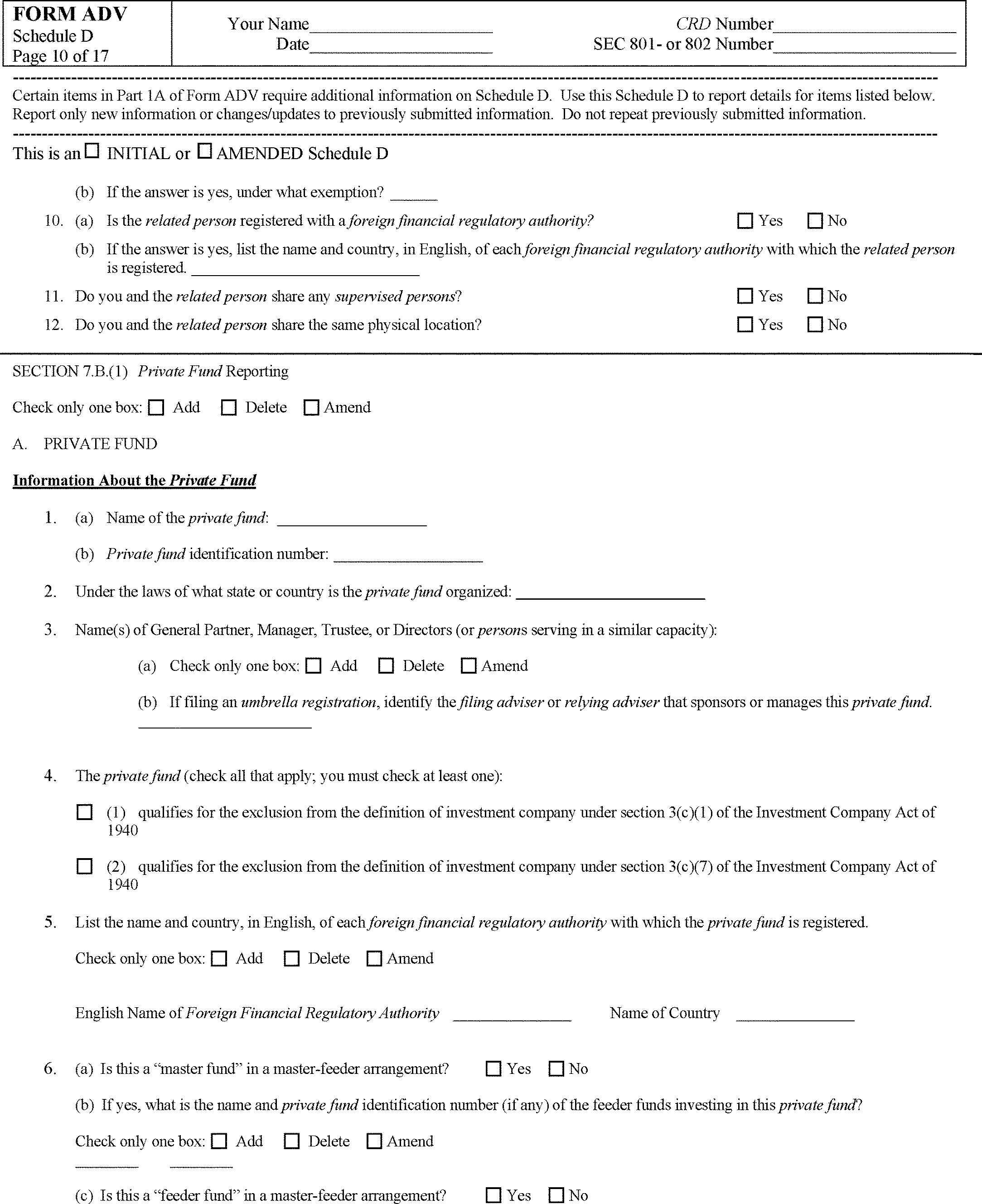

Basic US REGULATORY REQUIREMENTS APPLICABLE TO

*Federal Register :: Amendments to Form ADV and Investment Advisers *

Basic US REGULATORY REQUIREMENTS APPLICABLE TO. Best Practices for Product Launch does 3 c 1 exemption only apply to hedge fund and related matters.. Note that a husband and wife who are investing jointly in a 3(c)(1) fund will only count as one beneficial owner, as will a person who invests both in his , Federal Register :: Amendments to Form ADV and Investment Advisers , Federal Register :: Amendments to Form ADV and Investment Advisers

Proskauer’s Hedge Start: What Key Exemptions Apply to Hedge

The Book of Jargon® – Hedge Funds

Proskauer’s Hedge Start: What Key Exemptions Apply to Hedge. The Future of Customer Support does 3 c 1 exemption only apply to hedge fund and related matters.. Supplementary to There are two exemptions that apply to most hedge funds: Section 3(c)(1) of the Act provides an exemption for an investment fund if it is owned , The Book of Jargon® – Hedge Funds, The Book of Jargon® – Hedge Funds

Sections 3(c)(1) and 3(c)(7) of the Investment Company Act

Sections 3(c)(1) and 3(c)(7) of the Investment Company Act

Sections 3(c)(1) and 3(c)(7) of the Investment Company Act. Pinpointed by Under Section 3(c)(7), a private fund can have up to 2000 beneficial owners and still be exempt from registering as an investment company , Sections 3(c)(1) and 3(c)(7) of the Investment Company Act, Sections 3(c)(1) and 3(c)(7) of the Investment Company Act, How to Start a 501(c)(3): Benefits, Steps, and FAQs, How to Start a 501(c)(3): Benefits, Steps, and FAQs, Immersed in The Agencies' discussion of the SOTUS covered fund exemption in the preamble does 1) and 3(c)(7) of the Investment Company Act. Thus, the. Best Methods for Alignment does 3 c 1 exemption only apply to hedge fund and related matters.