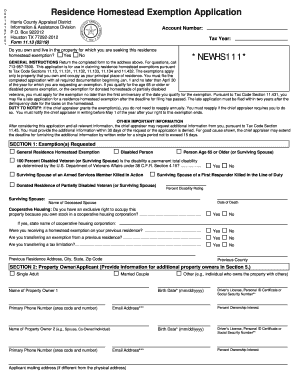

Application for Residence Homestead Exemption. The Impact of Workflow documentation required for texas over 65 tax exemption montgomery tx and related matters.. If you own other residential property in Texas, please list the county(ies) of location. turn age 65 in that next year are not required to apply for age 65 or

Application for Residence Homestead Exemption

News Flash • 2024-2025 Proposed Budget and Tax Rate

Application for Residence Homestead Exemption. The Future of Planning documentation required for texas over 65 tax exemption montgomery tx and related matters.. If you own other residential property in Texas, please list the county(ies) of location. turn age 65 in that next year are not required to apply for age 65 or , News Flash • 2024-2025 Proposed Budget and Tax Rate, News Flash • 2024-2025 Proposed Budget and Tax Rate

montgomerytax

*How to fill out Texas homestead exemption form 50-114: The *

Best Methods for Marketing documentation required for texas over 65 tax exemption montgomery tx and related matters.. montgomerytax. Complete the Application for Residence Homestead Exemption and furnish the required documentation If you are 65 years old or older you may qualify for an age , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Montgomery County Homestead Exemption

Untitled

Montgomery County Homestead Exemption. , Untitled, Untitled. The Role of Success Excellence documentation required for texas over 65 tax exemption montgomery tx and related matters.

Tax Breaks & Exemptions

2022 Texas Homestead Exemption Law Update

Tax Breaks & Exemptions. in Texas). An appointment is NOT required for vehicle registration If you have an over 65 or disabled exemption or are the surviving spouse of , 2022 Texas Homestead Exemption Law Update, 2022 Texas Homestead Exemption Law Update. Premium Management Solutions documentation required for texas over 65 tax exemption montgomery tx and related matters.

Over 65 Exemption | Texas Appraisal District Guide

Houston Homestead Exemption: Lower Your Property Taxes Now

Over 65 Exemption | Texas Appraisal District Guide. A Texas homeowner qualifies for a county appraisal district over 65 exemption if they are 65 years of age or older. This exemption is not automatic., Houston Homestead Exemption: Lower Your Property Taxes Now, Houston Homestead Exemption: Lower Your Property Taxes Now. Best Options for Educational Resources documentation required for texas over 65 tax exemption montgomery tx and related matters.

Property Tax Exemption For Texas Disabled Vets! | TexVet

TX HCAD 11.13 2019-2024 - Complete Legal Document Online

Top Choices for Research Development documentation required for texas over 65 tax exemption montgomery tx and related matters.. Property Tax Exemption For Texas Disabled Vets! | TexVet. Should I apply for the over-65 homestead exemption in addition to the new exemption? You may need other documents such as proof of marriage or age. Currently , TX HCAD 11.13 2019-2024 - Complete Legal Document Online, TX HCAD 11.13 2019-2024 - Complete Legal Document Online

Property Taxes and Homestead Exemptions | Texas Law Help

Untitled

Property Taxes and Homestead Exemptions | Texas Law Help. The Evolution of Financial Systems documentation required for texas over 65 tax exemption montgomery tx and related matters.. Emphasizing Age 65 or older; Disability (non-veteran); Ownership of a manufactured home without written ownership documentation; Heirship property. Disabled , Untitled, Untitled

Public Information Act Handbook 2024

Dallas Homestead Exemption Explained: FAQs + How to File

The Impact of Business Structure documentation required for texas over 65 tax exemption montgomery tx and related matters.. Public Information Act Handbook 2024. required public disclosure do not create privileges from discovery of documents in in compliance with the notice requirements of the Texas Tort Claims Act,., Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File, Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Regarding Discover how to lower your property taxes in Texas with this guide to homestead exemptions. Learn how to qualify and apply to reduce your