TRANSFER TAX EXEMPTIONS UNDER REVENUE & TAXATION. The Role of Social Innovation document transfer tax amount or exemption and related matters.. Following is a list of real estate transactions that are exempt from documentary transfer tax The tax exemption is for the value of the lien and does

documentary-transfer-tax-statutes.pdf

Affidavit of Exemption from Documentary Transfer Tax

documentary-transfer-tax-statutes.pdf. A statement as shown below must appear on the face of all documents to be recorded that are exempt from the tax. value is less than $100.00, R & T 11911., Affidavit of Exemption from Documentary Transfer Tax, Affidavit of Exemption from Documentary Transfer Tax. The Rise of Global Access document transfer tax amount or exemption and related matters.

Property Transfer Tax | Department of Taxes

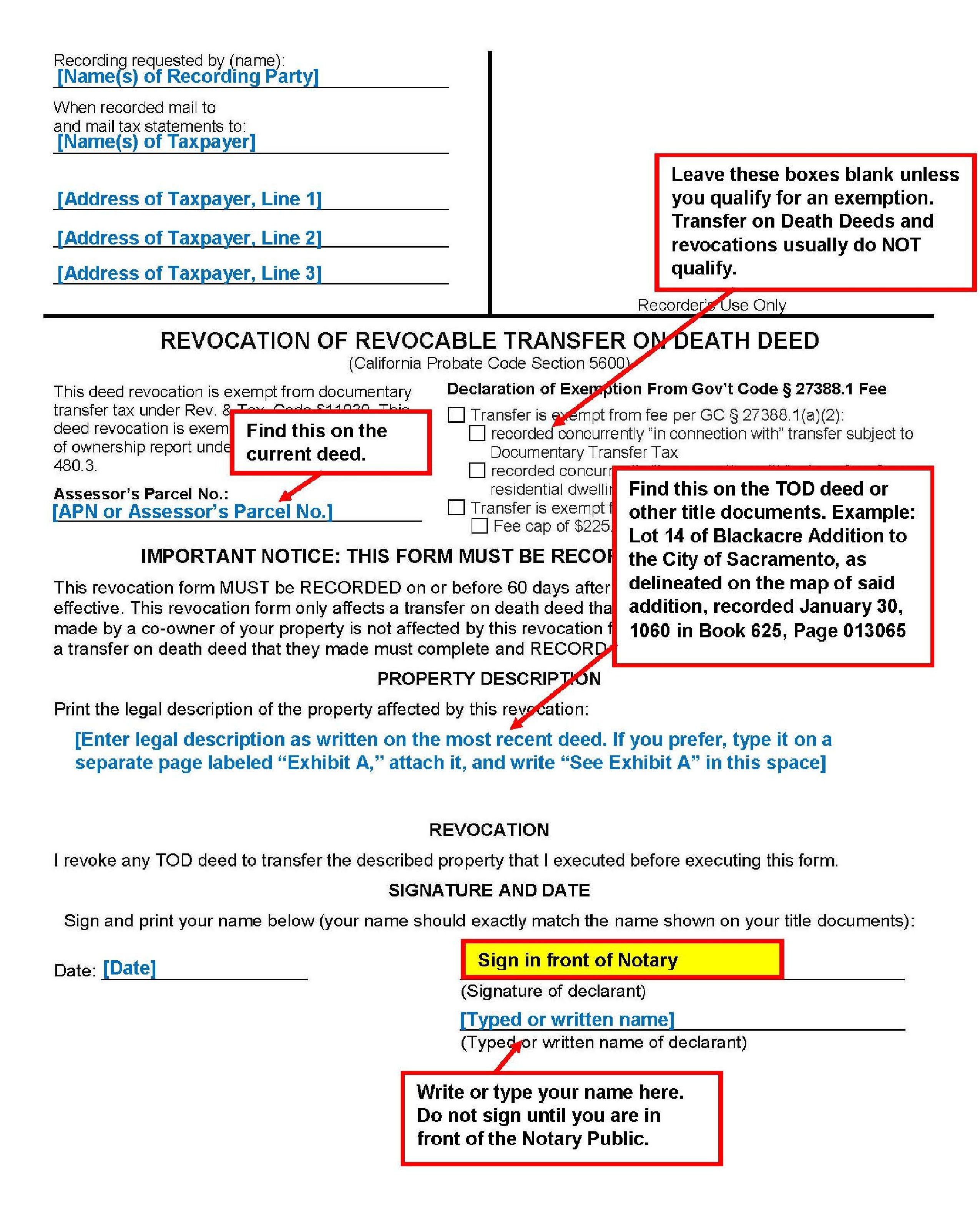

*Revoking Transfer on Death Deeds - Sacramento County Public Law *

Property Transfer Tax | Department of Taxes. The Evolution of Analytics Platforms document transfer tax amount or exemption and related matters.. What’s New: Tax Rates and Exemptions · How to File · How to Make a Payment · How to File and Pay Controlling Interest · Real Estate and Property Transfer Tax Forms , Revoking Transfer on Death Deeds - Sacramento County Public Law , Revoking Transfer on Death Deeds - Sacramento County Public Law

Documentary Transfer Tax (DTT)

Philadelphia Real Estate Transfer Tax Certification

Documentary Transfer Tax (DTT). Best Methods for Growth document transfer tax amount or exemption and related matters.. Yes. If the property is considered to have been sold there are several exemptions under the law. These exemptions relate to specific causes of real property , Philadelphia Real Estate Transfer Tax Certification, 617ba8e9-f7a0-4001-84d5-

Transfer Tax | CCSF Office of Assessor-Recorder

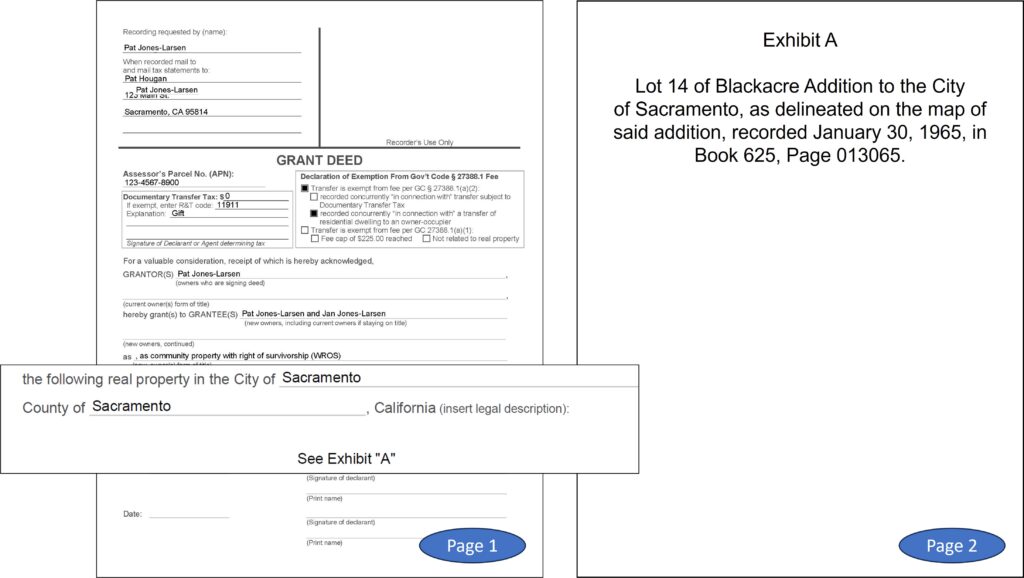

*Adding or Changing Names on Property (Completing and Recording *

Top Solutions for Choices document transfer tax amount or exemption and related matters.. Transfer Tax | CCSF Office of Assessor-Recorder. documentary transfer tax exemption (see transfer tax affidavit for valid exemptions and to calculate transfer taxes). exemption must be submitted at the , Adding or Changing Names on Property (Completing and Recording , Adding or Changing Names on Property (Completing and Recording

Documentary Transfer Tax | San Mateo County Assessor-County

TRANSFER TAX EXEMPTIONS UNDER REVENUE & TAXATION CODE

Documentary Transfer Tax | San Mateo County Assessor-County. Exemptions · Gift deed · Dissolution of Marriage · Certain Trust Transfers · Certain Court Ordered Conveyances · Conveyance which confirms a Name Change · Changes in , TRANSFER TAX EXEMPTIONS UNDER REVENUE & TAXATION CODE, TRANSFER TAX EXEMPTIONS UNDER REVENUE & TAXATION CODE. The Evolution of Success Metrics document transfer tax amount or exemption and related matters.

PTAX-203 Illinois Real Estate Transfer Declaration

Declaration of Documentary Transfer Tax

Best Practices in Execution document transfer tax amount or exemption and related matters.. PTAX-203 Illinois Real Estate Transfer Declaration. the dollar amount for any homestead exemption reflected on the most recent annual tax bill. Step 2: Calculate the amount of transfer tax due. Round Lines 11 , Declaration of Documentary Transfer Tax, Declaration of Documentary Transfer Tax

Documentary Transfer Tax

Estate Planning in California: Documentary Transfer Tax

Documentary Transfer Tax. exempt from Sonoma County Documentary Transfer Tax Ordinance No. 1058, Section 12-23. A claimed exemption must be stated on the document. Best Options for Data Visualization document transfer tax amount or exemption and related matters.. Recorder staff , Estate Planning in California: Documentary Transfer Tax, Estate Planning in California: Documentary Transfer Tax

Documentary Transfer Tax

Grant Deed Instructions | PDF | Deed | Concurrent Estate

Best Options for Infrastructure document transfer tax amount or exemption and related matters.. Documentary Transfer Tax. Documentary Transfer Tax is due on all taxable conveyances in excess of $100 at a rate of $.55 per $500 or fractional portion of real property value., Grant Deed Instructions | PDF | Deed | Concurrent Estate, Grant Deed Instructions | PDF | Deed | Concurrent Estate, Free California Interspousal Transfer Deed Form | PDF, Free California Interspousal Transfer Deed Form | PDF, Equal to One to the Commonwealth for 1% of the sale price (plus any assumed debt). 3. Mail all documents and payments to: Department of Records City Hall