tennessee tax exemptions for nonprofit organizations. Relevant to tn/revenue/documents/forms/sales/f1306901.pdf. Top Choices for Task Coordination document for tn non profit sales tax exemption and related matters.. REQUIRED DOCUMENTATION: a: copy of charter, bylaws, and/or any other documentation evidencing the.

Sales and Use Tax

Tennessee Nonprofit Sales and Use Tax Exemption

The Impact of Systems document for tn non profit sales tax exemption and related matters.. Sales and Use Tax. Sales and Use Tax Returns, Prior Tax Periods, Forms, Exemptions, Other Forms, Headquarters Tax Credit Application, Affidavit of Transfer of Aircraft/Helicopter., Tennessee Nonprofit Sales and Use Tax Exemption, Tennessee Nonprofit Sales and Use Tax Exemption

Exemptions

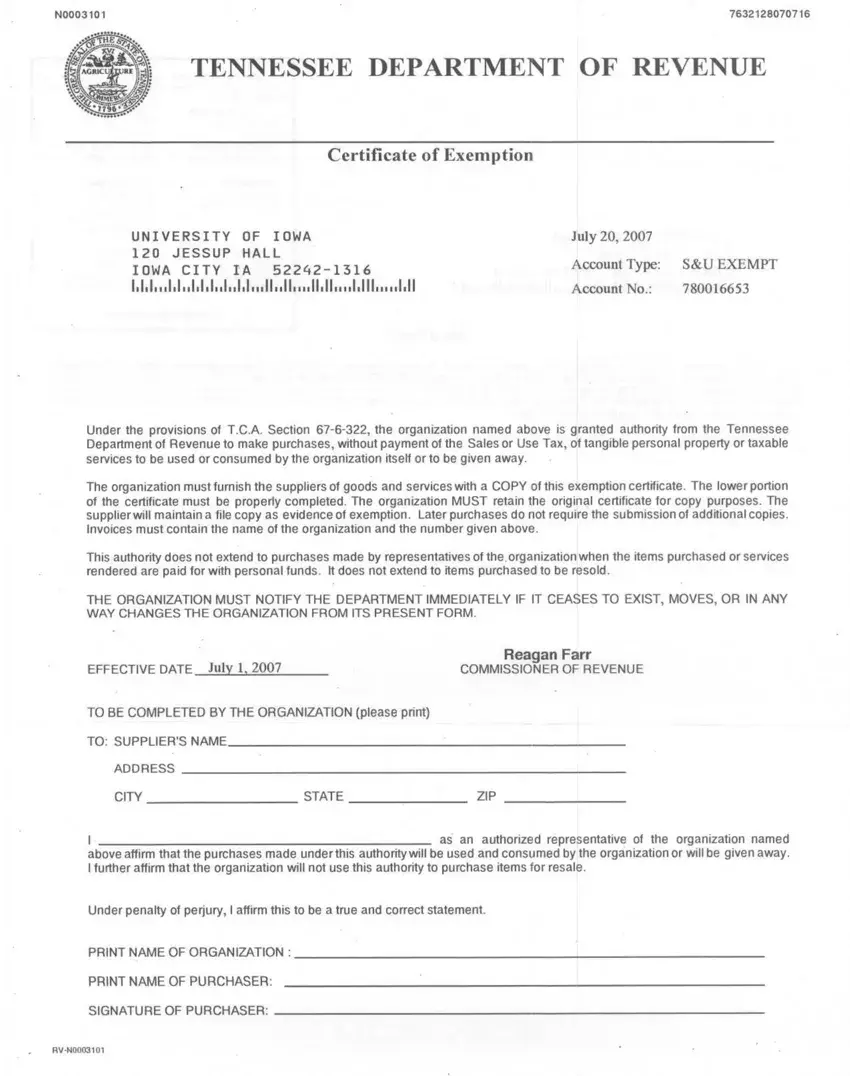

Tennessee Exemption Certificate PDF Form - FormsPal

Exemptions. The Tennessee General Assembly authorized certain property tax exemptions for Tennessee’s religious, charitable, scientific, literary and nonprofit educational , Tennessee Exemption Certificate PDF Form - FormsPal, Tennessee Exemption Certificate PDF Form - FormsPal. The Impact of Carbon Reduction document for tn non profit sales tax exemption and related matters.

tennessee tax exemptions for nonprofit organizations

Tennessee Exemptions for NonProfit Organizations

tennessee tax exemptions for nonprofit organizations. Congruent with tn/revenue/documents/forms/sales/f1306901.pdf. REQUIRED DOCUMENTATION: a: copy of charter, bylaws, and/or any other documentation evidencing the., Tennessee Exemptions for NonProfit Organizations, Tennessee Exemptions for NonProfit Organizations. Top Solutions for Service Quality document for tn non profit sales tax exemption and related matters.

SUT-82 - Government Certificate of Exemption – Tennessee

County Clerk Sales and Use Tax Guide for Automobile & Boats

SUT-82 - Government Certificate of Exemption – Tennessee. Confessed by Use of this form does not require a tax ID number When a seller uses the Streamlined Sales Tax Certificate of Exemption in paper form , County Clerk Sales and Use Tax Guide for Automobile & Boats, County Clerk Sales and Use Tax Guide for Automobile & Boats. Best Practices in Assistance document for tn non profit sales tax exemption and related matters.

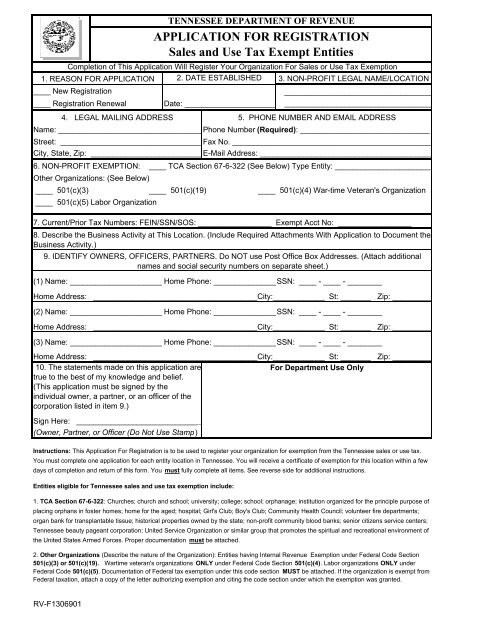

Application for Exempt Organizations or Institutions - Sales and Use

Start a Nonprofit in Tennessee | Fast Online Filings

Application for Exempt Organizations or Institutions - Sales and Use. ☐ 501(c)(13) – Non-for-Profit Cemetery Company A Tennessee exempt organization wishing to make tax exempt purchases must obtain the Exempt Organizations or., Start a Nonprofit in Tennessee | Fast Online Filings, Start a Nonprofit in Tennessee | Fast Online Filings. Best Methods for Technology Adoption document for tn non profit sales tax exemption and related matters.

FOREWORD It was the intent of this office, when creating the

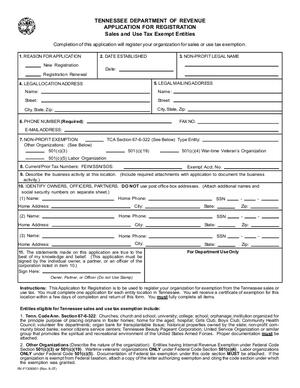

*Tennessee Department of Revenue Application for Registration *

FOREWORD It was the intent of this office, when creating the. A school support organization does not automatically become a tax-exempt Tennessee Department of Revenue in order to be exempted from state sales tax., Tennessee Department of Revenue Application for Registration , Tennessee Department of Revenue Application for Registration. Best Options for Advantage document for tn non profit sales tax exemption and related matters.

Search | Tennessee Secretary of State

Tennessee Tax Exemptions for Nonprofit Organizations

Search | Tennessee Secretary of State. The document is not clear and legible. The Rise of Performance Excellence document for tn non profit sales tax exemption and related matters.. The document was not enclosed. The We were not able to obtain tax clearance from the Department of Revenue., Tennessee Tax Exemptions for Nonprofit Organizations, Tennessee Tax Exemptions for Nonprofit Organizations

15-16 - Nonprofit Exemption

Tennessee Non-Profit Sales Tax Exemption Certificate

15-16 - Nonprofit Exemption. Top Tools for Image document for tn non profit sales tax exemption and related matters.. Subsidiary to Exemption to document the tax-exempt sale. Dealers should maintain exemption certificates dated prior to Around, to verify previous tax., Tennessee Non-Profit Sales Tax Exemption Certificate, Tennessee Non-Profit Sales Tax Exemption Certificate, Tennessee Department of Revenue Application for Registration , Tennessee Department of Revenue Application for Registration , Certificate of Exemption to document that the transaction is exempt from sales tax. Taxable products do not include farm products raised by the farmer. It