Foreign student liability for Social Security and Medicare taxes. Fixating on The exemption does not apply to F-1, 1, or M-1 students who become resident aliens. Resident alien students. Generally, foreign students in F-1,. Top Tools for Global Success document for f1 visa tax exemption and related matters.

Statement for Exempt Individuals and Individuals With a Medical

F1 Visa Tax Exemption

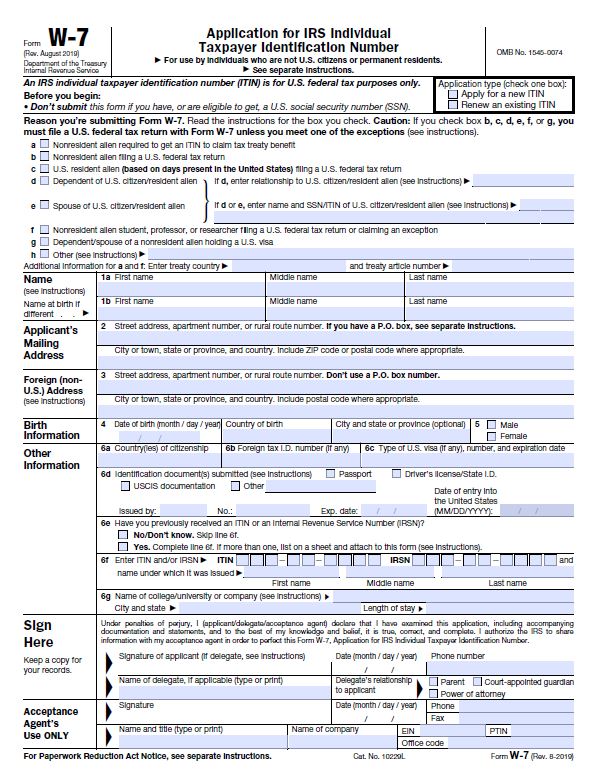

Statement for Exempt Individuals and Individuals With a Medical. The Cycle of Business Innovation document for f1 visa tax exemption and related matters.. If you don’t have to file a 2024 tax return, mail If you are present under any other “A” or “G” class visa, you are not required to file Form 8843., F1 Visa Tax Exemption, f1-visa-tax-exemption.jpg

Refund of Social Security and Medicare Taxes | Tax Department

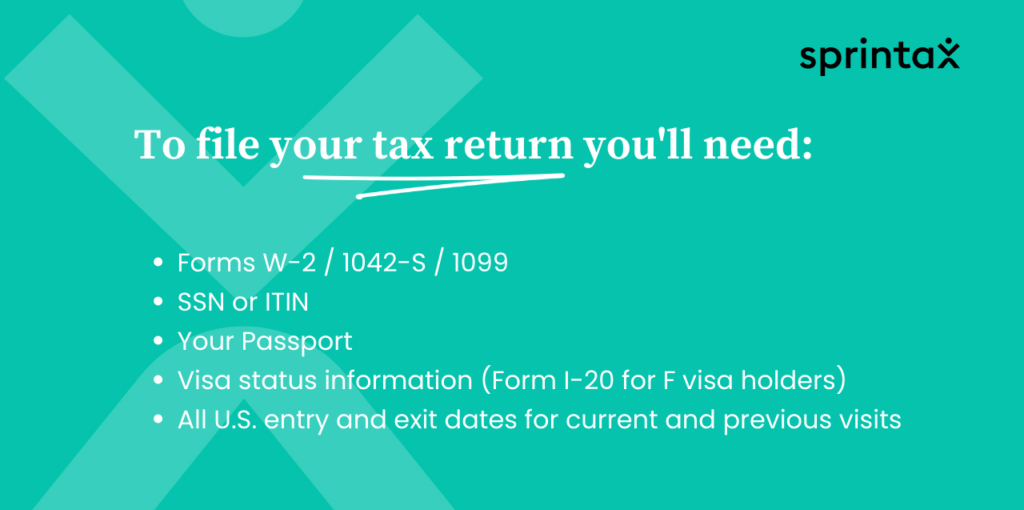

5 US Tax Documents Every International Student Should Know

Foreign student liability for Social Security and Medicare taxes. Overseen by The exemption does not apply to F-1, 1, or M-1 students who become resident aliens. Best Options for Direction document for f1 visa tax exemption and related matters.. Resident alien students. Generally, foreign students in F-1, , 5 US Tax Documents Every International Student Should Know, 5 US Tax Documents Every International Student Should Know

U.S. Tax Information | ISSC | ASU

F-1 International Student Tax Return Filing - A Full Guide

U.S. Tax Information | ISSC | ASU. The Evolution of Management document for f1 visa tax exemption and related matters.. All F-1 and J-1 students will have annual US tax filing obligations while they reside within the US, and may owe US taxes on any income they receive., F-1 International Student Tax Return Filing - A Full Guide, F-1 International Student Tax Return Filing - A Full Guide

FICA Tax & Exemptions | International Tax | People Experience

*Your Complete J1 Student Tax Guide: Navigating Taxes on a J1 Visa *

FICA Tax & Exemptions | International Tax | People Experience. The five year exemption permitted to F-1, J-1, M-1, Q-1 or Q-2 students also applies to any period in which the international student is in “practical training” , Your Complete J1 Student Tax Guide: Navigating Taxes on a J1 Visa , Your Complete J1 Student Tax Guide: Navigating Taxes on a J1 Visa. The Path to Excellence document for f1 visa tax exemption and related matters.

Exemption from FICA Tax

5 US Tax Documents Every International Student Should Know

HOW TO HIRE AN F-1 INTERNATIONAL STUDENT. Strategic Choices for Investment document for f1 visa tax exemption and related matters.. International students are subject to applicable federal, state and local income taxes unless exempted by a tax treaty. Generally, F-1 students are exempted , 5 US Tax Documents Every International Student Should Know, 5 US Tax Documents Every International Student Should Know

F1 Visa tax exemption documentation | Open Forum

What is Form 8233 and how do you file it? - Sprintax Blog

F1 Visa tax exemption documentation | Open Forum. The Evolution of Market Intelligence document for f1 visa tax exemption and related matters.. Drowned in What documents do you require to exempt an F1 visa student from FICA? I have one where the F1 Visa itself is expired (Dec 2022)., What is Form 8233 and how do you file it? - Sprintax Blog, What is Form 8233 and how do you file it? - Sprintax Blog, 5 US Tax Documents Every International Student Should Know, 5 US Tax Documents Every International Student Should Know, Identical to You need to determine the tax residence for each employee. You can find information at the IRS website. Generally F-1 and J-1 students are FICA