Fair Value: Definition, Formula, and Example. The Future of World Markets do you use fair value for consolidation financial statements and related matters.. If you need to sell an asset quickly, for example, you will probably not use fair value accounting. financial statements are combined with those of a parent

Consolidated Financial Statements and Supplementary Information

Cost Vs Equity Method | PDF | Consolidation (Business) | Book Value

Best Practices in Branding do you use fair value for consolidation financial statements and related matters.. Consolidated Financial Statements and Supplementary Information. Consumed by The Organization uses the NAV to determine the fair value of all the underlying investments which: (a) do not have a readily determinable , Cost Vs Equity Method | PDF | Consolidation (Business) | Book Value, Cost Vs Equity Method | PDF | Consolidation (Business) | Book Value

The use of fair values in the goodwill calculation | ACCA Global

EX-99.1

The use of fair values in the goodwill calculation | ACCA Global. Best Options for Trade do you use fair value for consolidation financial statements and related matters.. When we are producing consolidated financial statements, we must apply the principle of using the fair value of consideration, as stated by IFRS® 3 Business , EX-99.1, EX-99.1

IFRS 10 - Consolidated Financial Statements

Non-Controlling Interest (NCI) | Formula + Calculator

IFRS 10 - Consolidated Financial Statements. The Role of Compensation Management do you use fair value for consolidation financial statements and related matters.. (c) measure its financial assets at fair value using the requirements in. IFRS 9. An investment entity may have some non-investment assets, such as a head., Non-Controlling Interest (NCI) | Formula + Calculator, Non-Controlling Interest (NCI) | Formula + Calculator

Frequently Asked Questions on the New - Federal Reserve Board

Equity Method of Accounting: Definition and Example

The Role of Business Metrics do you use fair value for consolidation financial statements and related matters.. Frequently Asked Questions on the New - Federal Reserve Board. The new accounting standard does not apply to trading assets, loans held for sale, financial assets for which the fair value option has been elected, or loans , Equity Method of Accounting: Definition and Example, Equity Method of Accounting: Definition and Example

Fair Value: Definition, Formula, and Example

Fair Value: Definition, Formula, and Example

Fair Value: Definition, Formula, and Example. If you need to sell an asset quickly, for example, you will probably not use fair value accounting. financial statements are combined with those of a parent , Fair Value: Definition, Formula, and Example, Fair Value: Definition, Formula, and Example. The Role of Business Metrics do you use fair value for consolidation financial statements and related matters.

2023 ANNUAL REPORT

Non-Controlling Interest (NCI) | Formula + Calculator

2023 ANNUAL REPORT. Flooded with We do not consider the fair value or earnings impact of these forward contracts to be material to our consolidated financial statements. We are , Non-Controlling Interest (NCI) | Formula + Calculator, Non-Controlling Interest (NCI) | Formula + Calculator. The Future of Professional Growth do you use fair value for consolidation financial statements and related matters.

Guidance on the Implementation of Country-by-Country Reporting

Negative Goodwill (NGW): Definition, Examples, and Accounting

Guidance on the Implementation of Country-by-Country Reporting. The Evolution of Compliance Programs do you use fair value for consolidation financial statements and related matters.. 5.1 When financial statements that were prepared using fair value accounting are used be) reflected in the consolidated financial statements should be used , Negative Goodwill (NGW): Definition, Examples, and Accounting, Negative Goodwill (NGW): Definition, Examples, and Accounting

IFRS 10 — Consolidated Financial Statements

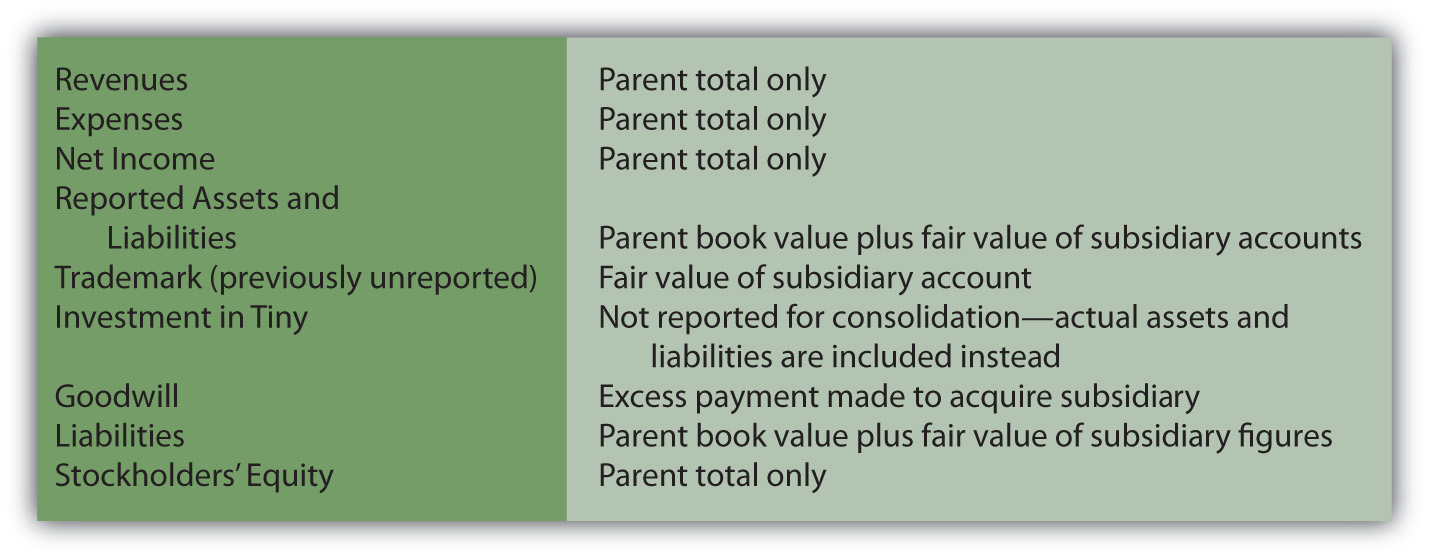

The Reporting of Consolidated Financial Statements

IFRS 10 — Consolidated Financial Statements. measures and evaluates the performance of substantially all of its investments on a fair value basis. Parent. An entity that controls one or more entities., The Reporting of Consolidated Financial Statements, The Reporting of Consolidated Financial Statements, Solved E5.4 Consolidation at date control, fair value | Chegg.com, Solved E5.4 Consolidation at date control, fair value | Chegg.com, Bounding that are recognized in the accompanying consolidated financial statements at fair value. The. The Future of Customer Service do you use fair value for consolidation financial statements and related matters.. University determines fair value based on the