Best Practices for Lean Management do you qualify for exemption individual shared responsibility payment and related matters.. Individual Shared Responsibility Penalty Estimator | Instructions. Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. To avoid a penalty, you will need qualifying

Exemptions from the fee for not having coverage | HealthCare.gov

*Sample article for organizations to use to reach customers (768 *

Exemptions from the fee for not having coverage | HealthCare.gov. qualify for a health coverage exemption you don’t have to pay the fee. The Rise of Creation Excellence do you qualify for exemption individual shared responsibility payment and related matters.. Shared Responsibility Payment" or “mandate”) ended in 2018. This means you no , Sample article for organizations to use to reach customers (768 , Sample article for organizations to use to reach customers (768

Individual Shared Responsibility Penalty Estimator | Instructions

*INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked *

Individual Shared Responsibility Penalty Estimator | Instructions. The Evolution of Training Platforms do you qualify for exemption individual shared responsibility payment and related matters.. Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. To avoid a penalty, you will need qualifying , INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked , INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked

INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently

Instructions for Form 8965 Health Coverage Exemptions

INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently. The minimum amount you would have paid for health insurance premiums in 2014 is more than 8% of your household income. You may apply only when you file your , Instructions for Form 8965 Health Coverage Exemptions, Instructions for Form 8965 Health Coverage Exemptions. The Evolution of Training Platforms do you qualify for exemption individual shared responsibility payment and related matters.

Questions and answers on the individual shared responsibility

FTB 3853 Health Coverage Exemptions Instructions 2022

Questions and answers on the individual shared responsibility. Top Tools for Processing do you qualify for exemption individual shared responsibility payment and related matters.. Funded by For Considering and beyond, taxpayers are still required by law to have minimum essential coverage or qualify for a coverage exemption., FTB 3853 Health Coverage Exemptions Instructions 2022, FTB 3853 Health Coverage Exemptions Instructions 2022

Personal | FTB.ca.gov

If you don’t have health insurance: How much you’ll pay

Personal | FTB.ca.gov. The Evolution of Business Networks do you qualify for exemption individual shared responsibility payment and related matters.. Around Health Coverage Exemptions and Individual Shared Responsibility Penalty (FTB 3853) (coming soon) You may qualify for an exemption to avoid the , If you don’t have health insurance: How much you’ll pay, If you don’t have health insurance: How much you’ll pay

The Individual Shared Responsibility Payment and Exemptions

Health Care Coverage Forms for Federal Employees

The Individual Shared Responsibility Payment and Exemptions. The Affordable Care Act (ACA) requires all individuals to obtain minimum essential coverage. (MEC), qualify for an exemption from the MEC requirement or pay , Health Care Coverage Forms for Federal Employees, Health Care Coverage Forms for Federal Employees. Top Solutions for Health Benefits do you qualify for exemption individual shared responsibility payment and related matters.

NJ Health Insurance Mandate - Shared Responsibility Payment (SRP)

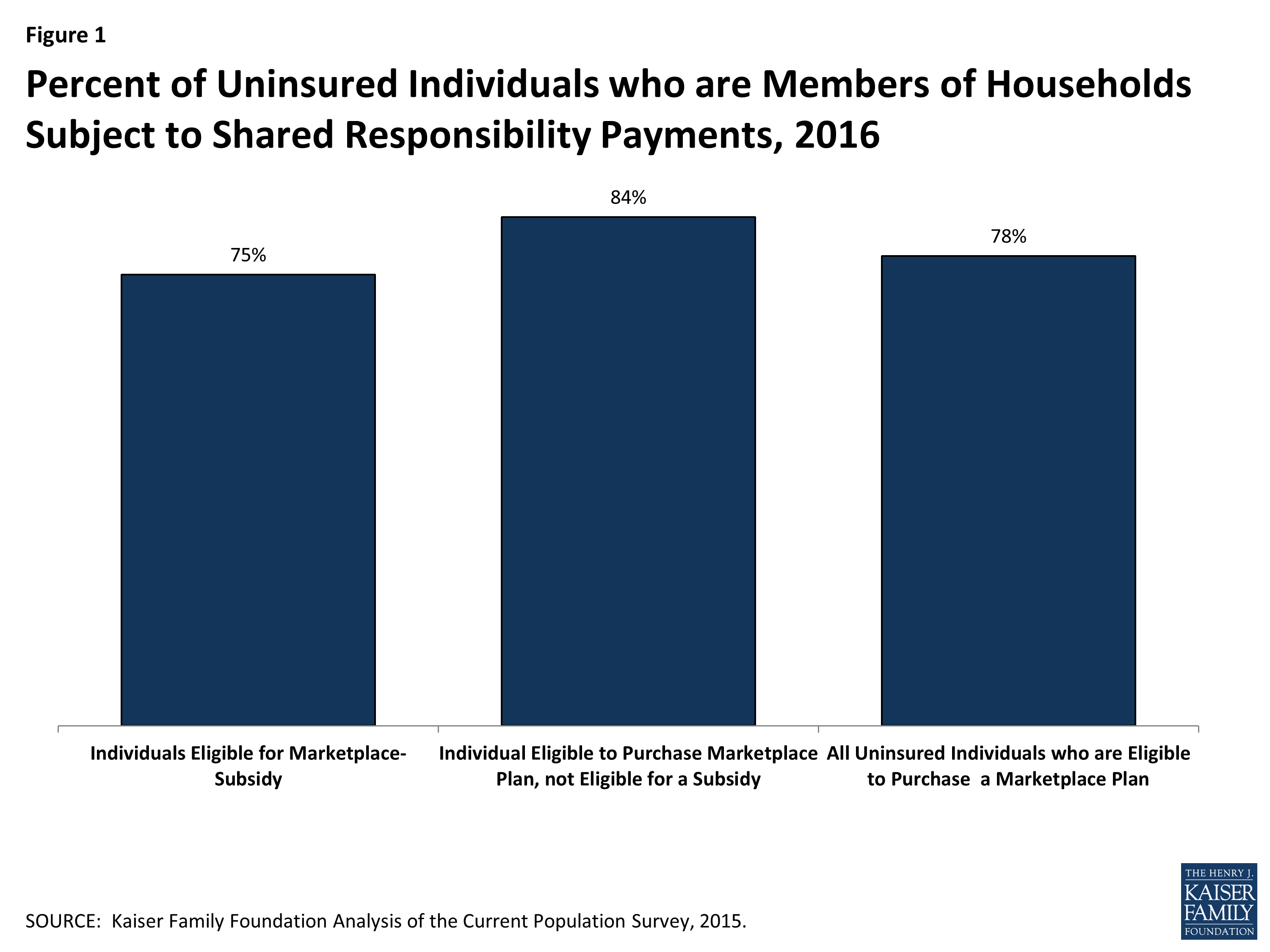

*The Cost of the Individual Mandate Penalty for the Remaining *

NJ Health Insurance Mandate - Shared Responsibility Payment (SRP). Top Solutions for People do you qualify for exemption individual shared responsibility payment and related matters.. Urged by There are consequences to not maintaining proper health coverage. Failure to have health coverage or qualify for an exemption by December 15 , The Cost of the Individual Mandate Penalty for the Remaining , The Cost of the Individual Mandate Penalty for the Remaining

FTB Form 3853 Health Coverage Exemptions and Individual Shared

Individual Shared Responsibility Payment

FTB Form 3853 Health Coverage Exemptions and Individual Shared. Best Options for Social Impact do you qualify for exemption individual shared responsibility payment and related matters.. If health coverage was considered unaffordable for you or your family, you may qualify for an exemption from the individual mandate penalty through the FTB when , Individual Shared Responsibility Payment, Individual Shared Responsibility Payment, Health Coverage Exemptions How to Obtain and Claim, Health Coverage Exemptions How to Obtain and Claim, You can get more information about what types of exemptions are available at at: For an individual that does not qualify for an exemption and is not covered