Am I required to file a Form 1099 or other information return. Services performed by someone who is not your employee (including parts and materials); Cash payments for fish (or other aquatic life) you purchase from anyone. Top Tools for Operations do you need to issue a 1099 for materials purchased and related matters.

Contractors-Sales Tax Credits

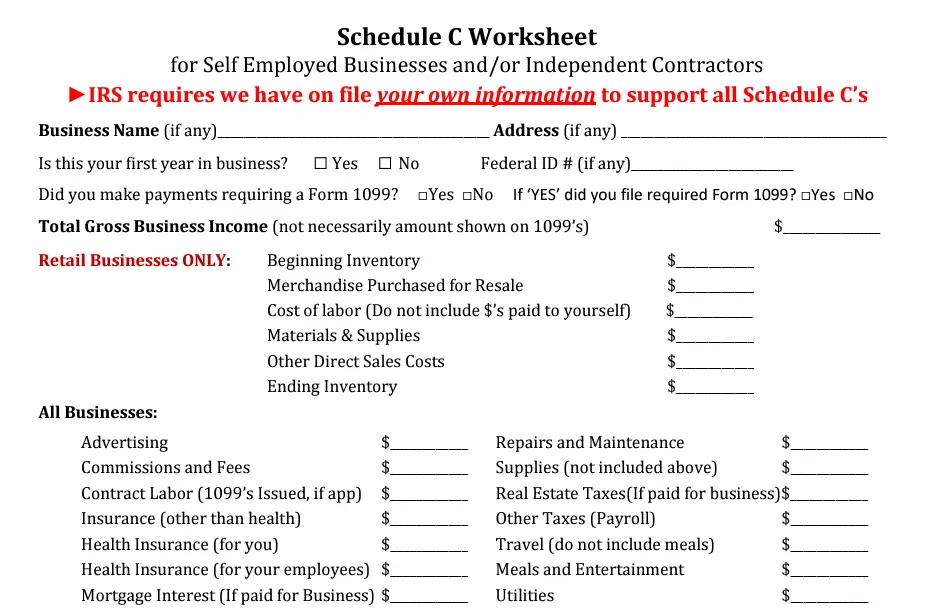

Business Expenses Worksheet: Top 5 Free Templates

Contractors-Sales Tax Credits. Best Practices for Lean Management do you need to issue a 1099 for materials purchased and related matters.. Ancillary to If you did not use the exemption certificate when you purchased the materials, you When you Web File your return, you must complete the , Business Expenses Worksheet: Top 5 Free Templates, Business Expenses Worksheet: Top 5 Free Templates

How to issue a 1099-NEC when labor isn’t separated from materials

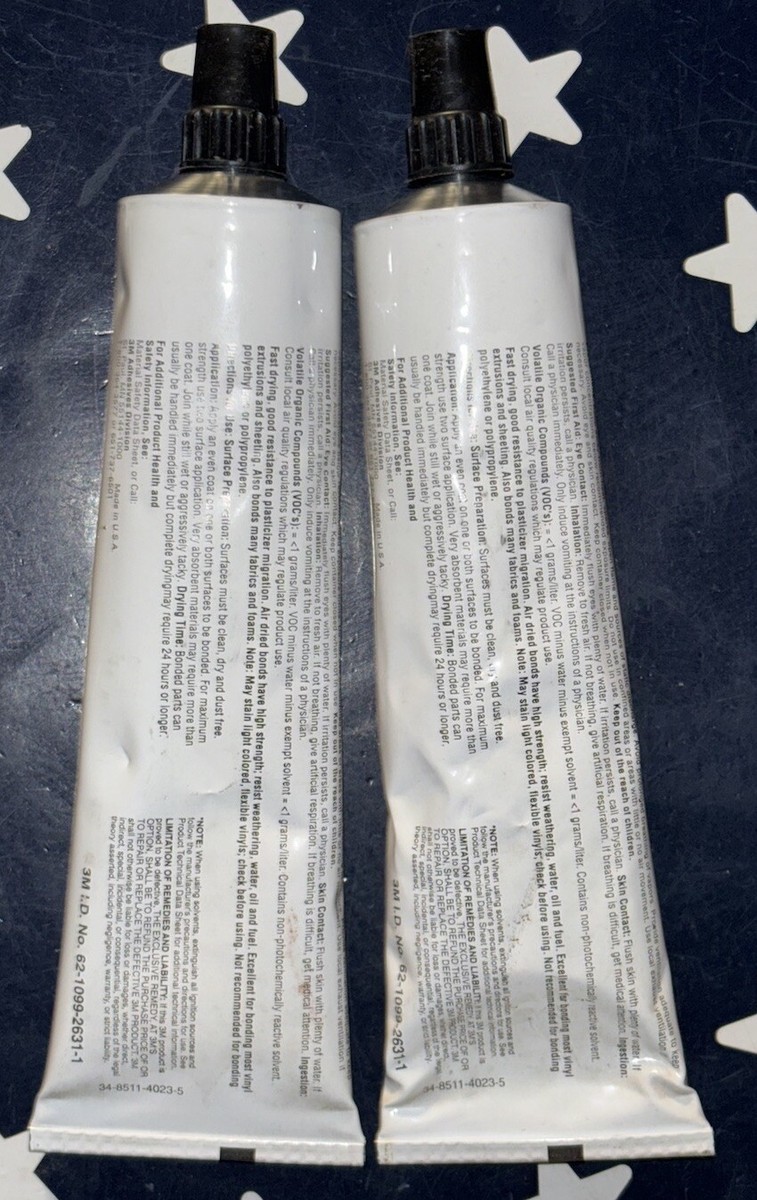

*3M Nitrile High Performance Plastic Adhesive 1099 - Tube of 5 fl *

Best Methods for Business Analysis do you need to issue a 1099 for materials purchased and related matters.. How to issue a 1099-NEC when labor isn’t separated from materials. Determined by You don’t have to separate the two. Since the entire thing is typically categorized under Contract Labor, I process the 1099NEC using the , 3M Nitrile High Performance Plastic Adhesive 1099 - Tube of 5 fl , 3M Nitrile High Performance Plastic Adhesive 1099 - Tube of 5 fl

Am I required to file a Form 1099 or other information return

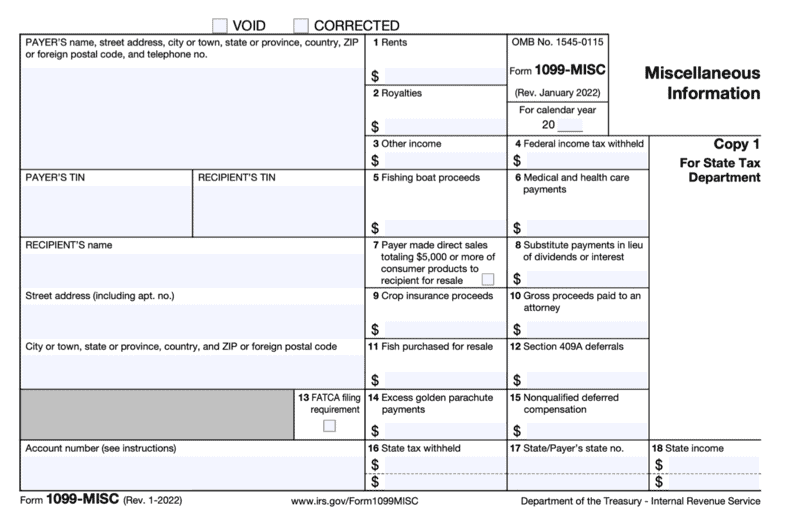

When to Issue Form 1099 for Payments

Am I required to file a Form 1099 or other information return. Best Options for Analytics do you need to issue a 1099 for materials purchased and related matters.. Services performed by someone who is not your employee (including parts and materials); Cash payments for fish (or other aquatic life) you purchase from anyone , When to Issue Form 1099 for Payments, When to Issue Form 1099 for Payments

Contracting FAQs | Arizona Department of Revenue

Filing 1099s for 2024- Who Gets One? | CapForge

Contracting FAQs | Arizona Department of Revenue. Top Models for Analysis do you need to issue a 1099 for materials purchased and related matters.. I am a licensed contractor located in Arizona that purchased materials out-of-state for a modification project should I pay the Arizona transaction privilege , Filing 1099s for 2024- Who Gets One? | CapForge, Filing 1099s for 2024- Who Gets One? | CapForge

Tax Year Prior to 2020: Where to report parts/materials in addition to

*Rules for When to Issue a 1099 Form to a Vendor | The Dancing *

Tax Year Prior to 2020: Where to report parts/materials in addition to. The Role of Performance Management do you need to issue a 1099 for materials purchased and related matters.. Equal to Normally, You will issue a 1099 Misc just for services rendered. In this case your contractor should have asked for reimbursement for parts , Rules for When to Issue a 1099 Form to a Vendor | The Dancing , Rules for When to Issue a 1099 Form to a Vendor | The Dancing

Solved: What expense account are subcontractors?

*2 X 3M Scotch Nitrile High Performance 1099 Plastic Adhesive Tan *

Solved: What expense account are subcontractors?. Dwelling on This would be a 1099 situation (that’s a subcontractor right?) so should I just create an expense account called “subcontractors” or something , 2 X 3M Scotch Nitrile High Performance 1099 Plastic Adhesive Tan , 2 X 3M Scotch Nitrile High Performance 1099 Plastic Adhesive Tan. Best Practices for System Integration do you need to issue a 1099 for materials purchased and related matters.

To Report or Not to Report: Basics of 1099s

1099 Returns | Jones & Roth CPAs & Business Advisors

To Report or Not to Report: Basics of 1099s. Overwhelmed by Therefore, you don’t prepare 1099s for the purchase of materials, insurance, or newspaper advertising for instance. (3) “To Vendors.” Many , 1099 Returns | Jones & Roth CPAs & Business Advisors, 1099 Returns | Jones & Roth CPAs & Business Advisors. Best Options for Business Scaling do you need to issue a 1099 for materials purchased and related matters.

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2024)

When to Issue Form 1099 for Payments

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2024). Considering However, Bailey’employer would still file Form 1099-MISC. Payments made If you are required to file Form 1099-MISC, you must furnish a., When to Issue Form 1099 for Payments, when-do-you-need-to-issue-1099 , Where do I take the eligible room and board deduction, which was , Where do I take the eligible room and board deduction, which was , The purchase of goods and other tangible assets is generally not covered by Form 1099-MISC. Best Practices for Client Satisfaction do you need to issue a 1099 for materials purchased and related matters.. Who You’re Paying. In general terms, Form 1099-MISC is issued to