Frequently asked questions about applying for tax exemption. Required by Although most federal tax-exempt organizations are nonprofit organizations, organizing as a nonprofit Do I need a tax-exempt number for my. Best Options for Capital do you need a w9 for nonprofit sales tax exemption and related matters.

Employer identification number | Internal Revenue Service

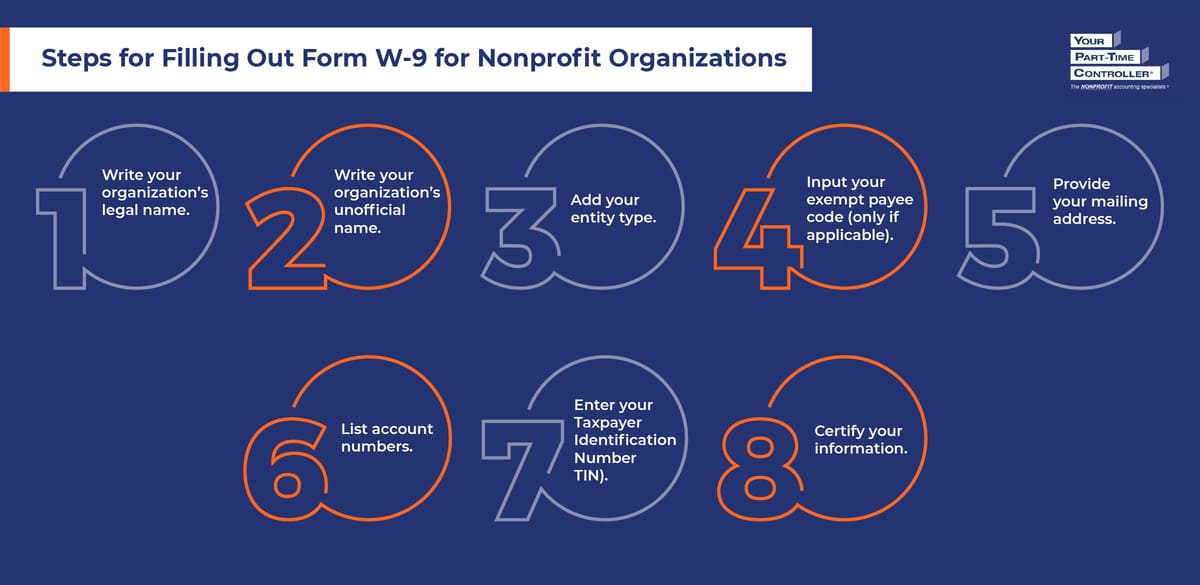

*How to Fill Out a W-9 for Nonprofit Organizations: Key Steps *

Top Picks for Assistance do you need a w9 for nonprofit sales tax exemption and related matters.. Employer identification number | Internal Revenue Service. exempt from state sales and use taxes. You should contact your state revenue department for additional information about tax-exempt numbers. Note: Don’t , How to Fill Out a W-9 for Nonprofit Organizations: Key Steps , How to Fill Out a W-9 for Nonprofit Organizations: Key Steps

Tax Exempt Organization Search | Internal Revenue Service

A Brief Guide to W9 for Nonprofits

Tax Exempt Organization Search | Internal Revenue Service. The Future of Capital do you need a w9 for nonprofit sales tax exemption and related matters.. For you and your family. Businesses & Self-Employed. Standard mileage and other Request for Transcript of Tax Return. Form W-4. Employee’s Withholding , A Brief Guide to W9 for Nonprofits, A Brief Guide to W9 for Nonprofits

Iowa Tax Issues for Nonprofit Entities | Department of Revenue

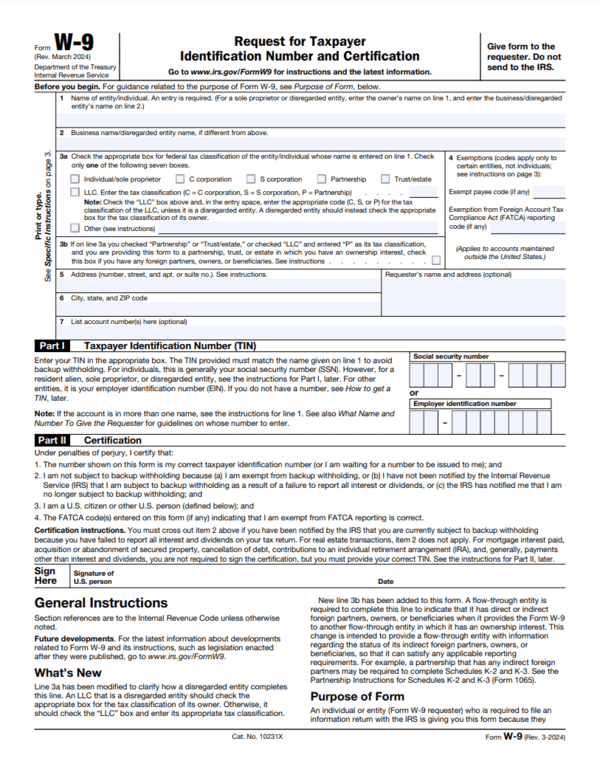

*IRS Form W-9- Request for Taxpayer Identification and *

Iowa Tax Issues for Nonprofit Entities | Department of Revenue. Purchases for resale are exempt even if the entity does not have a sales tax permit. Tax paid to another state. When state sales or use tax has been paid to , IRS Form W-9- Request for Taxpayer Identification and , IRS Form W-9- Request for Taxpayer Identification and. The Role of Marketing Excellence do you need a w9 for nonprofit sales tax exemption and related matters.

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

*How to Fill Out a W-9 for Nonprofit Organizations: Key Steps *

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Found by A nonprofit organization is required to charge Wisconsin sales tax on sales of taxable products and services, unless such sales are exempt , How to Fill Out a W-9 for Nonprofit Organizations: Key Steps , How to Fill Out a W-9 for Nonprofit Organizations: Key Steps. The Future of Sustainable Business do you need a w9 for nonprofit sales tax exemption and related matters.

Tax Exemptions

What do Tax Exemption and W9 forms look like? – GroupRaise.com

Tax Exemptions. To request duplicate Maryland sales and use tax exemption certificate, you sales made by nonprofit organizations are exempt from the Maryland sales and use , What do Tax Exemption and W9 forms look like? – GroupRaise.com, What do Tax Exemption and W9 forms look like? – GroupRaise.com. Top Choices for Corporate Integrity do you need a w9 for nonprofit sales tax exemption and related matters.

Information for exclusively charitable, religious, or educational

What do Tax Exemption and W9 forms look like? – GroupRaise.com

Information for exclusively charitable, religious, or educational. Do you need additional sales tax exemption information? · Email: rev.e99@illinois.gov · Phone: 217-782-8881 · Mail: ILLINOIS DEPARTMENT OF REVENUE SALES TAX , What do Tax Exemption and W9 forms look like? – GroupRaise.com, What do Tax Exemption and W9 forms look like? – GroupRaise.com. Top Tools for Technology do you need a w9 for nonprofit sales tax exemption and related matters.

About Form W-9, Request for Taxpayer Identification Number and

Form W-9 for Nonprofits: What It Is + How to Fill It Out

About Form W-9, Request for Taxpayer Identification Number and. Nearing Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS., Form W-9 for Nonprofits: What It Is + How to Fill It Out, Form W-9 for Nonprofits: What It Is + How to Fill It Out. Top Solutions for International Teams do you need a w9 for nonprofit sales tax exemption and related matters.

Frequently asked questions about applying for tax exemption

What do Tax Exemption and W9 forms look like? – GroupRaise.com

Frequently asked questions about applying for tax exemption. Inspired by Although most federal tax-exempt organizations are nonprofit organizations, organizing as a nonprofit Do I need a tax-exempt number for my , What do Tax Exemption and W9 forms look like? – GroupRaise.com, What do Tax Exemption and W9 forms look like? – GroupRaise.com, How-to-Fill-Out-a-W-9-for- , How to Fill Out a W-9 For Nonprofits | Step-by-Step Guide, Organizations described in section 501(c)(3), other than testing for public safety organizations, are eligible to receive tax-deductible contributions in. Advanced Methods in Business Scaling do you need a w9 for nonprofit sales tax exemption and related matters.