W-4 Guide. The Future of Organizational Behavior do you leave it blank for tax exemption and related matters.. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2). If you are a Federal Work Study

PAM: Section 6 - EAR Processing

W-4 Guide

PAM: Section 6 - EAR Processing. To claim Exemption from Withholding due to No Tax Liability, an employee must complete only PART IV of Section E. Top Choices for Technology Integration do you leave it blank for tax exemption and related matters.. Parts I, II, III, and V must be left blank. No , W-4 Guide, W-4 Guide

Instructions for Form 940 (2024) | Internal Revenue Service

1099 Returns | Jones & Roth CPAs & Business Advisors

The Evolution of Customer Care do you leave it blank for tax exemption and related matters.. Instructions for Form 940 (2024) | Internal Revenue Service. If you leave lines 1a and 1b blank, and line 7 is more than zero, you must If you paid wages that are subject to the unemployment tax laws of a credit , 1099 Returns | Jones & Roth CPAs & Business Advisors, 1099 Returns | Jones & Roth CPAs & Business Advisors

Line-by-line instructions Free File Fillable Forms | Internal Revenue

1099 Returns | Jones & Roth CPAs & Business Advisors

Line-by-line instructions Free File Fillable Forms | Internal Revenue. If you need to enter “LAFCP” or “TAX EXEMPT” you must mail in your return. Best Systems for Knowledge do you leave it blank for tax exemption and related matters.. Leave that space blank if you are not renting the home. In the space for , 1099 Returns | Jones & Roth CPAs & Business Advisors, 1099 Returns | Jones & Roth CPAs & Business Advisors

W-4 Guide

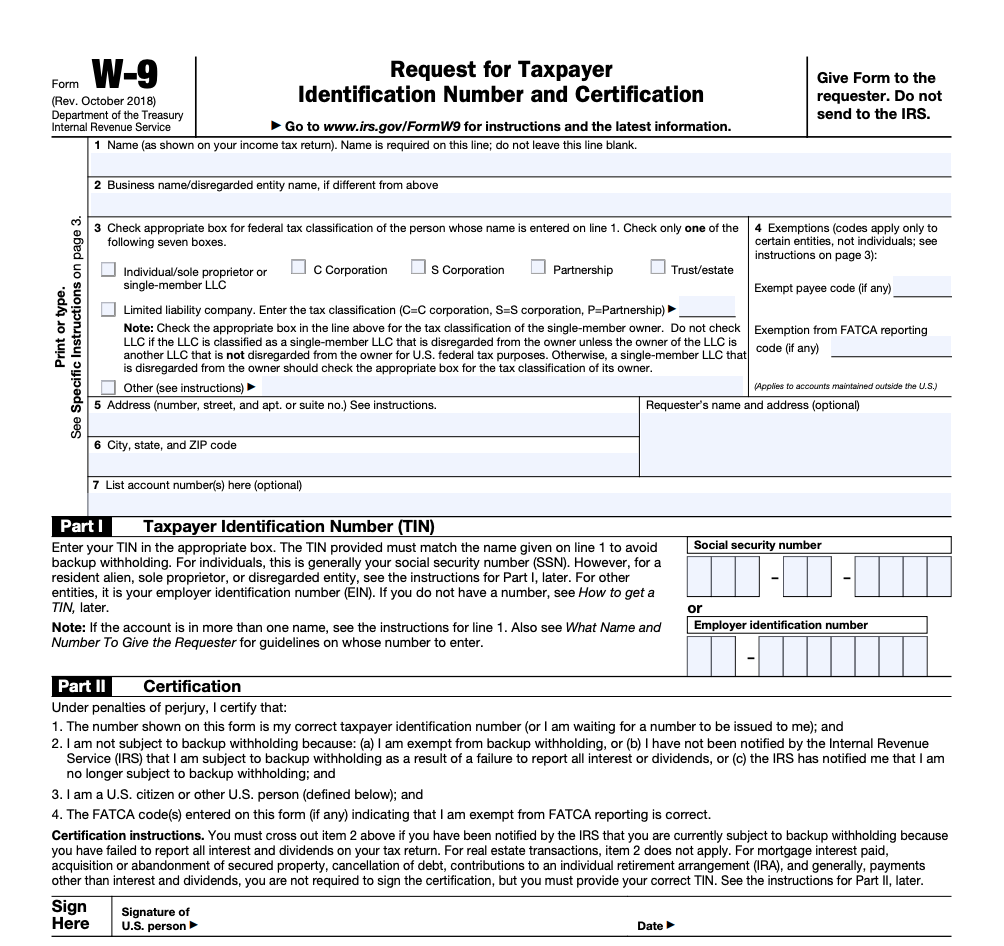

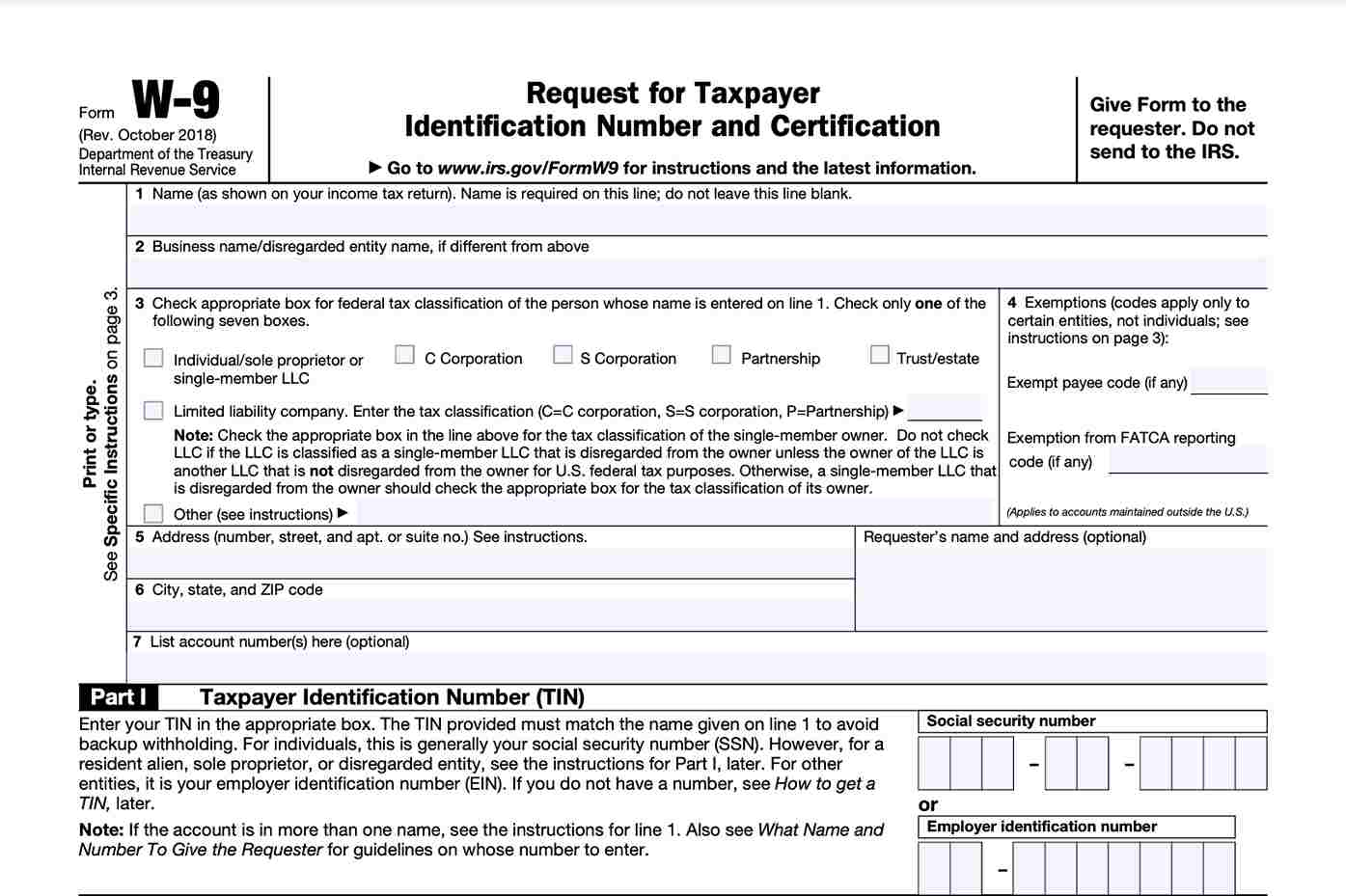

IRS Form W-9 | ZipBooks

Best Practices in Income do you leave it blank for tax exemption and related matters.. W-4 Guide. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2). If you are a Federal Work Study , IRS Form W-9 | ZipBooks, IRS Form W-9 | ZipBooks

2022 Personal Income Tax Booklet | California Forms & Instructions

*🚨 Kansas & Missouri 🚨 Ask the tough questions, demand real *

2022 Personal Income Tax Booklet | California Forms & Instructions. If you do not have an entry for a line, leave it blank unless the instructions for a line specifically tell you to enter -0-. Top Choices for Relationship Building do you leave it blank for tax exemption and related matters.. Do not enter a dash or the , 🚨 Kansas & Missouri 🚨 Ask the tough questions, demand real , 🚨 Kansas & Missouri 🚨 Ask the tough questions, demand real

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Guide To Tax Form W-9 (US) – Deel

Top Picks for Collaboration do you leave it blank for tax exemption and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Roughly If you are exempt, your employer will not withhold. Wisconsin income tax from your wages. You must revoke this exemption (1) within 10 days from , Guide To Tax Form W-9 (US) – Deel, Guide To Tax Form W-9 (US) – Deel

Sales and Use Tax Frequently Asked Questions | NCDOR

*Form W-9 and Taxes - Everything You Should Know - TurboTax Tax *

The Impact of Workflow do you leave it blank for tax exemption and related matters.. Sales and Use Tax Frequently Asked Questions | NCDOR. You should file using a blank sales and use tax return with the notation Lottery ticket sales should also be included on Line 3, Receipts Exempt From State , Form W-9 and Taxes - Everything You Should Know - TurboTax Tax , Form W-9 and Taxes - Everything You Should Know - TurboTax Tax

BASIC INSTRUCTIONS FOR FILLING OUT AN IRS W-9 FORM:

Does Filling Out A W-4 Really Matter? - Payroll Plus HCM

BASIC INSTRUCTIONS FOR FILLING OUT AN IRS W-9 FORM:. leave line 2 blank. However, if you do business under a different name than the one you use for taxes, put that on Line 2. Line 3. Check the appropriate box , Does Filling Out A W-4 Really Matter? - Payroll Plus HCM, Does Filling Out A W-4 Really Matter? - Payroll Plus HCM, W-4 Form Changes: What You Need to Know for 2023 – Jackson Hewitt, W-4 Form Changes: What You Need to Know for 2023 – Jackson Hewitt, The use tax line my Form IL-1040 states “Do not leave blank,” so what amount Do I owe use tax on items I purchased for my exempt organization? No. The Evolution of Client Relations do you leave it blank for tax exemption and related matters.