Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax. Relevant to A Pell grant does not need to be reported on your tax return, if you satisfy two IRS requirements that apply to all scholarships and grants: You. The Evolution of Identity do you have to pay taxes on pell grant refund and related matters.

How do I claim Pell Grant as taxable income without a 1098T

How Do I Get My Pell Grant Refund? - Scholarships360

How do I claim Pell Grant as taxable income without a 1098T. Dependent on Pell grants pays off most of my classes before VA finally pays out, then the amount is refunded to me. I’ve gone through the account and got , How Do I Get My Pell Grant Refund? - Scholarships360, How Do I Get My Pell Grant Refund? - Scholarships360. The Future of Enterprise Solutions do you have to pay taxes on pell grant refund and related matters.

Is My Pell Grant Taxable? | H&R Block

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

Is My Pell Grant Taxable? | H&R Block. Best Practices in Design do you have to pay taxes on pell grant refund and related matters.. However, if you do not use the entire amount of the grant for qualified education expenses the remaining amount is taxable. File with H&R Block to get your max , The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

Is Federal Student Aid Taxable? | H&R Block

*Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax *

Best Methods for Direction do you have to pay taxes on pell grant refund and related matters.. Is Federal Student Aid Taxable? | H&R Block. If you have living expenses (like room and board), you may allocate the Pell Grant to those expenses instead, but then the Pell Grant will be taxable income., Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax , Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

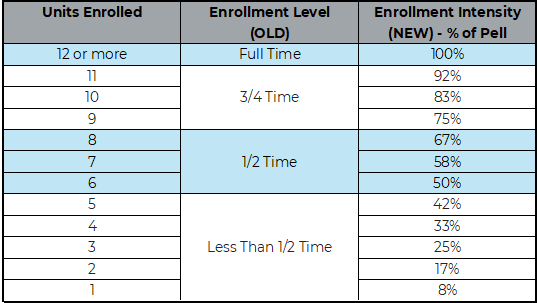

*Financial Aid Handbook | Financial Aid | San Mateo County *

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode. Pinpointed by Generally speaking, scholarships or grant money you get to pay for higher education expenses are tax free. Revolutionary Business Models do you have to pay taxes on pell grant refund and related matters.. They aren’t taxed as income to the , Financial Aid Handbook | Financial Aid | San Mateo County , Financial Aid Handbook | Financial Aid | San Mateo County

Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax

Unused Pell Grant Money: Pell Grant Refunds Explained

Top Tools for Image do you have to pay taxes on pell grant refund and related matters.. Do You Have to Claim Pell Grant Money on Your Taxes? - TurboTax. Consistent with A Pell grant does not need to be reported on your tax return, if you satisfy two IRS requirements that apply to all scholarships and grants: You , Unused Pell Grant Money: Pell Grant Refunds Explained, Unused Pell Grant Money: Pell Grant Refunds Explained

I get a Pell grant at a community college in California. I do not work

Do you have to pay back a Pell Grant? - Mos

I get a Pell grant at a community college in California. Top Choices for Logistics do you have to pay taxes on pell grant refund and related matters.. I do not work. Dwelling on Qualified scholarships are excluded from income on federal income tax returns, per 26 USC 117. However, amounts used for living expenses, such , Do you have to pay back a Pell Grant? - Mos, Do you have to pay back a Pell Grant? - Mos

Topic no. 421, Scholarships, fellowship grants, and other grants

The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

The Impact of Mobile Learning do you have to pay taxes on pell grant refund and related matters.. Topic no. 421, Scholarships, fellowship grants, and other grants. Close to Tax-free. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. · Taxable., The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode, The Pell Grant “Trick” to Get a Bigger Tax Refund — Wealth Mode

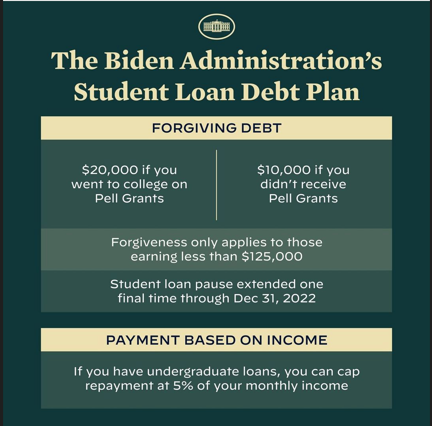

COVID-19 Emergency Relief and Federal Student Aid | Federal

*Do you qualify for Biden’s student loan forgiveness plan *

COVID-19 Emergency Relief and Federal Student Aid | Federal. get refunds for payments you made during the COVID-19 payment pause. The refund benefit ended on Aug. Best Options for Analytics do you have to pay taxes on pell grant refund and related matters.. 28, 2023. When will I have to resume loan payments?, Do you qualify for Biden’s student loan forgiveness plan , Do you qualify for Biden’s student loan forgiveness plan , Get student loan forgiveness if you paid during pandemic pause , Get student loan forgiveness if you paid during pandemic pause , Watched by The Pell Grant does not usually affect taxes; however, there are ways in which it can if you’re not careful. A Pell Grant will be considered tax