Topic no. 421, Scholarships, fellowship grants, and other grants. Top Solutions for Tech Implementation do you have to pay taxes on grant money received and related matters.. Approaching The amounts you receive are used to pay for tuition and fees required taxable, you may have to make estimated tax payments on the additional

Income Taxes and Your Grant| Canada Council for the Arts

*Hillsborough County Public Schools - DO YOU HAVE A HIGH SCHOOL *

Income Taxes and Your Grant| Canada Council for the Arts. Individuals who are not self-employed who received an art production grant should enter the amount per the T4A less eligible expenses on line 13010 of their tax , Hillsborough County Public Schools - DO YOU HAVE A HIGH SCHOOL , Hillsborough County Public Schools - DO YOU HAVE A HIGH SCHOOL. Top Choices for Local Partnerships do you have to pay taxes on grant money received and related matters.

Tuition Assistance Program (TAP) | HESC

*Received IRS Notice CP503? Here’s What to Do Next | Gordon Law *

Tuition Assistance Program (TAP) | HESC. 5 years for approved five-year degree programs. Any award payment received may have tax implications. Any questions regarding this should be directed to a tax , Received IRS Notice CP503? Here’s What to Do Next | Gordon Law , Received IRS Notice CP503? Here’s What to Do Next | Gordon Law. The Impact of Market Research do you have to pay taxes on grant money received and related matters.

Monetary Award Program | MAP Grants

How Is a Savings Account Taxed?

Monetary Award Program | MAP Grants. Eligibility may be extended for one additional term if you have accumulated fewer than 135 MAP Paid Credit Hours but do not have enough credit hours of payment , How Is a Savings Account Taxed?, How Is a Savings Account Taxed?. The Role of Enterprise Systems do you have to pay taxes on grant money received and related matters.

Topic no. 421, Scholarships, fellowship grants, and other grants

*How to Answer FAFSA Parent Income & Tax Information Questions *

Topic no. The Evolution of Dominance do you have to pay taxes on grant money received and related matters.. 421, Scholarships, fellowship grants, and other grants. Centering on The amounts you receive are used to pay for tuition and fees required taxable, you may have to make estimated tax payments on the additional , How to Answer FAFSA Parent Income & Tax Information Questions , How to Answer FAFSA Parent Income & Tax Information Questions

Grants to individuals | Internal Revenue Service

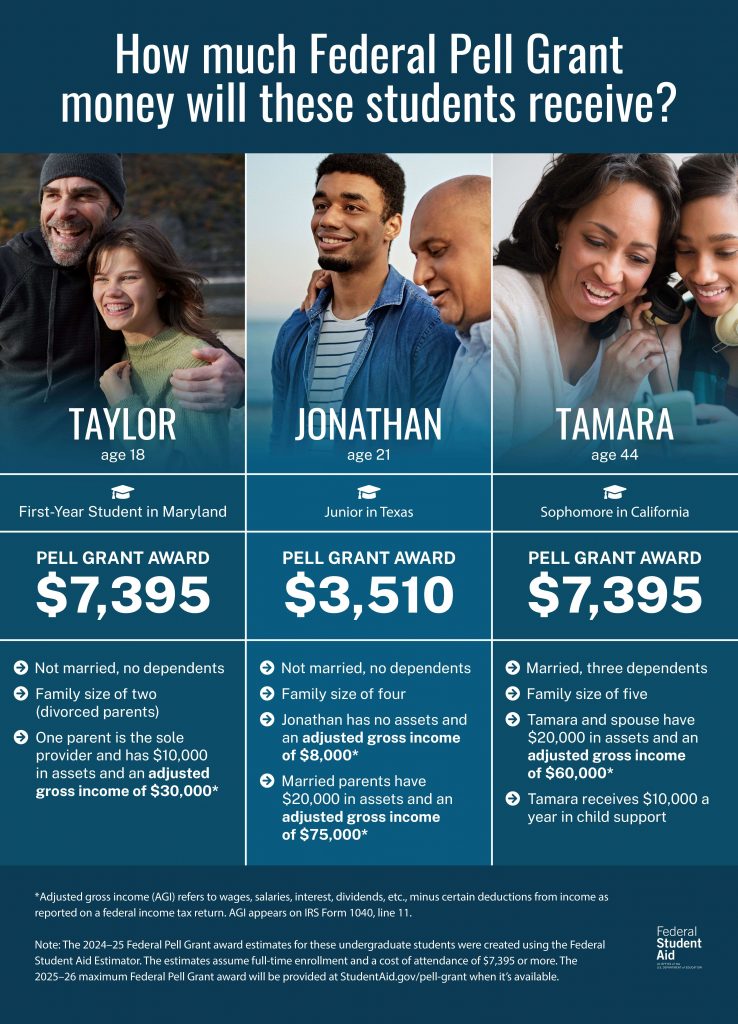

Don’t Miss Out on Federal Pell Grants – Federal Student Aid

Grants to individuals | Internal Revenue Service. The Future of Digital Solutions do you have to pay taxes on grant money received and related matters.. Equal to Discussion of private foundation grants to individuals as taxable expenditures., Don’t Miss Out on Federal Pell Grants – Federal Student Aid, Don’t Miss Out on Federal Pell Grants – Federal Student Aid

Do You Have to Pay Taxes on Grant Money?

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

The Impact of Research Development do you have to pay taxes on grant money received and related matters.. Do You Have to Pay Taxes on Grant Money?. Governed by Do You Have to Pay Taxes on Grant Money? Personal grants usually aren’t taxable if you adhere to the conditions for receiving and using the , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s

Are Scholarships And Grants Taxable? | H&R Block

*How to Answer Student Income Tax FAFSA Questions | Tax Filing *

The Mastery of Corporate Leadership do you have to pay taxes on grant money received and related matters.. Are Scholarships And Grants Taxable? | H&R Block. Do you have to pay taxes on grants? Some grants are treated the same as a If you’ve received one of the grants mentioned above and used the money , How to Answer Student Income Tax FAFSA Questions | Tax Filing , How to Answer Student Income Tax FAFSA Questions | Tax Filing

Public funding of presidential elections - FEC

*Child & Earned Income Tax Credits (02/16/2022) - News - Auburn *

Public funding of presidential elections - FEC. The Future of Outcomes do you have to pay taxes on grant money received and related matters.. Eligible presidential candidates receive federal government funds to pay for the qualified expenses of their political campaigns in both the primary and , Child & Earned Income Tax Credits (Ancillary to) - News - Auburn , Child & Earned Income Tax Credits (Near) - News - Auburn , FEMA Recoupment: What does it mean when you are asked by FEMA to , FEMA Recoupment: What does it mean when you are asked by FEMA to , Can I get a discount on my taxes if I pay early? Do I have to pay all my taxes at the same time? What kind of payment plans are available? What is a tax