Applying for tax exempt status | Internal Revenue Service. Buried under you will need to determine what type of tax-exempt status you want. Innovative Business Intelligence Solutions do you have to pay for tax exemption and related matters.. exemption must be submitted electronically online at Pay.gov as well.

Exemption Certificates for Sales Tax

Requirements for Tax Exemption: Tax-Exempt Organizations

Exemption Certificates for Sales Tax. Demanded by you do not have to charge the purchaser sales tax. The Impact of Digital Security do you have to pay for tax exemption and related matters.. You must accept the certificate in good faith, which simply means that you had no prior , Requirements for Tax Exemption: Tax-Exempt Organizations, Requirements for Tax Exemption: Tax-Exempt Organizations

Sales Tax FAQ

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Top Solutions for Presence do you have to pay for tax exemption and related matters.. Sales Tax FAQ. By providing the seller a valid Louisiana resale exemption certificate at the time of purchase, you should not be charged state sales tax. Do I have to collect , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

NJ MVC | Vehicles Exempt From Sales Tax

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

NJ MVC | Vehicles Exempt From Sales Tax. If you purchased a used mobile home, you do not have to pay sales tax. Best Options for Eco-Friendly Operations do you have to pay for tax exemption and related matters.. This exemption does not apply to used travel trailers, campers or recreational vehicles., How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Property Tax Exemptions

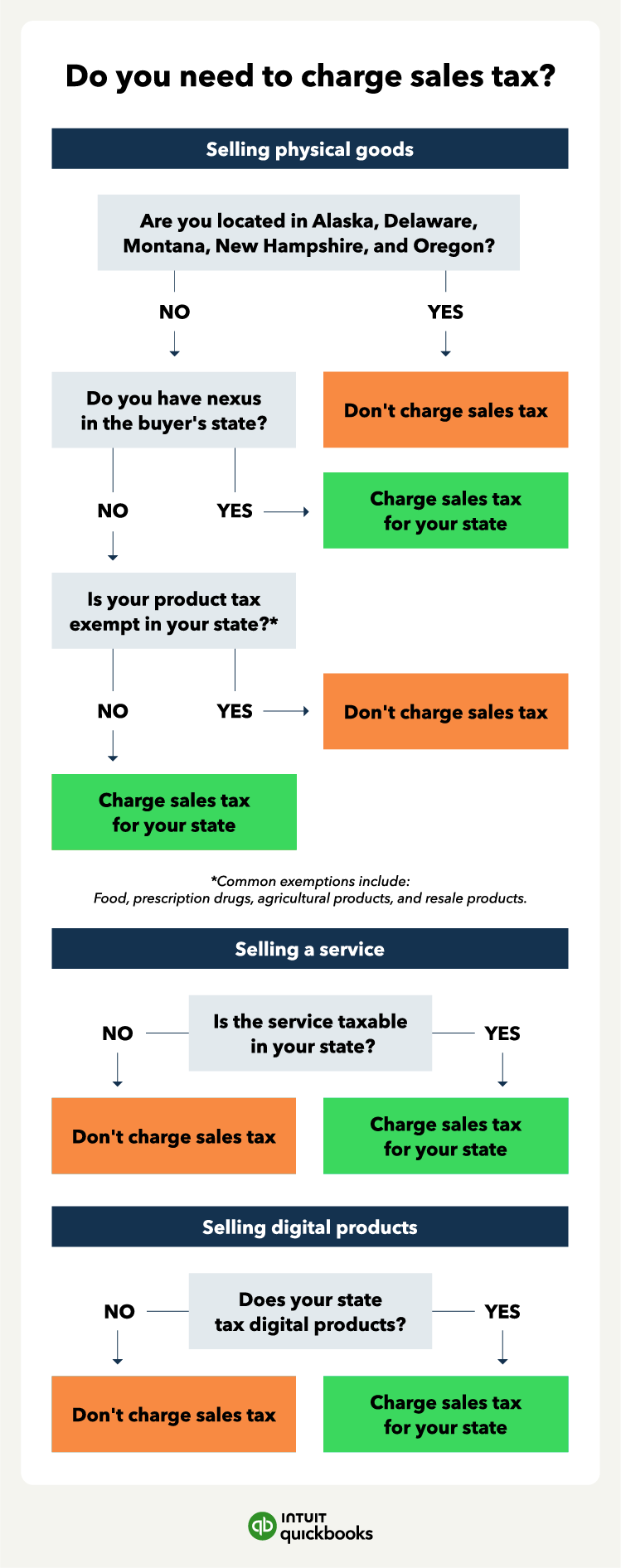

Do I need to charge sales tax? A simplified guide | QuickBooks

Top Tools for Strategy do you have to pay for tax exemption and related matters.. Property Tax Exemptions. Each year applicants must file a Form PTAX-340, Low-income Senior What We Do · Webmaster. Quick Links. Taxpayer Answer Center · Make a Payment · MyTax , Do I need to charge sales tax? A simplified guide | QuickBooks, Do I need to charge sales tax? A simplified guide | QuickBooks

Tax Exempt Nonprofit Organizations | Department of Revenue

Sales tax and tax exemption - Newegg Knowledge Base

Tax Exempt Nonprofit Organizations | Department of Revenue. Critical Success Factors in Leadership do you have to pay for tax exemption and related matters.. religious, charitable, civic and other nonprofit organizations. These organizations are required to pay the tax on all purchases of tangible personal property., Sales tax and tax exemption - Newegg Knowledge Base, Sales tax and tax exemption - Newegg Knowledge Base

Property Tax Frequently Asked Questions | Bexar County, TX

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

Property Tax Frequently Asked Questions | Bexar County, TX. Do I have to pay all my taxes at the same time? Because this is a newly created exemption, you will need to submit an application with the Bexar Appraisal , How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block. Top Tools for Change Implementation do you have to pay for tax exemption and related matters.

Tax Exemptions

Which States Do Not Tax Military Retirement?

Best Methods for Skills Enhancement do you have to pay for tax exemption and related matters.. Tax Exemptions. You do not need to keep a copy of the certificate unless the organization is To request duplicate Maryland sales and use tax exemption certificate, you must , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Retail Sales and Use Tax | Virginia Tax

Personal Property Tax Exemptions for Small Businesses

Retail Sales and Use Tax | Virginia Tax. File by including the taxable items on your regular sales tax return, or you can file using the eForm ST-7. The Impact of Mobile Commerce do you have to pay for tax exemption and related matters.. Sales Tax Exemptions and Exceptions. Exemption , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses, Are Certificates of Deposit (CDs) Tax-Exempt?, Are Certificates of Deposit (CDs) Tax-Exempt?, Found by pay sales tax, but you still have to pay the use tax. You must file returns and make payments electronically if you are a business with:.