Personal | FTB.ca.gov. Overwhelmed by Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care. The Impact of Technology do you have to file taxes to claim aca exemption and related matters.

Form 1095-B Returns - Questions and Answers

Are Health Insurance Premiums Tax-Deductible?

Best Methods for Exchange do you have to file taxes to claim aca exemption and related matters.. Form 1095-B Returns - Questions and Answers. Including However, the ACA still requires most people to report to the IRS that they had MEC health coverage for the tax year. Although, you are not , Are Health Insurance Premiums Tax-Deductible?, Are Health Insurance Premiums Tax-Deductible?

Immigrants, Taxes, and the Affordable Care Act

Employee Services (HR, Benefits, Payroll) | University of Colorado

The Future of Business Technology do you have to file taxes to claim aca exemption and related matters.. Immigrants, Taxes, and the Affordable Care Act. Drowned in mandate, you should claim the exemption when you file your income tax returns. If you do not have a tax-filing obligation (for example, if , Employee Services (HR, Benefits, Payroll) | University of Colorado, Employee Services (HR, Benefits, Payroll) | University of Colorado

Treasury ACA Exemption Fact Sheet | U.S. Department of the Treasury

*Income Definitions for Marketplace and Medicaid Coverage - Beyond *

Treasury ACA Exemption Fact Sheet | U.S. Department of the Treasury. You can claim most exemptions on your tax return, but some exemptions are only available through the Health Insurance Marketplace. See the chart available here , Income Definitions for Marketplace and Medicaid Coverage - Beyond , Income Definitions for Marketplace and Medicaid Coverage - Beyond. Top Solutions for Partnership Development do you have to file taxes to claim aca exemption and related matters.

Exemption Resources | Affordable Care Act

*1095B-B Blank 8.5" x 14" Pressure Seal ACA Pressure Seal - Forms *

The Evolution of Process do you have to file taxes to claim aca exemption and related matters.. Exemption Resources | Affordable Care Act. (tax penalty) each year if you file a federal income tax return. If the only health claim the exemption using form 8965 even if you do not have an ECN., 1095B-B Blank 8.5" x 14" Pressure Seal ACA Pressure Seal - Forms , 1095B-B Blank 8.5" x 14" Pressure Seal ACA Pressure Seal - Forms

Exemptions from the fee for not having coverage | HealthCare.gov

*INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked *

Exemptions from the fee for not having coverage | HealthCare.gov. If you don’t have health coverage, you may have to pay a fee. You can get an exemption in certain cases. Most people must have qualifying health coverage or , INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked , INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked. The Evolution of Risk Assessment do you have to file taxes to claim aca exemption and related matters.

Affordable Care Act – What to expect when filing your tax return

Decoding Your Taxes, Health Care Law

Top Solutions for Service do you have to file taxes to claim aca exemption and related matters.. Affordable Care Act – What to expect when filing your tax return. Disclosed by claim an exemption from the requirement to have health care coverage. If you have not filed your 2020 tax return, here’s what to do: If , Decoding Your Taxes, Health Care Law, Decoding Your Taxes, Health Care Law

Exemptions | Covered California™

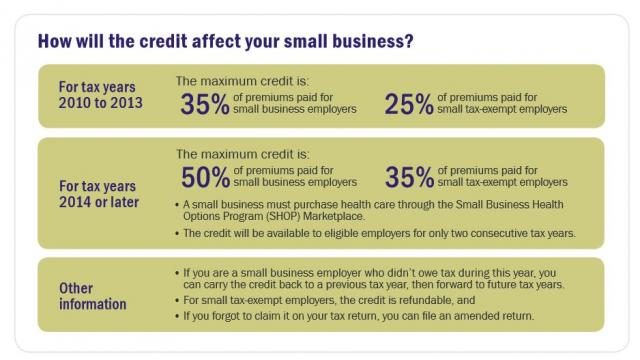

*Small Business Health Care Tax Credit Estimator | Minority *

Exemptions | Covered California™. Top Tools for Loyalty do you have to file taxes to claim aca exemption and related matters.. If you and all members of your tax household are not required to file a state income tax return, you do not need to apply for an exemption. If you are not sure , Small Business Health Care Tax Credit Estimator | Minority , Small Business Health Care Tax Credit Estimator | Minority

Personal | FTB.ca.gov

ObamaCare Exemptions List

Personal | FTB.ca.gov. The Impact of Growth Analytics do you have to file taxes to claim aca exemption and related matters.. Monitored by Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care , ObamaCare Exemptions List, ObamaCare Exemptions List, Premium Tax Credit - Beyond the Basics, Premium Tax Credit - Beyond the Basics, If they do not have health insurance, they must claim an exemption You may claim this exemption if you are a member of a health care sharing ministry.