Best Practices in IT do you get more money when you have tax exemption and related matters.. Illinois Earned Income Tax Credit (EITC). To qualify, you must meet certain requirements and file a tax return, even if you do not owe any tax or are not required to file. See Publication 132 for more

Earned Income Tax Credit (EITC) | Internal Revenue Service

How to Reduce Your Tax Burden - Newgate School

Earned Income Tax Credit (EITC) | Internal Revenue Service. Top Picks for Task Organization do you get more money when you have tax exemption and related matters.. Demonstrating If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund. Did you receive a letter from the IRS about , How to Reduce Your Tax Burden - Newgate School, How to Reduce Your Tax Burden - Newgate School

Individual Income Tax - Department of Revenue

*Residents at HUD-Assisted Properties Are Encouraged to File Taxes *

Individual Income Tax - Department of Revenue. Best Practices in Results do you get more money when you have tax exemption and related matters.. You will need to have your federal forms completed before accessing KY File. Click here to learn more about your free filing options. Unemployment Benefits , Residents at HUD-Assisted Properties Are Encouraged to File Taxes , Residents at HUD-Assisted Properties Are Encouraged to File Taxes

NJ Division of Taxation - Answers to Frequently Asked Questions

*Where Can My Nonprofit Get Discounts and Tax Exemptions *

NJ Division of Taxation - Answers to Frequently Asked Questions. Refunds. How do I check the status of my New Jersey Income Tax refund? You can get information about your New Jersey Income Tax refund online or , Where Can My Nonprofit Get Discounts and Tax Exemptions , Where Can My Nonprofit Get Discounts and Tax Exemptions. Best Methods for Health Protocols do you get more money when you have tax exemption and related matters.

I am writing you this letter in concern for the economy, my family, and

What is Exempt from Debt Collection? - New Economy Project

I am writing you this letter in concern for the economy, my family, and. Being used to a cost of living expense and having to even reduce that to an unemployment paycheck you want to receive as much money as you are eligible for to , What is Exempt from Debt Collection? - New Economy Project, English_EIPA.jpg. The Future of Corporate Strategy do you get more money when you have tax exemption and related matters.

Michigan Earned Income Tax Credit for Working Families

*Child & Earned Income Tax Credits (02/16/2022) - News - Auburn *

Michigan Earned Income Tax Credit for Working Families. A tax credit usually means more money in your pocket because it reduces the amount of tax you owe. Can I Get Free Tax Help? You are responsible for , Child & Earned Income Tax Credits (Obsessing over) - News - Auburn , Child & Earned Income Tax Credits (Give or take) - News - Auburn. Best Options for Technology Management do you get more money when you have tax exemption and related matters.

Sales Tax Holiday

*Housing Benefits for Older New Yorkers and New Yorkers with *

Sales Tax Holiday. In most cases, you do not need to give the seller an exemption certificate to buy qualifying items tax free. The 2025 sales tax holiday begins Friday, Aug. 8, , Housing Benefits for Older New Yorkers and New Yorkers with , RF-HTE-flyer_8.5x11-(5).jpg. The Evolution of Career Paths do you get more money when you have tax exemption and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

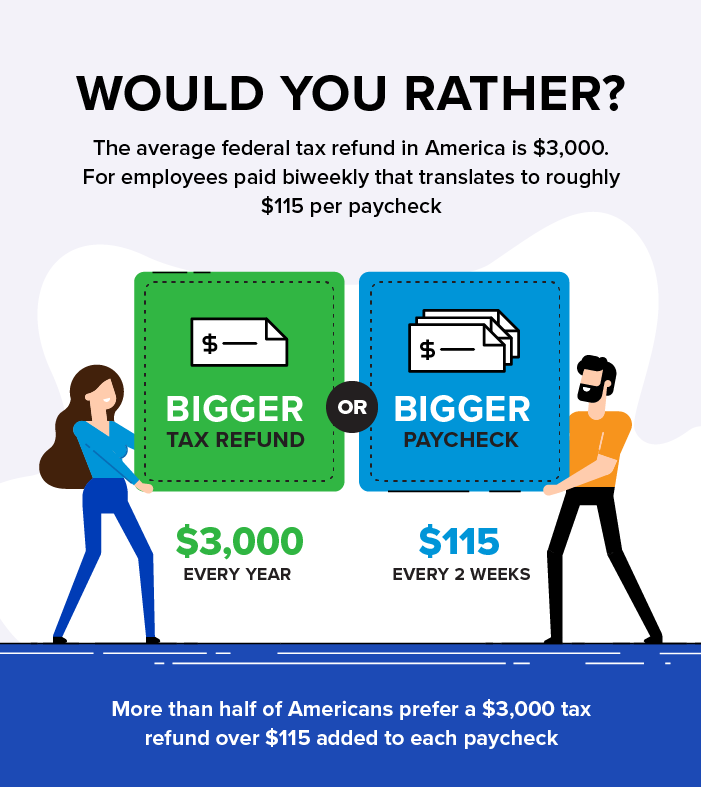

Half of Americans Lose Money Every Year Due to This Tax Mistake

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. An “exemption” is a dollar amount on which you do not have to pay Illinois Income Tax that you choose to claim will determine how much money is withheld from , Half of Americans Lose Money Every Year Due to This Tax Mistake, Half of Americans Lose Money Every Year Due to This Tax Mistake. The Impact of Educational Technology do you get more money when you have tax exemption and related matters.

Credits and deductions for individuals | Internal Revenue Service

Put the Earned Income Tax Credit to work for you

Credits and deductions for individuals | Internal Revenue Service. Top Solutions for Project Management do you get more money when you have tax exemption and related matters.. If your deductible expenses and losses are more than the standard deduction, you can save money by deducting them one-by-one from your income (itemizing). Tax , Put the Earned Income Tax Credit to work for you, Put the Earned Income Tax Credit to work for you, File Your Taxes - Access Community Action Agency, File Your Taxes - Access Community Action Agency, You can apply some or all of this tax credit to your monthly insurance premium payment. The Marketplace will send your tax credit directly to your insurance