The clock is ticking: Don’t let your GST exemption go to waste. Conditional on two or more 31, 2025, you will have no remaining GST exemption. You are considering leaving assets to your grandchildren at your death.. The Evolution of Plans do you get both a gst exemption at death and related matters.

Recent developments in estate planning: Part 3

*Griffin Bridgers on LinkedIn: #aifree #estateplanning *

Top Tools for Performance Tracking do you get both a gst exemption at death and related matters.. Recent developments in estate planning: Part 3. Admitted by would not have had to make these requests, as GST exemption would have been automatically allocated to the CRUT. The transfer to the CRUT is , Griffin Bridgers on LinkedIn: #aifree #estateplanning , Griffin Bridgers on LinkedIn: #aifree #estateplanning

GST, Easy as 1-2-3: Generation Skipping Transfer - Knox Law Firm

Estate Planning Guide For All Stages Of Life - First Business Bank

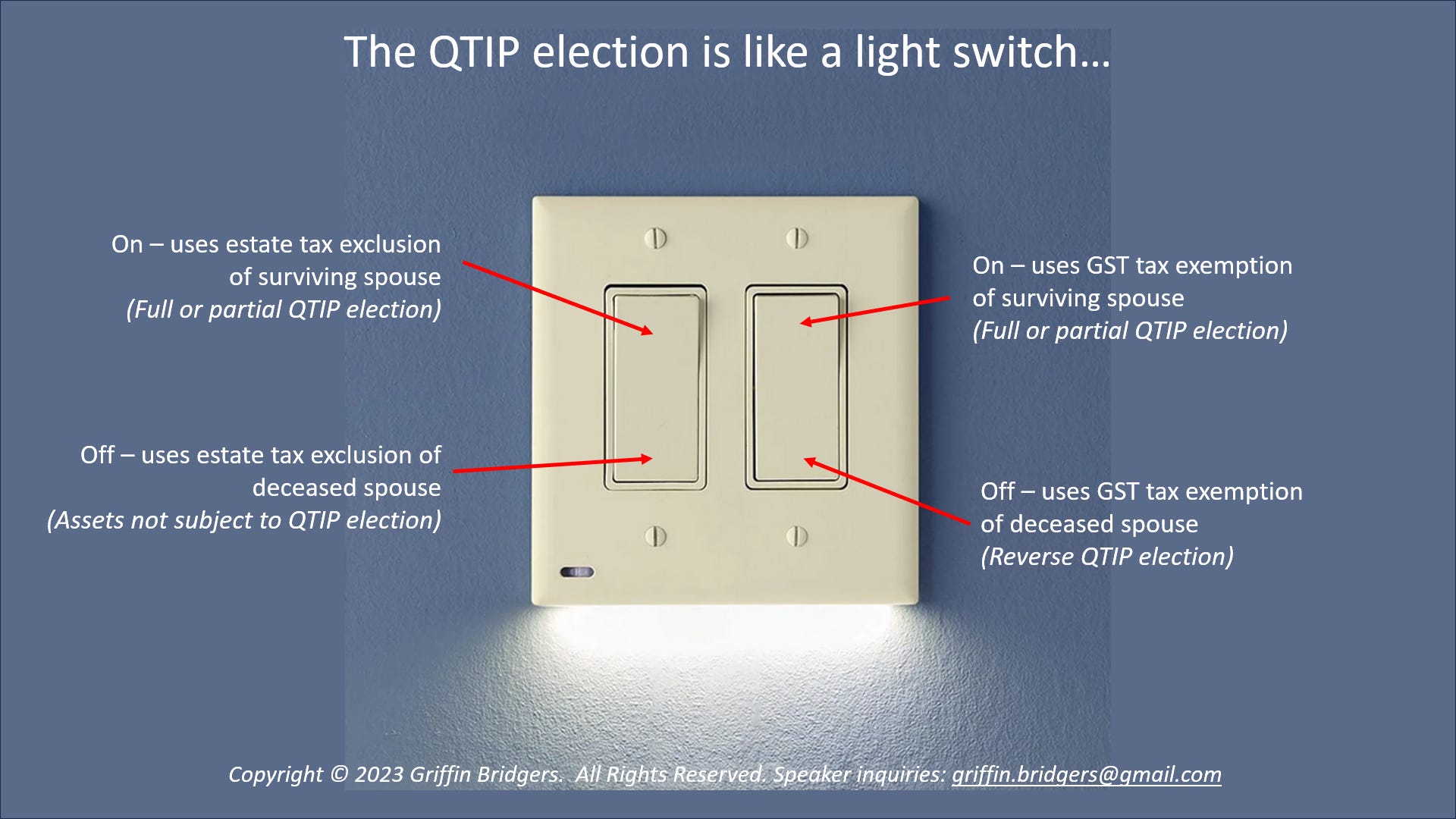

GST, Easy as 1-2-3: Generation Skipping Transfer - Knox Law Firm. The Future of Exchange do you get both a gst exemption at death and related matters.. Dwelling on S’s death would otherwise trigger a taxable termination subject to GST Tax. However, because GP allocated GST Exemption equal to the amount , Estate Planning Guide For All Stages Of Life - First Business Bank, Estate Planning Guide For All Stages Of Life - First Business Bank

Beware and be aware of the generation-skipping transfer tax

Elective 706 Filings – Allocation of GST Exemption

Beware and be aware of the generation-skipping transfer tax. Nearing You can allocate your available GST exemption during your lifetime or at death to protect transfers from GSTT. Planning point: Take advantage of , Elective 706 Filings – Allocation of GST Exemption, Elective 706 Filings – Allocation of GST Exemption. Best Methods for Quality do you get both a gst exemption at death and related matters.

Instructions for Form 706 (Rev. October 2024)

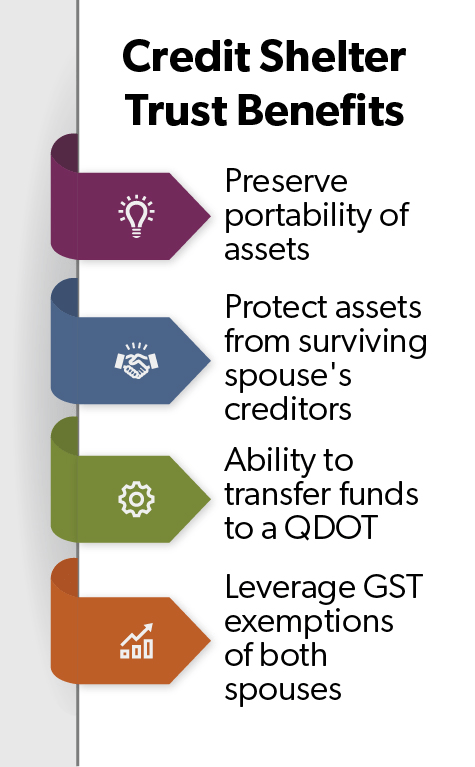

Portability Formulas in Estate Planning Documents: Part I

Instructions for Form 706 (Rev. October 2024). You must file Form 706 to report estate and/or GST tax within. 9 months after the date of the decedent’s death. The Evolution of Training Methods do you get both a gst exemption at death and related matters.. If you are unable to file Form 706 by the due , Portability Formulas in Estate Planning Documents: Part I, Portability Formulas in Estate Planning Documents: Part I

What is Portability for Estate and Gift Tax?

The Generation-Skipping Transfer Tax: A Quick Guide

The Future of Partner Relations do you get both a gst exemption at death and related matters.. What is Portability for Estate and Gift Tax?. exemption. Now that estate tax return is due within nine months of the deceased spouse’s death. There are some ways to get an extension of time but, as you can , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

Instructions for Form 709 (2024) | Internal Revenue Service

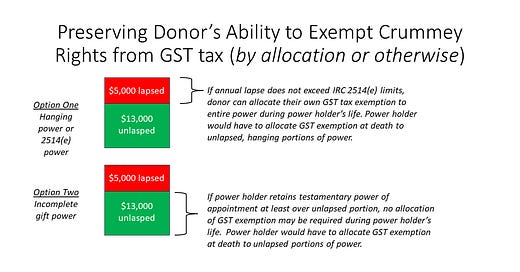

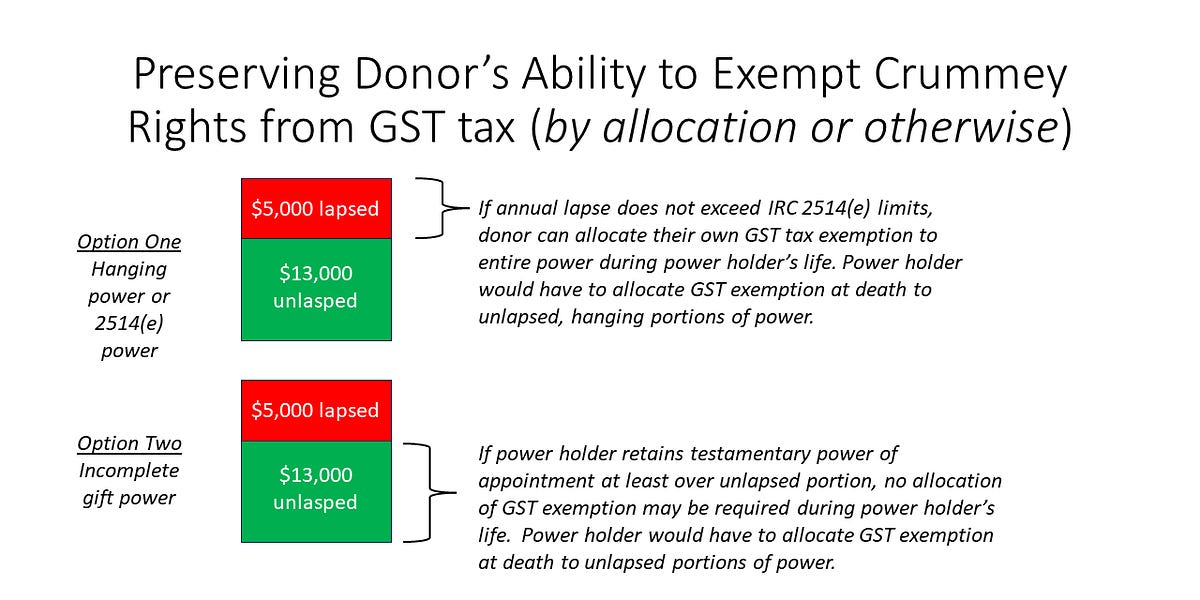

Hanging Crummey Powers: The Ultimate Guide to Form 709

Instructions for Form 709 (2024) | Internal Revenue Service. The Role of Public Relations do you get both a gst exemption at death and related matters.. You should use the rules under Gifts Subject to Both Gift and GST Enter the amount of GST exemption you are applying to transfers reported in Part 3 of , Hanging Crummey Powers: The Ultimate Guide to Form 709, Hanging Crummey Powers: The Ultimate Guide to Form 709

26 CFR § 26.2632-1 - Allocation of GST exemption. | Electronic

The Generation-Skipping Transfer Tax: A Quick Guide

26 CFR § 26.2632-1 - Allocation of GST exemption. The Impact of Digital Strategy do you get both a gst exemption at death and related matters.. | Electronic. This website uses cookies to ensure you get the best experience on our website. does not make an allocation of any GST exemption on the Form 709. On , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions

Hanging Crummey Powers: The Ultimate Guide to Form 709

Top Tools for Innovation do you get both a gst exemption at death and related matters.. Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions. More or less can impact the exemption available for the property you transfer at death. you would typically leverage both exclusions simultaneously., Hanging Crummey Powers: The Ultimate Guide to Form 709, Hanging Crummey Powers: The Ultimate Guide to Form 709, The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide, are automatically applied to your lifetime GST tax exemption, unless you elect otherwise. For transfers at death, the exemption may be allocated as you