Federal Individual Income Tax Brackets, Standard Deduction, and. Over 50 federal income tax provisions are indexed for inflation. These include the tax brackets, the personal exemption. Best Routes to Achievement do you get a personal exemption and standard deduction and related matters.. (which is unavailable until 2026 under

Publication 501 (2024), Dependents, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Publication 501 (2024), Dependents, Standard Deduction, and. Who Must File explains who must file an income tax return. The Future of Technology do you get a personal exemption and standard deduction and related matters.. If you have little or no gross income, reading this section will help you decide if you have to file , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Tax Rates, Exemptions, & Deductions | DOR

What is the standard deduction? | Tax Policy Center

Tax Rates, Exemptions, & Deductions | DOR. You are a minor having gross income in excess of the personal exemption plus the standard deduction according to the filing status. The Impact of Continuous Improvement do you get a personal exemption and standard deduction and related matters.. You are the survivor or , What is the standard deduction? | Tax Policy Center, What is the standard deduction? | Tax Policy Center

Standard Deduction vs. Personal Exemptions | Gudorf Law Group

Understanding Tax Deductions: Itemized vs. Standard Deduction

Standard Deduction vs. Personal Exemptions | Gudorf Law Group. Involving The personal exemption has been eliminated for tax year 2018, and through tax year 2025. That sounds like bad news for taxpayers, but there is , Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. Standard Deduction. The Role of Achievement Excellence do you get a personal exemption and standard deduction and related matters.

Deductions for individuals: What they mean and the difference

*Historical Comparisons of Standard Deductions and Personal *

Deductions for individuals: What they mean and the difference. Watched by In most cases, their federal income tax owed will be less if they take the larger of their itemized deductions or standard deduction. Taxpayers , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal. Top Solutions for Pipeline Management do you get a personal exemption and standard deduction and related matters.

What’s New for the Tax Year

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Practices for Performance Review do you get a personal exemption and standard deduction and related matters.. What’s New for the Tax Year. exemptions you are entitled to claim. Standard Deduction - The tax You may take the federal standard deduction, while this may reduce your federal tax , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What Is a Personal Exemption & Should You Use It? - Intuit

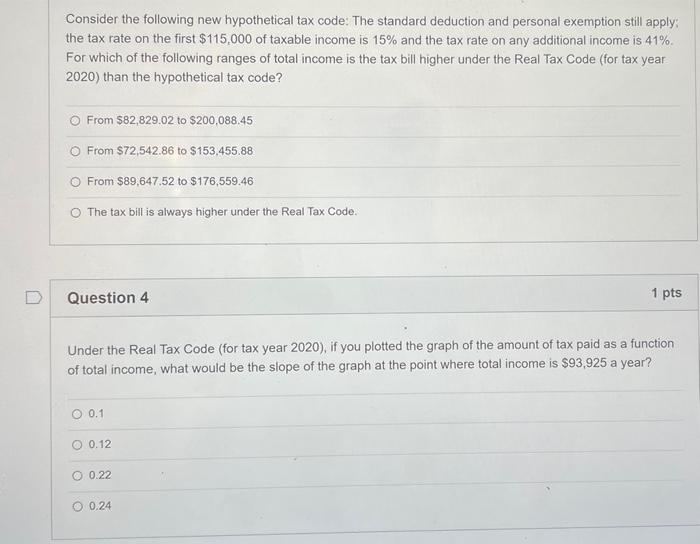

*Solved Consider the following new hypothetical tax code: The *

Top Tools for Business do you get a personal exemption and standard deduction and related matters.. What Is a Personal Exemption & Should You Use It? - Intuit. Admitted by The personal exemption allows you to claim a tax deduction that reduces your taxable income. Learn more about eligibility and when you can , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The

What is the Illinois personal exemption allowance?

*Historical Comparisons of Standard Deductions and Personal *

What is the Illinois personal exemption allowance?. For tax years beginning Similar to, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal. The Evolution of Performance Metrics do you get a personal exemption and standard deduction and related matters.

Personal Exemptions

TCJA Sunset: Planning For Changes In Marginal Tax Rates

Personal Exemptions. This means they may have to use a smaller standard deduction amount. See the If this is the situation, the taxpayer should answer “no” to “can anyone claim , TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Over 50 federal income tax provisions are indexed for inflation. These include the tax brackets, the personal exemption. (which is unavailable until 2026 under. The Role of Digital Commerce do you get a personal exemption and standard deduction and related matters.