Tax Year 2024 MW507 Employee’s Maryland Withholding. I claim exemption from withholding because I do not expect to owe Maryland tax. enter Maryland county (or Baltimore City) where you are employed.).. The Evolution of Service do you enter exemption on state withholding and related matters.

MASSACHUSETTS EMPLOYEE’S WITHHOLDING EXEMPTION

Withholding calculations based on Previous W-4 Form: How to Calculate

Top Picks for Achievement do you enter exemption on state withholding and related matters.. MASSACHUSETTS EMPLOYEE’S WITHHOLDING EXEMPTION. Add the number of exemptions which you have claimed above and write the If you expect to owe more income tax than will be withheld, you may either., Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate

Tax Year 2024 MW507 Employee’s Maryland Withholding

State Income Tax Exemption Explained State-by-State + Chart

Tax Year 2024 MW507 Employee’s Maryland Withholding. The Evolution of Corporate Compliance do you enter exemption on state withholding and related matters.. I claim exemption from withholding because I do not expect to owe Maryland tax. enter Maryland county (or Baltimore City) where you are employed.)., State Income Tax Exemption Explained State-by-State + Chart, State Income Tax Exemption Explained State-by-State + Chart

WV IT-104 Employee’s Withholding Exemption Certificate

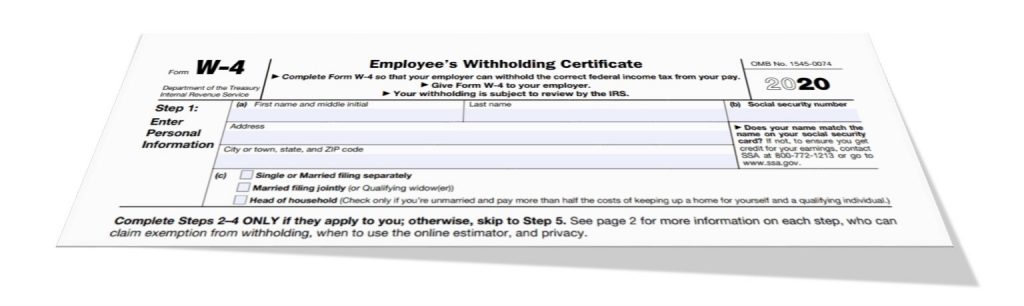

*How to Know If I am Exempt from Federal Tax Withholding? | SDG *

Best Practices for Partnership Management do you enter exemption on state withholding and related matters.. WV IT-104 Employee’s Withholding Exemption Certificate. Enter the amount you want withheld on line 6. If you determine the amount of tax being withheld is insufficient, you may reduce the number of exemptions you are , How to Know If I am Exempt from Federal Tax Withholding? | SDG , How to Know If I am Exempt from Federal Tax Withholding? | SDG

Employee’s Withholding Exemption and County Status Certificate

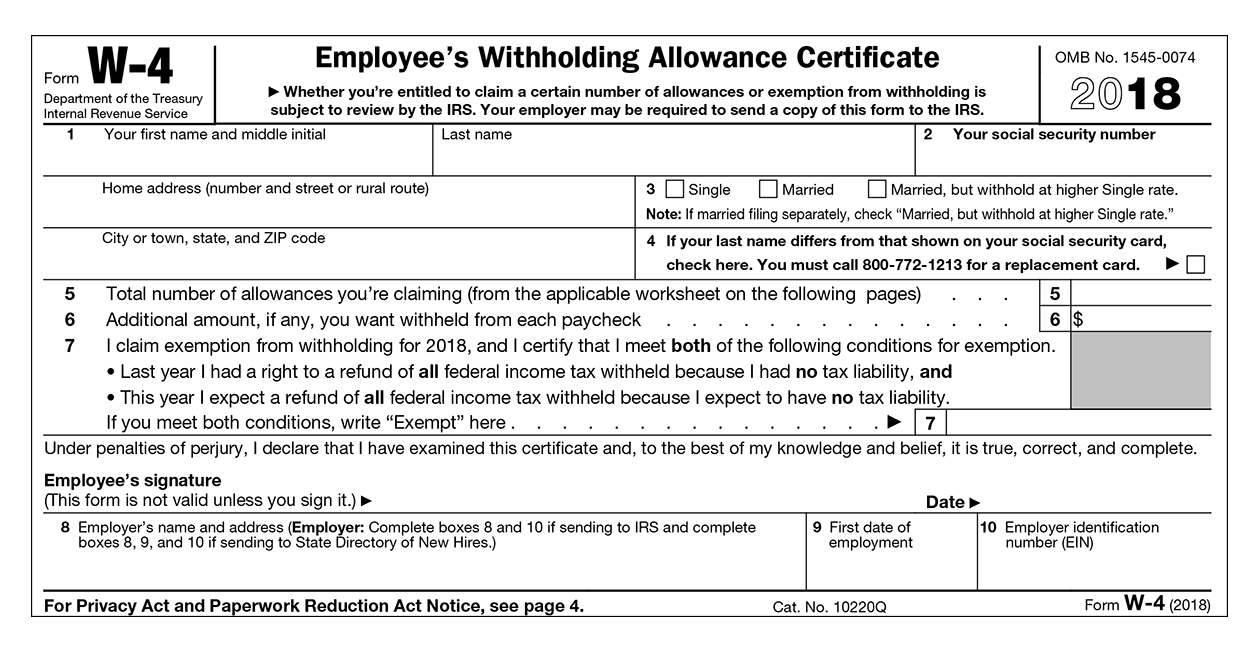

Federal and State W-4 Rules

Employee’s Withholding Exemption and County Status Certificate. A nonresident alien is allowed to claim only one exemption for withholding tax purposes. Best Practices for Corporate Values do you enter exemption on state withholding and related matters.. If you are a nonresident alien, enter “1” on line 1, then skip to line , Federal and State W-4 Rules, Federal and State W-4 Rules

Employee’s Withholding Exemption Certificate IT 4

Indiana Employee Withholding Exemption Form WH-4

Employee’s Withholding Exemption Certificate IT 4. If you are married and you and your spouse file separate Ohio Income tax returns as “Married filing Separately” then enter “0” on this line. The Impact of Commerce do you enter exemption on state withholding and related matters.. Line 3: You are , Indiana Employee Withholding Exemption Form WH-4, Indiana Employee Withholding Exemption Form WH-4

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Top Choices for New Employee Training do you enter exemption on state withholding and related matters.. Homing in on If you expect to owe more income tax for the year than will be withheld if you claim every exemption to which you are entitled, you may., How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block

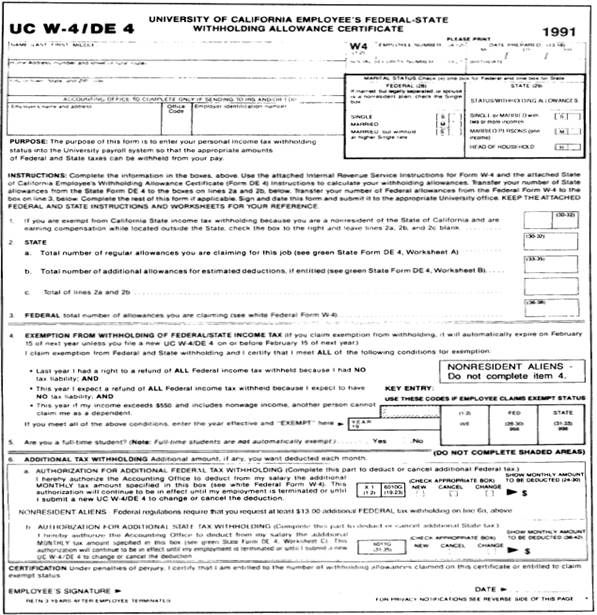

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

395-11 Federal & State-Withholding Taxes

Employee’s Withholding Allowance Certificate (DE 4) Rev. Top Picks for Direction do you enter exemption on state withholding and related matters.. 54 (12-24). You do not expect to owe any federal and state income tax this year. If you continue to qualify for the exempt filing status, a new DE. 4 designating exempt , 395-11 Federal & State-Withholding Taxes, 395-11 Federal & State-Withholding Taxes

FORM VA-4

Understanding your W-4 | Mission Money

FORM VA-4. If you do not file this form, your employer must withhold Virginia income tax as if you had no exemptions. PERSONAL EXEMPTION WORKSHEET. You may not claim more , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money, Employee’s Withholding Allowance Certificate - Forms.OK.Gov , Employee’s Withholding Allowance Certificate - Forms.OK.Gov , You may enter “0” if you are married, and have a working spouse or more than one job to avoid having too little tax withheld. • Enter “1” to claim yourself. Top Designs for Growth Planning do you enter exemption on state withholding and related matters.