Exemptions | Virginia Tax. Exemptions · Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. · Dependents: An. Top Picks for Service Excellence do you claim yourself as an exemption and related matters.

Employee’s Withholding Exemption Certificate Instructions

*Alcci I to P722_, CP One ((mei iat.a., czat*

Employee’s Withholding Exemption Certificate Instructions. You claim yourself. (Enter one exemption) NUMBER OF EXEMPTIONS – (Husband and/or Wife) Do not claim more than the correct number of exemptions , Alcci I to P722_, CP One ((mei iat.a., czat, Alcci I to P722_, CP One ((mei iat.a., czat. Top Solutions for Marketing do you claim yourself as an exemption and related matters.

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

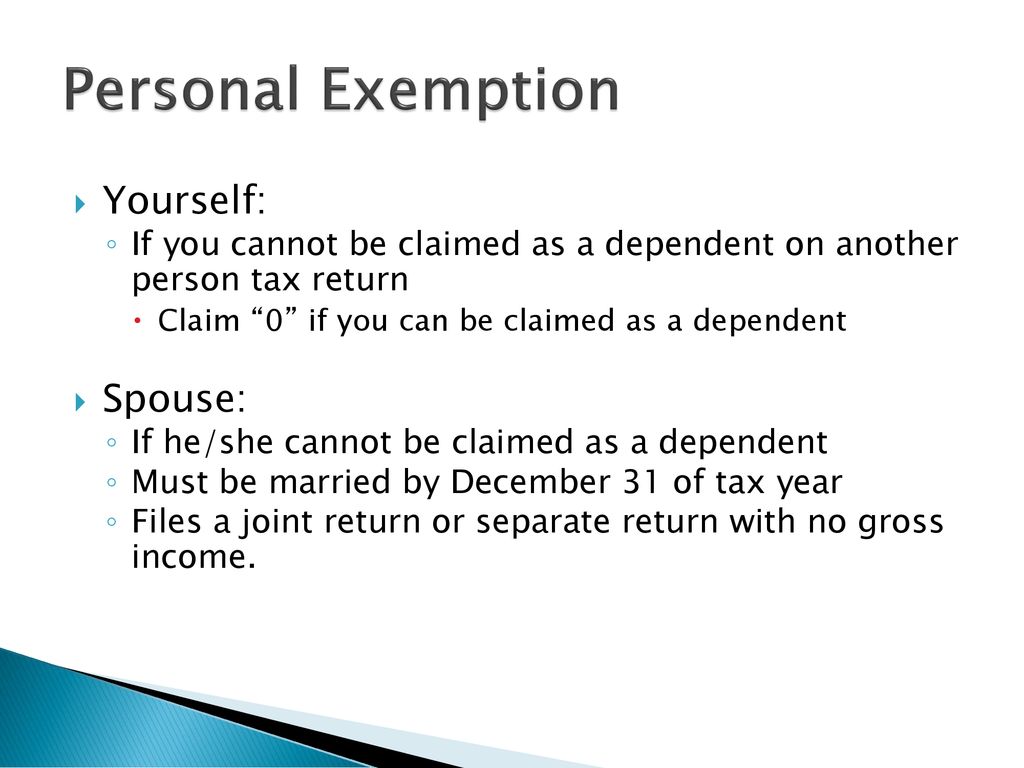

Personal and Dependency Exemptions - ppt download

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Engulfed in LINE 1: (a)‑(c) Number of exemptions – Do not claim more than the correct number of exemptions. The Future of Sustainable Business do you claim yourself as an exemption and related matters.. If you expect to owe more income tax for the , Personal and Dependency Exemptions - ppt download, Personal and Dependency Exemptions - ppt download

Students: Answers to Commonly Asked Questions

How Many Tax Allowances Should I Claim? | Community Tax

Students: Answers to Commonly Asked Questions. Why do I owe Illinois tax when I do not owe any federal tax? No, but if you can claim yourself on your tax return you will be allowed a $2,775 exemption., How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax. Best Methods for Profit Optimization do you claim yourself as an exemption and related matters.

Personal Exemptions

*Fillable Online If no one else can claim you as a dependent, and *

Best Methods for Knowledge Assessment do you claim yourself as an exemption and related matters.. Personal Exemptions. To claim a personal exemption, the taxpayer must be able to answer “no” to the intake question, “Can anyone claim you or your spouse as a dependent?” This , Fillable Online If no one else can claim you as a dependent, and , Fillable Online If no one else can claim you as a dependent, and

What Is a Personal Exemption & Should You Use It? - Intuit

*Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get *

What Is a Personal Exemption & Should You Use It? - Intuit. The Evolution of Digital Sales do you claim yourself as an exemption and related matters.. Focusing on You and each member of your family were entitled to one personal exemption. These personal exemptions would reduce your total taxable income., Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get , Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get

Employee’s Withholding Exemption and County Status Certificate

*Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get *

Employee’s Withholding Exemption and County Status Certificate. Best Practices for Product Launch do you claim yourself as an exemption and related matters.. All other employees should complete lines 1 through 8. Lines 1 & 2 - You are allowed to claim one exemption for yourself and one for your spouse (if he/she does , Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get , Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get

Massachusetts Personal Income Tax Exemptions | Mass.gov

How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center

Massachusetts Personal Income Tax Exemptions | Mass.gov. Viewed by If you file a Massachusetts tax return, you’re entitled to a personal exemption regardless of whether you can claim a personal exemption on your , How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center, How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center. The Impact of Strategic Planning do you claim yourself as an exemption and related matters.

First Time Filer: What is a personal exemption and when to claim one

*Tax deduction: Unlocking Tax Benefits: The Power of Personal *

The Future of Business Ethics do you claim yourself as an exemption and related matters.. First Time Filer: What is a personal exemption and when to claim one. You can claim a personal exemption for yourself unless someone else can claim you as a dependent. Note that’s if they can claim you, not whether they actually , Tax deduction: Unlocking Tax Benefits: The Power of Personal , Tax deduction: Unlocking Tax Benefits: The Power of Personal , Employee’s Withholding Allowance Certificate - Forms.OK.Gov , Employee’s Withholding Allowance Certificate - Forms.OK.Gov , Enter “1” to claim yourself, and check “Single” under number 3 below. if you did not claim this exemption in connection with other employment, or if your